$8bn in solar subsidies for what?

This the second article in a four part series on the rise of rooftop PV in Australia. In the first article, available here, we concluded that the 899,014 households that installed PV in the period from 1 January 1, 2010 to December 31, 2012, when subsidies from feed-in tariffs and renewable energy certificates peaked, have not on average had windfall gains. But we concluded that article by noting that without feed-in tariffs and renewable energy certificates, returns to households that installed PV would have been strongly negative. So, what does the picture look like from the perspective of the other energy users whose involuntary largesse therefore explains so much of the rise of residential rooftop PV in Australia?

We estimate that the total, undiscounted value of the feed-in tariff and renewable energy certificates accrued to the 899,014 PV systems installed between the start of 2010 and end of 2012 will be a little over $8 billion. But stated as a present value discounted at the Internal Rate of Return, we estimate that feed-in tariffs and renewable energy certificates will provide approximately equal amounts of support ($2.6 billion and $2.8 billion respectively).

The renewable energy certificates are a capital subsidy, being payable up-front at the time of the PV installation. Feed-in tariffs are a production subsidy, being paid over the life of the tariff based on actual PV production (net of the amount consumed at the point of use except in the ACT and NSW).

The aggregate annual renewable certificate subsidy for PV is shown in Figure 1.

Figure 1: Renewable energy certificates created through the installation of household PV $bn (2013)

Figure 1 shows that the aggregate payment in 2012 was less than 2010 despite more than twice as many PV installations in 2012 than in 2010. The declining payment is attributable to the certificate multiplier for the first 1.5 kW of installed capacity that declined from 5 at the beginning of 2010 to 1 by the end of 2013.

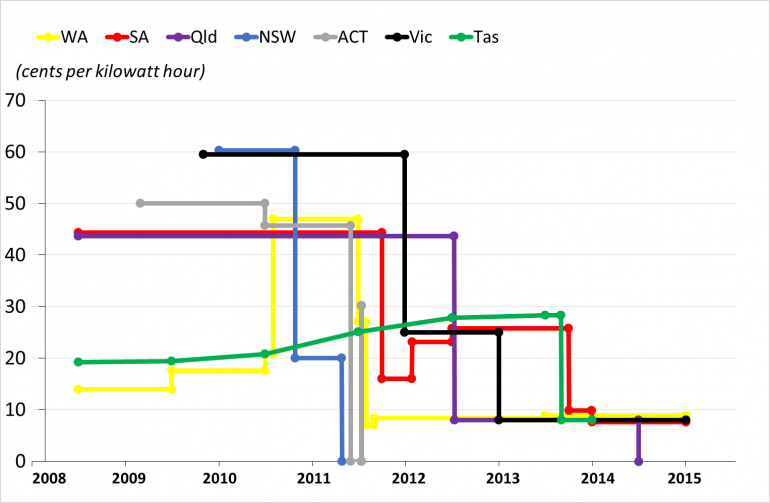

Feed-in tariffs also declined strongly over the period from a high of 60 cents per kWh for “gross” PV production in New South Wales in 2010, all the way down to 8 cents per kWh at the start of 2014, as show in Figure 2.

Figure 2: Jurisdiction-specific feed-in tariffs, 2008 to 2015

While the total Australia-wide value of feed-in tariff payments peaked at the end of 2013, we expect the aggregate to decline quite rapidly particularly as the NSW gross feed-in tariff comes to an end at the end of 2016, and then as the gradual churn in home ownership results in an ever diminishing stock of households that continue to receive premium feed-in tariff income, as shown in Figure 3.

Figure 3: Jurisdictional Mandated Feed-in tariff (FiT), 2010 to 2030, $millions(2013)

Aggregate subsidy of $8 billion for 899,014 rooftop PV system is undoubtedly a large sum of money. By comparison for example, the Australian Government has committed to spend less than half of this over the next 7 years to meet its 5 per cent emission reduction commitment. But pointing to the fact that it is large sum of money does not answer the question whether PV subsidy recipients are free-loading: the subsidised PV could be delivering reductions in wholesale electricity prices and in avoided network expansion that could more than off-set the cost of the subsidy.

So, is this the case? We don’t know for sure. We found that others have a range of views on this issue, but the evidence is lacking.

On networks, its seems fairly clear that rooftop PV, on average, does not do terribly much to reduce peak demands on residential feeders, even though it does have a reasonably significant impact on regional peak demands – about one third of average daily peak PV generation occurs at the time of the summer regional peak demands. This means PV is making a sizeable difference at the transmission and sub-transmission levels – particularly in Queensland and South Australia. However its impact lower down the networks (in voltage terms) is less certain. The extent to which residential demand reduction will affect network expansion will depend on many factors not least on the design of the network – the extent to which residential feeders are meshed with other feeders – and the network service providers’ approach to load management. In addition, the extent of any surplus capacity on different parts of the network will affect the value of demand reductions in reducing the need for network expansion. Anecdote and isolated example – which characterise the little work that has been done in this area – has little value in providing robust, Australia-wide conclusions. A methodical and rigorous analysis, network-by-network is needed.

On wholesale markets, we estimated that the 899,0014 rooftop PV systems installed between the start of 2010 and end of 2012 will produce around 3.4 TWh per annum. This is just 1.6 per cent of Australia’s centrally dispatched electricity production. Prima facie a 1.6 per cent reduction in average demand is unlikely to have a significant or lasting impact on electricity prices.

However, 90 per cent of the daily PV production occurs in just 6 hours from 10am to 4pm, so PV’s share of consumption is more appropriately stated as a percentage of consumption during this time, in which case PV’s share of the market (half-hourly demand) rises to around 5 per cent. This is just a national average, and again the assessment is made more meaningful by looking at individual regions.

In South Australia, where PV is installed on more than 21 per cent of households roofs, PV’s share of South Australia’s centrally dispatched electricity production between 10am and 4pm averages around 15 per cent. Furthermore this PV production coincides with higher prices in the NEM. Over the last seven years the average price in the NEM between 10am and 4pm has been $60/MWh. By comparison the average price in the NEM outside of these hours has been $41.8/MWh. The supply cost curve is likely to be relatively steeper at times of higher market prices, which implies that reduction in residual demand (total demand less PV production) can be expected to have a reasonably significant impact on wholesale market prices.

Isolating the impact of the many factors that affect electricity prices is an inevitably fraught exercise. Rigorous analysis, such as that recently undertaken by Energy and Environmental Economics for the Californian Public Utility Commission helps to focus debate. Australia’s academies, institutions and some associations have dabbled in this area, but much more could be done.

So, what’s the conclusion to the question of this article? There is no doubt that $8 billion is a great deal of subsidy and Australia’s state and federal governments were right to scale subsidies back as it became clear that other factors made PV very attractive to households. With the benefit of hindsight, much more could have been done with much less if the drastic reduction in PV system costs and concurrent drastic rise in residential electricity prices had been anticipated by policy makers.

There are big lessons here for policy makers and regulators. But notwithstanding that, it would be churlish not to recognise that the subsidised PV is reducing both shared network expenditure and wholesale energy market prices. All electricity users benefit from this. From what we can see at this point however, the benefits though probably sizeable, are unlikely to exceed the value of the subsidies. More rigorous work on these questions would be valuable not just in writing an accurate history but also for the leaning that this offers for better policy in future.

Bruce Mountain is director of Carbon and Energy Markets.

*This article is the second in a four part series based on the chapter Australia’s million solar roofs: Disruption on the fringes or the beginning of a new order by Bruce Mountain and Paul Szuster to be published in Distributed Generation and its Implications for the Utility Industry, edited by Fereidoon P. Sioshansi, published by Academic Press. The first article can be found here.