A balancing act for directors

PORTFOLIO POINT: The fiduciary duties of directors are being constantly tested as they weigh up the interests of shareholders against external advice.

If anyone thought that being a public company director is an easy job, then hopefully I can show in this report that it is not. I hope that my piece is timely given the early stage development of investor activist entities, which I believe is actually the result of confusion regarding the role, abilities and duties of public company directors in Australia.

By way of background I draw reader’s attention to the incessant behaviour of directors in seeking professional advice for every decision they make. By doing so, directors are constantly balancing their fiduciary duty to all shareholders against the advice from intermediaries who are rewarded by undertaking transactions. In particular, when a board needs advice on capital management then I suspect that their fiduciary duty is being tested.

So if a board is constantly being seen to take external advice, then it is open to shareholders, investors and activists alike to question the true basis or logic of its decisions.

It is generally accepted that directors have the following fiduciary duties under general law in Australia. These include:

- Duty to act in good faith, and not to act contrary to the interest of the company.

- Duty not to use power for an improper purpose.

- Duty to avoid conflicts of interest.

- Duty to retain discretion.

In particular, over the last five or so it has become arguable that the concept of directors’ fiduciary duty and how it governs the actions of public company directors has been severely muddied. This is particularly so given the insistence by boards to seek advice from investment banks that were shown by the global financial crisis to have more concern with their fee income than with the fairness of their proposals.

To be frank, it seems that directors who should have enough experience to make decisions on behalf of their company will constantly default or defer to advisors to avoid personal liability. I suspect that they do so because in the back of their mind they are not absolutely certain that what they are doing is for the benefit of their company and all their shareholders.

Let’s flesh this out by considering two current corporate events.

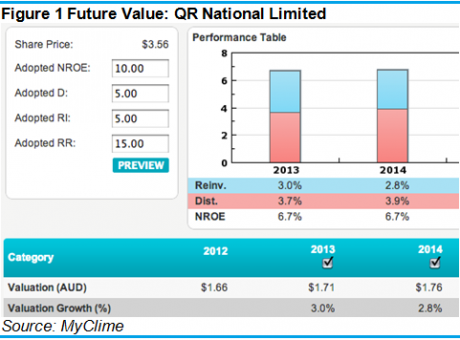

First, consider the buyback of shares from the Queensland government by the listed QR National (ASX: QRN). At the outset, I maintain that it is important to differentiate between price and value. So when a director decides to support a buyback proposal they should absolutely have an assessment of value and be certain that the purchase price of those shares is well below that valuation.

From a fiduciary perspective the utilisation of company shareholders’ funds to purchase the shares of a single shareholder is a very difficult decision to justify. Why purchase shares from one shareholder utilising the capital of all shareholders? Indeed, such a decision should not be part of a contrived scheme to unbalance the demand/supply metrics of the market.

The proposed QRN selective buyback is one part of a scheme whose other essential component included the purchase of shares from the Queensland government by a select number of pension funds at $3.47. The whole scheme has been heralded as cunning and clever in its construction. Those same adjectives could be used for a whole raft of schemes that were hatched throughout the financial world prior to the GFC. In this case, the cunning and clever scheme is aimed to theoretically catch index funds short. What a wonderful basis for a public company board to undertake a $1 billion buyback funded by debt!

The results of this scheme will only be truly assessed in years to come – well after advisory fees are paid and the directors have moved on. So did the directors consider whether the $1 billion buyback should have been a $1 billion return of capital to all shareholders? Anyway, right now who cares given the shareholders have voted the buyback through. Phew – now no one can complain if and when the share price falls back to value.

Second, let’s now review the tricky concept of declaring a fully franked dividend. Sounds easy, doesn’t it? Indeed it was meant to be easier after Parliament amended the Corporations Act in 2010 to give companies greater flexibility to pay dividends. Prior to the change, companies had to pay dividends out of profits. The amendment to the Act (section 254T) removed the specific reference to profits and replaced it with a balance-sheet test for paying dividends. As long as a company's assets exceed its liabilities by an amount sufficient for the dividend payment, then the company can declare a dividend.

What the change meant was that a company could pay dividends up to the value of their net assets. As long as a company had cash or debt capacity and was solvent it could pay a dividend.

The Australian Taxation Office put out a ruling in December last year and a further discussion paper last June. There, it said that although profits are no longer referred to in the relevant section of the Act, the concept of profits as the source of dividend payments continues to be relevant to the assessment and franking of dividends for taxation purposes. The ATO’s apparent view was that a company with accumulated losses that pays a dividend may be deemed to have paid shareholders out of share capital. In such a case, it would not be franked and would be treated as a capital return and not income. This might apply even if the company had made a profit that year but had accumulated losses.

This background leads to the messy takeover bid for Alesco Ltd (ASX: ALS) by DuluxGroup (ASX:DLX). Here the combatants have ended hostilities and arranged a scheme whereby ALS will pay a special franked dividend of about $25 million, even though it has neither the retained earnings nor the financial ability to fund such a dividend. Indeed, the funding will need the financial support of DLX once its bid becomes unconditional. Now that certainly is a minefield for the directors of both companies.

A few days ago, in its non-binding ruling, the ATO agreed that the ALS special dividend could be franked. However, it remained silent as to its view on the capital gains tax consequences of accepting ALS shareholders. Whether the dividend is an income receipt (logical) or is in fact part of the capital receipts (no precedent for this) of accepting shareholders remains an open issue. So that one will wait for another day and accepting shareholders are advised by their ALS directors to seek their own taxation advice in due course because the directors just do not know what the ATO will decide.

So here is a final thought. Why doesn’t the Australian Securities and Investments Commission get involved? Apparently ASIC oversees the listed securities market, and so it could request (through the Treasurer or Attorney General) that the ATO be definitive and clear in its rulings. Then we would have a fully informed market so that directors could make important fiduciary decisions without the need for expensive advice.

John Abernethy is the Chief Investment Officer at Clime Investment Management. Register for a free trial to MyClime – Clime’s online stock valuation service.

Clime Growth Model Portfolio

Return since June 30, 2012: 17.04%

Returns since Inception (April 19, 2012): 8.84%

Average Yield: 6.64%

Start Value: $111,580.24

Current Value: $130,595.40

Clime Growth Portfolio - Prices as at close on 29th November 2012 | |||||||

| Company | Code | Purchase Price | Market Price | FY13 (f) GU Yield | FY13 Value | Safety Margin | Total Return |

| BHP Billiton | BHP | $31.45 | $34.21 | 4.89% | $42.97 | 25.61% | 9.97% |

| Commonwealth Bank | CBA | $53.10 | $59.44 | 8.34% | $61.37 | 3.25% | 18.03% |

| Westpac | WBC | $21.13 | $25.23 | 9.85% | $27.54 | 9.16% | 23.94% |

| Blackmores | BKL | $26.25 | $30.50 | 6.23% | $29.85 | -2.13% | 19.73% |

| Woolworths | WOW | $26.80 | $29.35 | 6.52% | $31.22 | 6.37% | 13.57% |

| Iress | IRE | $6.55 | $8.11 | 5.31% | $7.29 | -10.11% | 25.64% |

| The Reject Shop | TRS | $9.15 | $15.21 | 3.94% | $15.53 | 2.10% | 51.46% |

| Brickworks | BKW | $10.10 | $11.34 | 5.17% | $12.27 | 8.20% | 15.56% |

| McMillan Shakespeare | MMS | $11.82 | $13.30 | 5.48% | $13.84 | 4.06% | 16.69% |

| Mineral Resources | MIN | $8.95 | $8.17 | 8.57% | $11.99 | 46.76% | -2.99% |

| Rio Tinto | RIO | $56.50 | $57.18 | 4.25% | $65.87 | 15.20% | 2.49% |

| Oroton Group | ORL | $7.30 | $6.56 | 11.11% | $6.22 | -5.18% | -3.94% |