A grim prediction for the middle class

As Australian companies announce their half-yearly results, few are pondering the fundamental and unique changes taking place in Australia. This week I will look at some of them.

The first and most important is that we are about to follow the United States in seeing a decline in the middle class and rise in the number of people on high incomes, and an even sharper rise in those on low incomes. Apart from the dramatic effect this will have on a great many lives, in the US it has also required a different approach to managing enterprises.

In post-war Australia, most of the major trends we have experienced have duplicated what took place in the US a year or two earlier. Last week’s rise in Australian unemployment caught many analysts on the wrong foot, but it was really only confirmation that we are headed in the same direction as the United States. And there is a lot further to go.

The biggest single change in American society over the last five to 10 years has been the dramatic decline of the middle class. And the factors that caused that reduction are being duplicated in Australia. Analysis by Michael Snyder shows that six years ago some 53 per cent of all Americans considered themselves to be ‘middle class’. Now it’s only 44 per cent – and falling.

In 2008, a quarter of all Americans in the 18 to 29-year-old age bracket considered themselves to be ‘lower class’. In 2014, that has doubled to an astounding 49 per cent of youngsters believing they are in the lower class. The movement to lower incomes is worst among young people, who can’t gain employment. Retailers like Sears and JC Penney, which relied on the middle class, are now struggling. There is a very similar pattern in the United Kingdom, where retailers who service the middle class are in decline.

Real disposable income in the United States in 2013 experienced their largest ever drop since 1974. The medium household income has fallen for five years in a row, while the rate of home ownership has fallen for eight consecutive years. You can go on and on.

Why should Australia duplicate what has taken place in the US and the UK? Put simply: because we have adopted the same policies and strategies. The US transferred much of its manufacturing operation to China and, in doing so, it decimated a vast number of middle-class workers.

Some 15 years ago, I can remember dining with a top Chinese official who confessed he was staggered that the US would allow its manufacturing skills base to be decimated. He knew what it would mean to American income structures. At that time, the US believed manufacturing jobs would be replaced by the services sector, not realising that just as many of those jobs would go offshore on the back of internet technology.

In Australia, there will be some 100,000 to 150,000 people set to lose their jobs in the motor business, including all the groups that provide support services. The great bulk of these people are middle class. Similarly, the dismantling of the mining investment industry and the very big reductions in retail selling in stores will each have a similar effect on the middle class population of the country (A tsunami warning for business and executives, February 11).

A whole generation of young people in both Australia and the US who are now aged in their thirties and forties thought that IT was the way go and trained themselves accordingly. They secured good middle-class jobs. But now more and more of the work is being transferred offshore and many IT workers now struggle.

In Australia, call centre work got the unions into the area and made work practices difficult for people operating in Australia. Vast chunks of the business were then transferred offshore, again hitting the middle class.

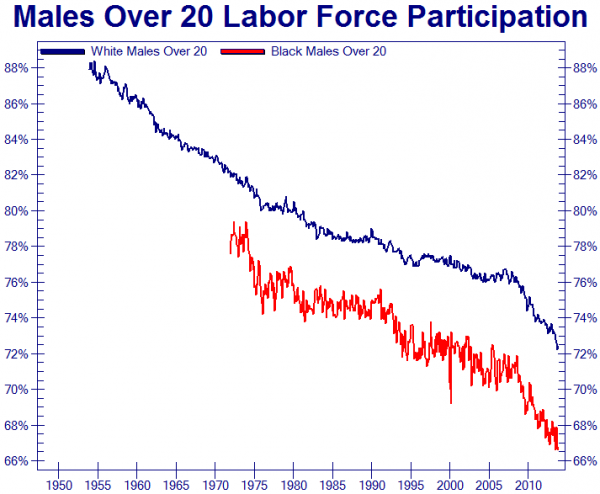

My belief is that, following the US, the movement of jobs offshore in motor industries, IT, retail and (in Australia) mining investment will hit male workers the hardest.

And once again, the staggering accompanying graph shows that the Americans are the trailblazers.

Male labor force participation in the US. Source: Zero Hedge.

I asked Morgan Research to give me some indicators as to what is happening to male employment in Australia and we discovered that current full-time male employment is lower than two years ago, whereas female employment is higher. Surprisingly, in the part-time area males are doing better than two years ago and females not as well. Male mining employment is well down, as is retail.

Conversely, female retail employment is holding. Both males and females will of course be affected by this downturn, but the male community – particularly those coming out of the motor industry – will find it hard to gain employment.

Unfortunately those employed in the motor industry had a work practice agreement that was a big contributor to them losing their jobs. Managers didn’t manage – it was all down to committees.

To get jobs, these males are going to have to learn a totally new work ethic and method that will involve a far simpler management process where unions will not be greatly involved. There simply aren’t the profit margins anymore to afford the luxury of inefficient labour agreements.

Increasingly, independent contracting is going to be the way for both male and female employment. Those who have operated in very strict award situations are going to find adapting tough. Many will move out of the work force, lowering the participation rate and masking underemployment.

I might add that as the public service is reduced, government employees will also find it extremely difficult to adapt their working patterns to get jobs. What happened in the US was that the jobs that did emerge tended to be lower-paid jobs, which is why so many more people see themselves in the ‘lower class’.

In Australia, the Abbott Government will attempt to overcome this problem by deregulation and investment in infrastructure. There is no doubt that will help, but unless the Australian dollar falls substantially from its current levels, more and more work will go overseas.

Just to make it more difficult for the middle class, we have increased salaries of carers and child minders but in the process we have priced many potential customers out of the market and forced grandparents into doing this work for nothing. All this means is that companies that are serving the middle class need to watch very carefully how their demand patterns are moving. It might be necessary to organise products and services that are either up market or downmarket.

In the US, companies have responded with enormous productivity drives.They are way ahead of Australia, but we will follow.