A bearish outlook for the Aussie dollar

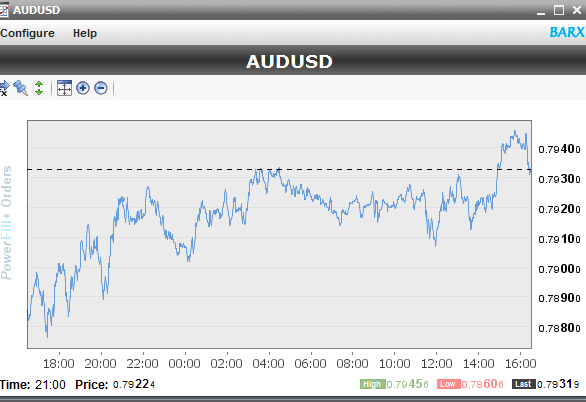

Dire global growth forecasts and shock decisions by central banks saw the Australian dollar test new six-year lows last week. A bout of aggressive selling took hold of the commodity-driven currency, and it fell below the key US80c level.

Central banks send shockwaves

The European Central Bank's announcement of a larger-than-expected quantitative easing program boosted the US dollar at the expense of other currencies. ECB policymakers have committed to €60bn per month for the next 18 months, well above analysts' expectations.

The open-ended commitment to monthly bond purchases and effective injection of cash into the European Union sent the euro down to 11-year lows. EUR/USD now looks set to test levels below 1.10 in the short term, with euro-Greenback parity by 2016 now a real possibility.

Though each QE experience must have its own unique outcomes, consensus has already formed that the ECB's program will not be enough to stimulate wide-ranging asset price inflation.

The Bank of Canada also shocked investors when it reduced its official cash rate by 25 basis points and sparked speculation that the Reserve Bank of Australia may be forced to do the same.

China slowdown drags on the dollar

The Australian dollar certainly suffered in the wake of the ECB announcement as investors, hedge funds and speculators increased euro shorts against the US dollar and Swiss franc. But it's the gloom over China that's presenting the biggest mid- to long-term drag.

Last week the International Monetary Fund downgraded its forecast for global growth, citing stagnant European, Japanese and Russian economies alongside a slowdown in Chinese GDP numbers. Chinese GDP edges ever closer to 7 per cent, marking a significant downtrend over the past 12 months.

The slowdown in Chinese growth prospects has amplified the effect on falling commodity prices and reduces demand for key Australian exports, primarily copper and iron ore. With expectations of a longer term slow down and stabilisation around 7 per cent the days of double digit growth appear a thing of the past, and result in a very bearish outlook for the Australian dollar.

Key inflation numbers this week should give some domestic direction. We also have the US federal reserve and its Federal Open Markets Committee rate statement for offshore stimuli. With support found on approaches to 0.7850 we expect the Aussie to remain range bound in the lead up to these data releases and further central bank announcements.

But there is certainly a bearish bias towards the Australian dollar at present and our medium- to long-term expectations are for further depreciation.

Greece continues to send jitters

In Greece, radical left-wing party Syriza was able to form a coalition with the Independent Greeks after Sunday's election. New Prime Minister Alexis Tsipras has stated his aim is to write off half of Greece's debt, which is no mean feat in light of already stark warnings from EU leaders about the limits of potential negotiations.

Despite the new PM's posturing, the most likely outcome is that a deal improving Greece's terms will be reached in the coming months, sometime prior to debt repayments of €8bn currently scheduled for July.

The extent of any concessions made on the part of the troika will be keenly watched by other (mostly Southern) European economies.

If Greece successfully rejects the conditions of multiple bailouts and secures a sizeable haircut on its current obligations, Syriza's counterparts in other beleaguered nations will perhaps become emboldened to pursue the same path.

The result must mean further destabilisation down the track, which, combined with eurozone QE, means you should sell euro rallies when you see them.

Matt Richardson is Corporate Foreign Exchange Dealer at OzForex, a global supplier of online international payment services and a key provider of Forex news. OzForex Group Limited is a publicly listed entity with shares traded on the Australian Securities Exchange under the code "OFX".