A foreign warning on long-term unemployment

Both the United States and eurozone economies may have turned the corner but for the long-term unemployed, the pain will persist for years to come. That is the unfortunate reality for millions of Americans and Europeans, even seven years after the onset of the global financial crisis.

Long-term unemployment has remained a persistent problem for the US since the global financial crisis began. Despite the unemployment rate declining significantly in recent years there has been little progress made to unwind the roughly 4 million people who have been unemployed for more than half a year.

The challenge is a fairly new one for the US, which has traditionally had a more dynamic labour market than its cousins in Europe.

Higher long-term unemployment is a natural characteristic of the stronger European safety net and stronger labour protections, though the present episode is largely without precedent, particularly throughout the periphery.

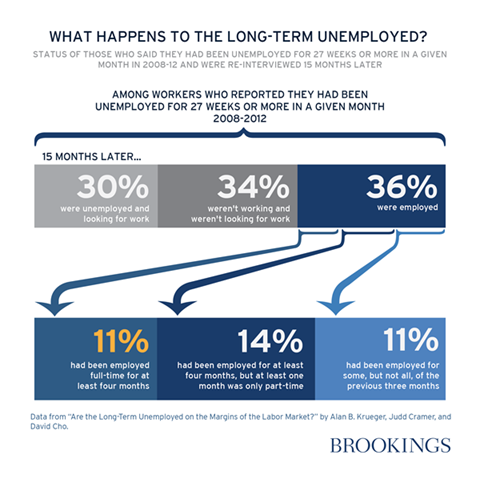

Recent research by Alan Krueger, Judd Cramer and David Cho from Princeton University find that even after finding another job, the long-term unemployed often find themselves jobless soon after.

They find that for workers classified as being long-term unemployed (unemployed for 27 weeks or more), just 11 per cent had been in full-time employment for at least four consecutive months when surveyed 15 months later.

By comparison, 34 per cent had simply given up trying to find a job. 30 per cent remained unemployed, but were still looking.

It is sobering news for the US economy and, with job creation running at less than 200,000 jobs per month, it will take at least four to five years to find jobs for most of the 4 million people who are long-term unemployed (simply to keep up with inflation US payrolls must rise by around 100,000 per month).

The reality is that many of that group simply won’t find jobs. And, if and when they do, they will find that their skills have eroded and they are no longer as productive as they once were. Jobs will be lost to younger, more dynamic workers who have maintained and developed their skills.

The research by Krueger et al also has broader implications for both monetary and fiscal policy. Effectively, they conclude that the long-term unemployed are not really part of the labour market at all.

Why does this matter?

As we know, an economy faces a trade-off between inflation and unemployment -- known as the Philips curve -- which often guides monetary policy decisions.

To lower the unemployment rate, an economy will typically have to tolerate a higher inflation rate. However, the research indicates that it is the short-term unemployment rate that explains inflationary pressures since the long-term unemployed have such a weak attachment to the labour force.

This may at least partially explain why we haven’t witnessed greater deflationary pressures in the US and the eurozone despite record levels of unemployment. Since the long-term unemployed quickly came to account for such a large share of total unemployment, the labour market was actually tighter than the headline data suggests.

This realisation has important policy implications.

First, it is difficult to reverse long-term unemployment once it has become entrenched. Businesses do not want to hire people who have been unemployed for years, while central banks have pushed trillions of dollars through the economy with little effect on long-term unemployment.

Second, the best way to deal with long-term unemployment is to avoid it initially. Proactive fiscal and monetary policy could deter long-term unemployment from developing.

Some analysts argue that fiscal stimulus is wasteful since the stimulus must be paid back at a later stage via higher taxes. However, if the stimulus deters long-term unemployment, then it not only provides an immediate gain but also a persistent long-term impact by avoiding the loss of economic potential that occurs once an individual has been unemployed for a long time.

Luckily in Australia we avoided a long-term unemployment problem -- in part due to China -- but also because of the massive stimulus program put through by the then Rudd Government.

Our stimulus was by some magnitude larger than in most other developed countries and we were lucky that we didn’t have to waste money bailing out irresponsible banks.

But we may face the prospect of rising long-term unemployment in the near future. Our manufacturing sector is slowing but surely dying, and employees in this sector do not necessary possess skills that will be easily transferable to other sectors.

The research by Krueger et al indicate that we must address these issues proactively, encouraging additional training and support during the difficult transition. Otherwise we could find ourselves in the same position as the US, with a long-term unemployment problem that may take years to fix.