A boon for Australian banks

2014 was a mixed year for Australia's major banks. There was a lot of pressure to sell from various quarters on the view that banks were expensive. Commonwealth Bank in particular looks to have had a good year -- up 9.4 per cent as I write -- although this is not a performance that was matched by the other large banks.

Admittedly there have been some serious headwinds facing the sector. Incredibly, regulators thought that the slump in commodity prices and the associated pressure that brought onto the large miners signalled a good time to scare investors witless about the banking sector. The banks alone are about 30% of the market. Needless to say, the Aussie market hasn't shared much in the bounty wrought by the global equity bull run on 2014.

2015 could be a better year for our banks. That is, if regulators can remember that Australia is not the US nor the UK: that our banks are already well capitalised, are not globally systemic and didn't take part in the pre-GFC excess. If they can do that and stop scaring off global investors, then it could be a good year.

Underpinning that fact is the rebound in credit growth.

We know the story for housing credit: credit growth for owner occupiers and investors is picking up. This is a good thing and has helped drive banks earnings through 2014. The important point to note is that even with the marked recovery in credit growth,growth in lending to both owner occupiers and investors remains well below ‘normal' rates. That is, there is scope for further upside in 2015. Recall that cash deposits of households are quite elevated relative to recent history.

The key positive for our banks isn't so much the housing credit story; it's what we're seeing in the business space.

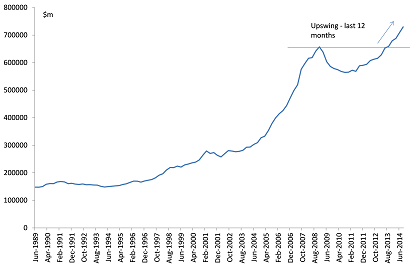

Take a look at chart 1. It shows that businesses are becoming much more confident. Lending has started to grow again in through 2014, with non-financial public corporations taking on an additional $729bn in debt over the last year -- the largest gain on record.

Chart 1: Business is becoming more confident

Normally when people see the words ‘debt' and ‘record', they panic. It never used to be the case, but the GFC has changed how people look at debt. That's not necessarily a bad thing; debt isn't to be taken lightly.

Yet it isn't the case that debt isn't always bad. It's often forgotten in the broader commentariat that debt does have a place in societyif used properly and not to excess. In the Australian context, and when we are taking about Australia's non-financial companies, it could hardly be said the debt burden is excessive.

Cash held as a percentage of total debt has averaged 60 per cent these last few years (currently at 55 per cent) which is a full 12 percentage points above what we saw pre-GFC. Cash holdings are very high and as a percentage of GDP, non-financial debt is extremely low at 1.8 per cent. In any case, total debt is always going to increase over time as a nominal economy expands. It's what a reasonable person would expect. As long as it is used productively, it makes sense to take advantage of the lowest interest rates in a generation.

That business is borrowing more after a post GFC hiatus shows that they are becoming more confident, more willing to spend and invest. This is a very good signal that non-mining investment is on the uptick. Secondly, it suggests that banks will see business lending as a source of solid revenue growth into 2015.