10 property predictions for 2017

Summary: While demand is high nationally, conditions remain highly variable across the country. |

Key take-out: Melbourne and Sydney are expected to experience continued strong housing demand, while apartments in the Melbourne and Brisbane CBDs will come under increased pressure. |

Key beneficiaries: General investors. Category: Property investment. |

Too many apartments, low levels of affordability and variable performance across capital cities defined the Australian residential property market in 2016. Can we expect more of the same in 2017? Here are my predictions, and also watch my latest Property Point video interview with Eureka Report's editor, Tony Kaye.

1. Global political uncertainty to impact Australian economic growth

Brexit and Trump were two surprises in 2016, and the ramifications will continue to be felt across the global economy into 2017. While the impact of Brexit has been largely self-contained, the same cannot be said for the US election result, and how the US economy performs next remains uncertain. We'll see this impact upon the Australian economy and, ultimately, the direction of our interest rates.

If the US economy continues its strong growth, it will put pressure on the US Federal Reserve to increase interest rates even further in 2017 following its rate hike this week (on 15 December). For Australia this means better economic growth and less pressure on the RBA to cut rates.

Conversely, if economic growth in the US economy slows dramatically and global trade is adversely impacted by policy decisions made in that country, it will have a strong negative impact on the Australian economy. Fortunately, in that situation the RBA still has capacity to cut rates. However, due to the ongoing impact of interest rate decisions on housing demand, this will continue to fuel the already-strong housing markets in Sydney and Melbourne.

2. Sydney, Melbourne to continue to see strong housing demand

In 2016 the REA Group Property Demand Index reached the highest level recorded. While this was partly due to a drop in the number of properties for sale, a surge in the number of people looking at properties on the site was the key driver. As we look forward, there is nothing that suggests we'll see demand decrease significantly. Factors that could change this include a rise in unemployment, a rise in interest rates or changes to negative gearing.

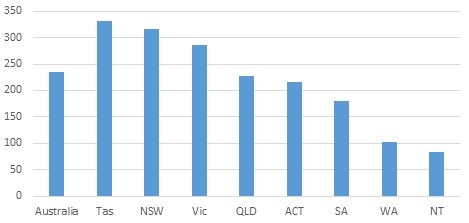

While demand is high nationally, conditions are highly variable across the country. New South Wales and Tasmania are both incredibly in-demand markets, while Western Australia and Northern Territory are seeing much lower levels of demand according to the index.

3. Perth to remain challenged, opportunities will present

The Western Australian economy is still growing, but growth is far lower than what the state is accustomed to. Next year, the WA Government forecasts growth of 1.25 per cent, far lower than the long-term average of 5 per cent. This, combined with a slowing in population growth and continued high levels of new housing development, are challenges for the residential sector.

House prices and rental rates have fallen and, given the poor demand conditions the state is experiencing, it is unlikely that this will reverse quickly. However in any market, even low-growth ones, there are always opportunities and Perth is no exception. While overall prices are down, suburbs like Peppermint Grove and Swanbourne saw substantial price increases in excess of 14 per cent in 2016 as buyers saw an opportunity to upgrade in an otherwise slow market.

4. Overdevelopment to still challenge some apartment markets

It should be made clear that not all apartment markets are challenged. However, unprecedented levels of development in the Melbourne and Brisbane CBDs will make these the markets the most likely to see price declines. While good for affordability, the potential for price decreases isn't great news for investors in these markets or, for that matter, the banks. Other CBD markets are seeing less development, however slow conditions in Perth are also causing concern.

In Sydney, apartment development needs to continue at its current rate to ease affordability issues and ensure adequate housing for population growth forecasts. Sydney is finally catching up to Melbourne in terms of development, however the city is coming off an extended period where very little new housing was being built.

Chart 1: Housing approvals, 2007-2016

Source: REA Group

5. Affordability to be a focus

Tasmania is currently the only state or territory in Australia where a single person on an average income can still afford to buy a house at the median. This is perhaps one of the key drivers in the increased popularity of Tasmania in 2016. This state has risen rapidly in popularity since mid-2015 on the REA Group Property Demand Index, and is now seeing the highest levels of demand of all states and territories for all dwellings.

With median prices continuing to rise across all capital cities, with the exception of Perth and Darwin, the drive for affordable housing is changing behaviour. In NSW, Central Coast suburbs are increasing in popularity, driven primarily by homebuyers from Sydney looking for larger, more affordable homes. In Melbourne, the outer-east is also seeing increasing interest from home buyers, again driven by relative affordability and larger homes on larger blocks.

Chart 2: REA Group Property Demand Index – all dwellings, November 2016

6. Negative gearing: still a hot topic

Negative gearing was introduced to increase the supply of rental housing and stop it from being a government-supplied service. It worked well, with government-provided rental housing declining from 25 per cent of the total, to less than 12 per cent today.

The original intent of negative gearing has largely been forgotten and it's more often now seen as a tax break for wealthy people, which contributes to decreasing affordability for homebuyers.

The negative gearing debate will continue in 2017, and although the Federal Government continues to publicly support it, recent comments by the NSW Planning Minister, Rob Stokes, show that the issue is far from resolved.

7. Unique properties to sell well

Unique dwellings are the properties that attract the most interest on realestate.com.au. Uniqueness comes in many different forms – perhaps the house is beautifully designed, architecturally interesting or of historic note – but the fact is, strong interest usually attracts more buyers and higher prices. Of course, a property can also be too unique and too different to attract buyers, so finding balance is key.

Despite discussion and concern surrounding oversupply of apartments in some suburbs, not all properties can be painted with the same brush. A recent analysis of art deco apartments in Melbourne showed that they attracted a premium when compared to other styles. While location remains important and a significant driver of price, there is no doubt that scarcity can also play a role.

8. Gold Coast, Melbourne Inner and Sydney Inner West to still be the top markets for renters, sharers

Analysis of where renters on realestate.com.au and sharers on flatmates.com.au are looking show the Gold Coast, Melbourne Inner and Sydney Inner West as the most popular locations. In these areas the number of people looking to rent or share far outstrips the number of listings on the respective sites. For both renters and sharers, the main driver of location popularity continues to be the amenities in the area. Good restaurants, bars, retailing and access to public transport are all high on the agenda.

Table 1: Top 10 suburbs for sharers (May 2016 to November 2016)

| Rank | State | Suburb |

| 1 | NSW | Sydney |

| 2 | Vic | Fitzroy |

| 3 | NSW | Surry Hills |

| 4 | NSW | Newtown |

| 5 | NSW | Bondi Junction |

| 6 | Qld | Broadbeach |

| 7 | NSW | Bondi Beach |

| 8 | Vic | Collingwood |

| 9 | NSW | Darlinghurst |

| 10 | NSW | North Sydney |

Source: Flatmates.com.au

Table 2: Top 10 suburbs for renters (May 2016 to November 2016)

| Rank | State | Suburb |

| 1 | Vic | Richmond |

| 2 | Vic | St Kilda East |

| 3 | Vic | South Melbourne |

| 4 | Qld | Surfers Paradise |

| 5 | Vic | Northcote |

| 6 | NSW | Surry Hills |

| 7 | Vic | Brunswick |

| 8 | Vic | Prahran |

| 9 | Vic | Port Melbourne |

| 10 | Vic | Elwood |

9. China's major influence on Austrlian residential property will remain

Property seekers from the US are the dominant offshore group viewing residential property on realestate.com.au, however it's China that has seen the strongest increase in interest over the past three years. Chinese developers and subsequently Chinese buyers are increasingly intrinsically linked to the level of new apartment development in our capital cities.

In 2016, there was a slight drop-off in Chinese interest in Australian property on realestate.com.au driven by new taxes on foreign buyers, difficulties in accessing finance in Australia and capital controls in China. The cities most impacted were Melbourne and Sydney, which saw an overall decrease.

As Chinese buyers become more educated about the Australian market, and the restrictions as to what they can buy, it will continue to impact our market. Changes in 2016 included a growing interest in Brisbane as well as house and land developments. The most popular price points for Chinese buyers also changed, as many looked to more affordable markets.

Chinese buyers also drove price growth in favoured locations. Melbourne's Glen Waverley, which is often the top location searched by Chinese property seekers, has seen some of the strongest price growth over the past five years and a very high number of sales over $1 million. In Sydney, Chatswood has seen a similar dynamic.

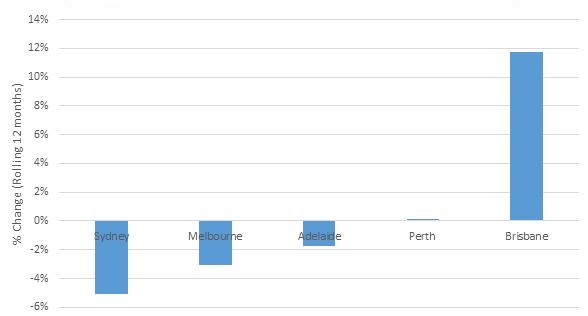

Chart 3: Views by China-based property seekers (percentage change, November 20, 2015 to November 20, 2016)

10. Digital disruption to continue to change property markets

As 'fintech' becomes increasingly overcrowded, 2016 saw a significant growth in 'proptech'. To keep pace with changes in digital advertising, at REA Group we announced the appointment of a chief inventor to focus on proptech initiatives such as virtual reality, augmented reality, drones and robotics.

BrickX launched the first fractional ownership model in Australia, while Purplebricks, a success in the UK, launched in the Australian market, offering a fixed price for people wanting to sell their homes.

In 2017 we can expect to see more digital initiatives targeting the property sector as companies look for a competitive edge.

Nerida Conisbee is chief economist of REA Group.