A flicker of hope for business lending

Low interest rates continue to support business lending but growth has moderated significantly during 2014. The outlook for business lending remains uncertain and will largely depend on whether the non-mining sector can gather momentum over the remainder of this year and maintain it through next year.

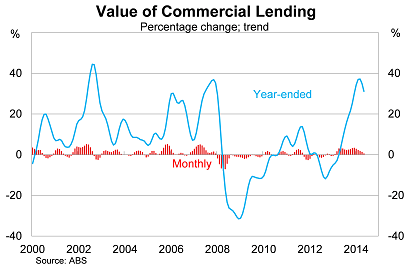

Commercial lending continues to show signs of moderation, with seasonally-adjusted estimates declining by 6.0 per cent in May. On a trend basis that looks through the monthly volatility, commercial lending rose by just 0.5 per cent in the month, with annual growth softening throughout 2014.

Based on previous episodes, it is common for commercial lending to rise sharply and then taper off quickly, resulting in either modest growth or a sharp decline in lending activity. It is too soon to identify what form the current episode will take: conditions for the non-mining sector remain difficult although sentiment is still somewhat upbeat.

One key distinguishing feature of this recent upswing in lending activity is that it hasn’t been broad-based. While some firms have been happy to take on additional leverage at historically low lending rates, many firms have taken the opportunity to refinance existing obligations or pay down their debts.

But that isn’t the entire story. Small businesses, who rely disproportionately on domestic banks, continue to find it difficult to access credit markets. By comparison, large businesses have more options and can tap into equity, corporate bonds and syndicated lending markets to expand their operations.

As a result, outstanding credit growth has been fairly anaemic since the onset of the global financial crisis. Most of the recent growth in outstanding credit has been directed towards the household sector. To some extent housing investment may be crowding out more productive business opportunities (How the housing obsession is short-changing business, June 2).

The outlook for business lending is largely dependent on the interplay between domestic demand and businesses which are expanding, those deleveraging or refinancing and whether small and medium-sized firms can convince banks to lend them money.

If conditions and opportunities improve for the latter two groups, then I’d expect to see a camel-shaped growth profile emerge, like the one between 2006 and 2008 in the graph above. It is also worth noting that on a trend basis commercial lending activity remains 10.5 per cent below its peak, suggesting that there might be some upside risk to the outlook.

Moving away from the outlook for a moment, commercial lending declined in May due to a sharp fall in new issuances of fixed credit facilities, which more than offset strong growth in revolving credit facilities.

Personal lending is trending upwards, though primarily on the back of particularly strong growth in May. Lending was up by 9.1 per cent in May -- the strongest monthly outcome in seven years. Personal lending can be particularly volatile, so I’d treat this recent upward trend with a grain of salt -- it could easily reverse next month when the June data is released.

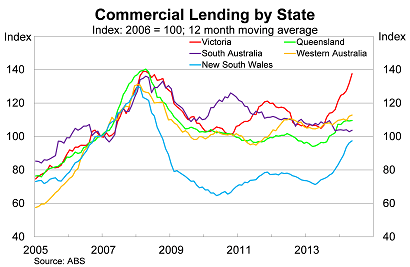

At the state level, lending activity is fairly mixed. With the exception of Victoria, lending activity in most states is largely unchanged since 2006, highlighting how weak the non-mining sector has been over this period. The mining sector in Queensland and Western Australia are typically financed via foreign investment, which skews the data somewhat.

Growth has been strongest in both Victoria and New South Wales, but there is a noticeable divergence between commercial lending and household lending in New South Wales. Rampant speculation in the housing sector is at odds with a state economy that is otherwise muddling along. The same could be said about the Victorian economy, albeit to a lesser extent.

Commercial lending rose rapidly over the past year and is showing some signs of moderation. But unlike housing finance -- which is poised to fall sharply over the next year -- I see some upside for business lending. The non-mining sector should pick up a little over the coming year, supported by the dollar eventually declining against key trade-partners, and I suspect that the Reserve Bank of Australia will lower rates again to encourage greater business investment.

Nevertheless, there remain considerable challenges for the business sector and by no means is the non-mining sector out of the woods just yet. We remain far too reliant on the Chinese economy to generate growth and, if the dollar doesn’t depreciate soon, then a sluggish business sector and subdued household spending will be poorly placed to offset the sharp decline in mining investment.