A dangerous housing downturn could be just around the corner

Speaking in Hobart yesterday, Reserve Bank of Australia governor Glenn Stevens talked down the broader concern regarding Australian housing, preferring instead to focus on the rising speculation in Sydney. In doing so it is clear the RBA simply doesn’t understand the systemic risk that high leverage poses for the broader financial system.

Stevens explained that the bank’s views on housing can be captured by four points.

First, some recovery in prices was to be expected following a significant decline between 2010 and 2012. Low interest rates freed up household balance sheets, allowing more people to borrow and either upgrade or purchase investment properties. That is part of what Stevens called ‘the normal transmission process’.

Second, the RBA would be more concerned about recent rises if those gains were leading to overconfident expectations or speculation regarding future gains. If that was accompanied by a significant rise in household leverage, from already high levels, then there would be reason for concern.

Given the RBA’s inaction on housing or stability issues, it is fair to say that it doesn’t think that household leverage or speculation is a concern yet (APRA’s inaction brings a housing crisis closer, June 30). Unfortunately, they have read the market completely wrong.

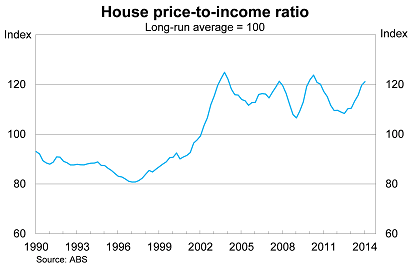

Recent house price growth has been much stronger than a simple recovery, albeit not in every capital city. There is a good chance that house prices as a share of income will rise to its highest level in history during the June quarter. On every previous occasion that house prices has reached these levels there has been a housing downturn.

Furthermore, speculation has been rampant throughout Sydney and Melbourne and from all indications is driving price growth in both those markets. Investor activity has been less bullish in the other states but nevertheless is supporting growth.

The reality is that almost all investor activity in the residential property market is speculative. Investors largely ignore new construction in favour of established housing and due to negative gearing, rental yields are so low that few investors even try to make a return through rent.

Stevens’ third point was that "the amount of new borrowing does not appear, overall, to be imprudent". He notes that lending activity as a share of credit outstanding is actually not that high compared with its longer-run history. The graph below was featured in Stevens’ speech.

Unfortunately the governor’s assessment is nonsense and the graph above is a terrible way to measure lending activity. Effectively he is arguing that lending activity is not a concern because outstanding credit is huge. To the contrary: that is the very reason why mortgage lending is a concern.

Furthermore, the graph completely ignores the broader economic climate. Earlier episodes of elevated lending occurred during strong periods of economic growth, with rising participation and elevated income growth. By comparison, this recent episode occurs against the backdrop of what is likely to become the weakest economy in at least two decades.

At least Stevens’ fourth point was more sensible. He noted that "investors should take care in the Sydney market", which has been driving the recent pick-up in speculation. There has even been some increase in lending with loan-to-valuation ratios above 80 per cent.

Australians should remember that prices don’t always rise, and that over the past decade there have been three housing downturns. Those downturns occurred despite solid income growth, low unemployment and the mining boom.

Based on price multiples, and recent lending and spending behaviour, it is possible that the next downturn could be right around the corner. But this downturn will occur against the backdrop of historically low wage growth and rising unemployment.

Stevens said that "banks and other lenders need to maintain strong lending standards". By international standards, our banks already lend at multiples of income that would leave many foreign banks speechless (Why Australia is floored by sky-high house prices, June 13). Despite the governors’ insistence and recent comments by the Australian Prudential Regulation Authority, I doubt financial stability and prudent lending is high on the list of priorities for Australian banks.

The RBA appears largely unconcerned about the housing market. But with lending activity at an elevated level -- despite the governor’s insistence -- and economic conditions souring, the housing market poses a systemic risk for the Australian financial system.

House prices have moderated somewhat in recent months and with low wage growth and unsustainable lending activity, I’d be surprised if the market doesn’t reach its peak before the end of the year.