A hard slog ahead for the labour market

The unemployment rate might have peaked, but there remain considerable challenges to overcome if labour market conditions are to improve significantly. The budget next week marks the first of those challenges.

On a seasonally adjusted basis, the unemployment rate remained at 5.8 per cent in April, beating market expectations, and is 0.2 percentage points higher over the year. The trend measure was a touch higher at 5.9 per cent.

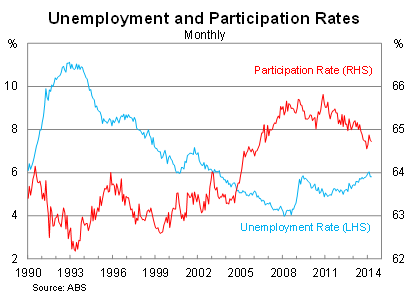

The participation rate was largely unchanged during April but ticked down due to rounding. However, it remains at a low level by historical standards, as retirements and discouraged workers continue to weigh on the labour force.

The good news is that the unemployment rate may have peaked, though it certainly faces challenging times. The bad news is that participation will continue to decline.

With the first of the baby boomers hitting 65 in 2011, the participation rate will continue to fall over the next few decades. The effect will create a downward bias in the unemployment rate.

As always, a correct assessment of Australia’s labour market requires consideration of both the unemployment and participation rates. Considering either one in isolation is often misleading. Last month, for example, almost the entire decline in the unemployment rate was driven by falling participation rather than strong employment growth.

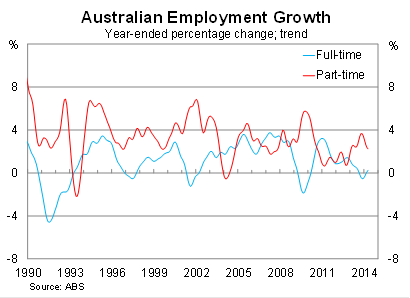

On a trend basis, employment rose by 17,200 people in April, which is a little lower than growth in February and March. Employment is up 72,300 in 2014 to date, though this includes considerable sampling effects from February, which overestimates the actual rise in employment.

Full-time employment has been driving job creation over the past four months, partially offsetting the recent trend towards casualisation in the workforce. Part-time employment growth has been soft.

At the state level, the unemployment rate remains lowest in Western Australia and fairly elevated across the remaining states.

Despite the rise in employment, hours worked fell sharply to be at their lowest level since April 2011.

The results suggest that labour market conditions improved in April, with the exception of hours worked. But the future contains a range of obstacles.

The first is the budget next Tuesday, and there are several measures which are set to weigh on household spending and confidence (Households shop to it, but not for long, May 7). The second and more daunting challenge is the collapse of mining investment.

From a monetary policy perspective, the result changes little. First, the data simply isn’t strong enough and the Reserve Bank of Australia won’t ignore the role that sampling methodology played in February. Second, the RBA has made it abundantly clear that they intend to leave rates unchanged for some time (RBA keeps rates lower for longer, May 6).

The bank’s primary concern isn’t the unemployment rate in April but business investment and government spending next year and whether the non-mining sector can generate sufficient momentum to drag the Australian economy into a new generation of prosperity.

Its approach recognises that the Australian economy has yet to meet its biggest challenge and until it does rates should remain at a low level. A solid but unspectacular jobs report will do little to shift them off course.