A hybrids health check

| Summary: Investors who bought into hybrid securities in their hunt for yield have achieved mixed results, with some issues trading below their face value and unlikely to ever be redeemed by the issuer. However others are not only trading above their issue price but are paying very healthy returns. For investors, it’s part luck of the draw and part doing your homework beforehand to minimise risk. |

| Key take-out: After a big year in 2012, the volume of new hybrid issues to date has virtually dried up. For investors wanting to buy non-bank issued hybrids, the only option is to look at the outstanding corporate hybrid notes listed on the ASX. |

| Key beneficiaries: General investors. Category: Fixed interest. |

With the latest Reserve Bank interest rate cut taking the official cash rate to 2.5% per annum, it has become just that much harder again for investors to earn a decent rate of return. The relentless search for yield has become even more imperative.

ASX-listed hybrid notes have been very popular among such investors. While there are many risks attached to these instruments, most have so far generated above-average returns while providing a reasonable capital stability or even small capital gains.

However, hybrid note issuance has slowed dramatically this year, with only one issue coming from outside of the banking sector. Corporate hybrid issuance has all but ceased thanks to changes made to rating criteria by Standard & Poor’s.

For investors wanting to diversify away from the heavy concentration of bank hybrid notes, the latest being ANZ’s capital note, the only option is to look at the outstanding corporate hybrid notes listed on the ASX.

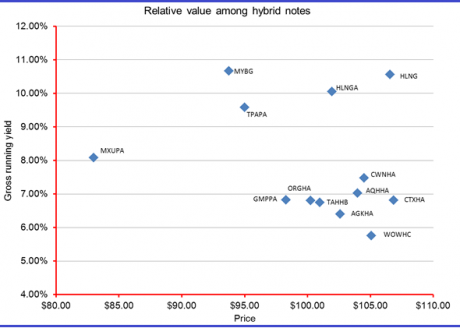

The chart below presents a selection of the listed corporate hybrid notes, with gross running yield plotted against price. This is one way of analysing relative value.

Six hybrid notes stand out from the rest. Five of the notes, MXUPA (Mulitplex SITES), TPAPA (Transpacific Industries), MYBG (MYOB), HLNGA and HLNG (Healthscope) are currently producing running yields of more than 8% per annum. GMPPA (Goodman PLUS II notes), along with MXUPA, TPAPA and MYBG is priced below its face value of $100.

Therefore, in terms of relative value, these six bonds are offering either higher than average gross running yields or the opportunity for capital gain on redemption or both. The question that must be asked is why?

Suffice it to say, none of the issuers have defaulted on the terms and conditions of their hybrid notes. To understand what else could account for these hybrid notes standing out from the others, it is necessary to look at their terms and conditions in more detail.

It is also necessary to consider where the hybrids fit into the capital structure of the issuer and the issuer’s intentions in relation to the hybrid notes.

Starting from the left hand side of the chart, the Mulitplex SITES (MXUPA) are offering a gross running yield of more than 8% and are priced at less than $85. Investors could realise a capital gain of around 20%, if the notes are ever redeemed.

Ever, is the operative word here.

The notes were originally issued in 2004 to refinance the acquisition of Duelguide Plc by Multiplex. It was intended that the notes would be redeemed or exchanged for other Multiplex securities in April 2010.

However, in the meantime, Multiplex found itself in financial difficulty and was acquired by the giant Canadian fund manager, Brookfield Asset Management. Brookfield was content to let the SITES become perpetual debt from April 2010 and has paid the coupon step-up to 3.9% over the 90-day bank bill rate, since then.

In the 2012 SITES annual report, directors advise that the only asset of the SITES Trust is an investment in the Multiplex Hybrid Investment Trust and this is not expected to change. It seems that the SITES notes will only be redeemed if 3.9% per annum over the 90-day bank bill rate becomes too much to pay for perpetual debt on which the coupons are non-cumulative.

Don’t hold your breath.

It is a similar story for the SPS notes issued by Transpacific Industries (TPAPA). The notes were issued in 2006 to finance the amalgamation of Transpacific with a company called Waste Management NZ. The notes pay a non-cumulative, fully franked coupon and were due to be redeemed in October 2011.

Transpacific went through a debt restructure following the GFC and SPS notes became perpetual. Transpacific has been focused on asset sales and repaying its still considerable debt ever since.

Transpacific has more than $1 billion of debt due to be repaid between now and 2016. Transpacific directors say they wish to lengthen the maturity profile of the company’s debt and want to diversify sources of debt funding.

The SPS notes stand out as the only perpetual debt on the company’s balance sheet.

The Goodman PLUS II notes (GMPPA) are the product of a restructuring of the Goodman PLUS notes undertaken last year. Goodman Funds Management advised PLUS investors that it would not be redeeming the PLUS notes as expected in March this year, but rather than letting the notes become perpetual, it would offer investors the PLUS II notes on slightly more attractive terms and conditions.

The PLUS II notes, which also pay a non-cumulative coupon, may be redeemed in September 2017 but there is no coupon step-up until September 2022 and the notes do not mature until the end of 2073.

MYOB issued its MYBG hybrid notes in December last year. The issue struggled from the start, labouring under private equity ownership that used the proceeds to take some equity off the table.

The notes are subordinated to the considerable debt of the senior lenders and the senior debt has very challenging financial covenants. In fact, after the book-build for the issue was completed, MYOB issued a revised prospectus that showed that its prospects of meeting the covenants are even more challenging than originally thought.

It is now clear why these four issues are trading at less than face value.

The two note issues from Australia’s largest private healthcare services provider, Healthscope Limited, are trading for more than their face value. This suggests that investors are much more confident about prospects for these issues and the issuer and are prepared to pay up accordingly.

These issues also have the advantage of paying fixed coupons of 11.25% (HLNG) and 10.25% (HLNGA) per annum. The notes will mature June 2016 and March 2018 respectively, unless an IPO takes place in the meantime.

Healthscope was privatised by The Carlyle Group and TPG in 2010 and sold $200 million of Subordinated Notes (HLNG), as part of the financing. In March, a $300 million of Subordinated Notes II (HLNGA)were sold to repay some senior debt and provide flexibility for future borrowing.

Healthscope has a strong business and has not missed any coupon payments so far. It is expected that the company will be relisted on the ASX before the Subordinated Notes mature.

If investors are looking for above average yields with commensurate risk, the Healthscope Subordinated Notes and Subordinated Notes II are worth considering.

Philip Bayley is a former director of Standard & Poor's and now works as an independent consultant to debt capital market participants. He also writes on matters concerning debt capital markets and banking for various publications and is associated with Australia Ratings.