A bumpy ride for bonds

Holders of exchange traded bond funds could be in for a shock when it comes time to go through how each investment has fared during the year.

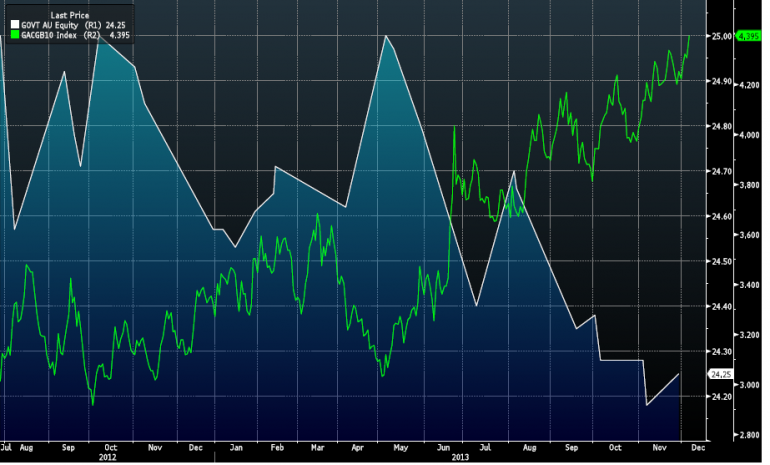

Rising long-term yields on government debt has sent the actual price of debt issued by the government lower, impairing capital along the way. This relationship is explained in the graph below: the SPDR Australian Government Bond Fund is represented by the white line and the 10-year government bond yield, the green line.

Source: Bloomberg

For Australia, the local bond market is at the mercy of what the US Federal Reserve does when it comes to unwinding the $US85 million a month bond buying program. Just as the domestic equity market and currency is affected by what the Federal Reserve does, so too is the debt market.

It is probably best to acknowledge US 10-year Treasury yields will continue to push higher as the Federal Reserve exit the market as a buyer of securities. Less buyers, or essentially less liquidity, will be the cause of yields creeping higher. How high long-term yields go or the shift in the yield curve along the way to the 10-year mark is extremely difficult to predict. Regardless, yields are going higher.

So your capital has declined and you might be thinking higher yields mean you have more than made up for this on income. Unlikely. For this year the SPDR Bond Fund it has paid a total of 64.77 cents in the last four distributions, which are of course unfranked. The total yield comes in at 2.6 per cent based on today’s prices. Capital wise you are down 1.3 per cent.

Higher yields sending bond prices lower is an inherent risk of going long only in the bond market. The alternative is to have faith in a fund manager with the option to go both long and short bonds and their ability to pick the future direction of interest rates.

Government bond options listed on the ASX are relatively new, with the SPDR and a Vanguard option only coming in the past 18 months. While the listings created more investment options for investors, the risk-reward trade off wasn’t overly compelling in light of the government guarantee on term deposits. Unsuspecting investors will now have a different view on this.

While bonds make up an important part of any conservative or balanced portfolio, capital is wiped out when interest rates start to rise. This is a good time to be searching for other investment options across fixed income.