10% in a Week, It's Different This Time, Fed, Gold?, Chinese Chernobyl, Zoono, more

We are currently offering one month's free access to Eureka Report, including Alan's Weekend Briefing. Sign up here.

10% in a Week

It’s Different This Time

Fed Sidelined

What about Gold?

If not Gold, what?

Zoono Group

Chinese Chernobyl?

The Show Must Go On

Eureka Report Filter Tools

Roadshow

10% in a Week

The S&P 500 has produced another fall of more than 2 per cent this morning, so that means it has dropped near enough to 13% since last Saturday morning’s close.

So both the ASX200 and the S&P500 have dropped 10% in a week, which is a very rare event. Falls of 10% or more in a week have only happened four other times since the Second World War.

They are:

-

The October 1987 crash. That was triggered first by a huge run-up in the market in the previous 12 months and then by the Bundesbank tightening monetary policy, to offset the loose US fiscal policy. Underlying this was the rise in the US dollar brought about by the Plaza Accord of 1985. Markets realised that either the US dollar would fall or the Fed would have to tighten, or both, which would lead to downward re-rating of equities.

-

The 2000 dot com bust. In March 2000, the S&P 500 fell 10% but it took the Australian index three weeks. Once again it was preceded by a huge spike in prices due to a runaway expansion of multiples. The crash was a Minsky moment (that is, spontaneously combusting) exacerbated by tightening Fed policy in April through the removal of Y2K liquidity support and the raising of interest rates in May 2000.

-

After the 2001 terrorist attacks on New York. The New York Stock Exchange closed for three days after 9/11 and then dropped 12% in the following five sessions. The Australian market took two weeks to fall 10%. But they both took about a fortnight to regain the previous level after the Fed slashed interest rates immediately.

-

The Lehmann Brothers collapse, 2008. Lehman going belly up on September 15, 2008, culminated in the US real estate bust which had been slowly grinding global banking into submission for 12 months. The S&P 500 fell 10% and 35% by March 9 2009. The Australian market took three weeks to lose 10%, and ended up losing 29% between September 15, 2008 and March 9 2009.

To this list we can now add the fifth, the “Coronavirus Correction”, or “Pandemic Panic” of 2020. That definitely doesn’t mean we should panic and sell now, far from it – after all, on three of the previous four occasions prices rallied quickly and those who sold after the first week caught the bottom.

That is most definitely not what you want to do.

But this is the first correction caused by a medical event – a viral pandemic – which makes it unique. I’ll get into the differences in more detail below, but history prompts us to ask two immediate questions: how will the Fed react, and will it matter.

Previous form would suggest it will slash interest rates pretty soon. This time there is less room to cut, but it’s also true that before 2008 there was no such thing as Quantitative Easing either. Now there is.

As to whether a big easing of monetary policy, rate cut, or QE, will make any difference, that’s harder to answer. There is no precedent for what the global economy is now facing; nothing to go by.

But it’s worth noting that after each of the four previous times the market fell 10% in a week, there was a significant shift in the leadership of the sharemarket.

October 1987 was the beginning of the end of the corporate raiders of the 80s; March 2000 marked the end of the first period of supremacy of internet and technology stocks (they came back with a vengeance after 2008); the 9/11 attacks began a period of emerging market outperformance, led by China; and the 2008 GFC ended the supremacy of banks and financials.

For Australia, 2000/01 began a decade of outperformance led by mining companies and banks; from 2009 that was reversed as Silicon Valley technology stocks made their comeback, led by Amazon, Apple, Facebook and Google.

Will history show that the Covid-19 pandemic kicked off a period of outperformance by healthcare stocks? Maybe. I don’t know.

What I do know is that what’s happening is a very big deal, that potentially changes everything.

It’s Different This Time

There are many differences between this pandemic and previous ones, not the least of which is the nature of the virus itself: it spreads more quickly and more comprehensively because it kills fewer of its hosts.

Moreover, the world has also changed in important ways. We now have social media and, partly because of that, health and safety have become more important to governments than economics. That is evident in the behaviour of governments all over the world lately, but especially in China where lockdowns are widespread and absolute, with no thought for the economic five-plan.

All over the world, travel bans and quarantines are sudden and absolute, with no thought whatsoever for the impact on businesses or economic growth.

But the most important change is in the way global business itself operates.

It used to be that a company designed a product, manufactured it and then marketed and sold it. Vertical integration was just the way business operated, basically forever.

In recent decades that has changed: the fancy pursuits of design and marketing have been separated from the humdrum, capital-intensive business of manufacturing, which was handed over to China.

Companies have become “brands”, preferably global ones, and even functions like accounting and HR have been outsourced to digital agencies. No self-respecting startup these days has a factory – heaven forbid! They have carefully nurtured brands, digital platforms and IT developers playing ping pong at lunchtime. The name for this? Globalisation.

A side-effect of this has been to free up huge amounts of capital, since most the capital-intensive business activity – manufacturing – has been left to others. The capital freed up has been used to buy back shares in the US and pay dividends in Australia, and the purpose of that has been to super-charge shareholder returns and thus inflate executive salaries. It has worked beautifully.

And finally, these ethereal “brand” businesses can make their profits appear wherever they want, namely in low tax jurisdictions. This has created problems for countries with significant welfare structures like Australia, leaving them with structural deficits.

We can imagine we were heading for a globalised utopia where everything is designed in the US, Israel, Europe and Australia, manufactured in China and the profits pop up in Ireland, Hong Kong, and the Cayman Islands.

Except we are now discovering that this blissful global supply chain is only as strong as its weakest link, and in fact China is not just a link in the chain – it sits at the centre of a hub.

So now the fulcrum of the global industrial system has come to a standstill, brought to its knees by a tiny bug. After twenty years of supply chain optimisation – which more or less coincides with the period since the SARS epidemic – China appears somewhere in the supply chain of just about every manufactured product, whether consumer goods, industrial machinery and parts, drugs, you name it.

And because of the sheer number of people there that have become moderately wealthy and ambitious, China has also become central to global tourist and education industries.

The immediate consequence throughout the global supply chain is a cash flow drought due to a simultaneous demand/supply shock rippling around the world.

It doesn’t matter whether a business’s sales are affected by a collapse in demand or a lack of stock, the result is the same: the cash flow evaporates.

Obviously the cash drought is severest in China right now. This chart is from a survey by Tsinghua and Peking Universities of 1000 small to medium-sized businesses across China:

.png)

So 85% of businesses can last no more than three months, which sounds about right.

Chinese businesses already suffer a cash drain in the first quarter of every year because of the Lunar New Year holiday: only 22 per cent of annual sales occur in the quarter but workers get paid more because they traditionally get annual bonuses before going on holidays.

No doubt the Communist Party Government and the People’s Bank of China would step in to prevent a wave of mass bankruptcies if it came to that, simply by telling banks to support them, but clearly China’s businesses are already under a lot of pressure.

Similarly, the Federal Reserve and other central banks would ease monetary policy significantly if mass quarantines caused economic dislocation around the world, which is the scenario that markets had been pricing in before this week – a deflationary shock followed by monetary easing.

Several questions confronted markets this week, as they shifted from anticipating monetary and fiscal stimulus to fear about recession:

-

Will the global cash flow drought overwhelm the feeble efforts of central banks in cutting interest rates and buying bonds from banks?

-

Will central banks in fact judge that monetary policy will do little to defend the economy against an exogenous shock like a pandemic, not that they have any experience of such a thing, and decide instead to sit on their hands, in which case this week’s correction would be just the beginning?

-

And to what extent will the entire global industrial system be structurally undermined if its fulcrum – China – is out of action for a long time? When combined with Trump’s efforts to disengage the US from China, will this fundamentally disrupt globalisation itself?

It’s now clear that the pandemic will be a massive hit to global cash flows and GDP, which is why the global market has corrected by 11% as I sit here on Saturday morning reflecting on a very big week.

If we end up with a global recession, then nothing will prevent an even deeper correction and possibly a bear market developing.

The bond market often moves earlier than the sharemarket, and it now seems to be anticipating more trouble, along with gold:

.png)

One other point on the coronavirus: Black Swans often have a habit of arriving at a time of extreme complacency in financial markets, and this one was no exception. That can be shown with a few charts.

First, (thanks to David Scutt of the Sydney Morning Herald) here’s the Nomura global equity sentiment index two weeks ago – near a record high:

.jpg)

Here’s the same thing now:

.jpg)

This one from a couple of weeks ago shows that the Vix volatility index has parted company with policy uncertainty:

.png)

The bond term risk premium – that is the extra yield you get for going longer term and taking more risk – is at a record low:

.png)

The spread of corporate debt to Treasuries is near record lows

.png)

And although the Vix index of volatility has now spiked back to the 2015 peak, before this every peak since the GFC was lower than the last, and shorting the Vix has been a virtual one-way trade.

Vix index, past 20 years:

.jpg)

Fed Sidelined

In some ways this may be this month’s biggest development: the Fed has been sidelined.

For two decades, since the dot com bust in 2000, the only macro question that mattered for investors, apart from the questions around individual assets, was: what will the Fed do? “Don’t fight the Fed”, has been the correct mantra.

As things stand today, the market is still wondering what the Fed’s gonna do, but I venture to suggest that it doesn’t matter.

The liquidity-fuelled euphoria of the past 12 months is now over and it’s end has nothing to do with what caused it – the Fed’s dovish pivot last January, followed by restarting QE in October.

The new “risk-off” disposition of markets is entirely due to an exogenous Black Swan triggering a sharp increase in volatility, in turn triggering sell orders from the algorithms that account for about 80% of stock market volumes these days.

As the volatility continues a vicious spiral develops as algorithms step up the selling and cause still more volatility. That’s what happened towards the end of last week.

I very much doubt that a rate cut will do anything to turn this around.

To the extent the decisions are being made by human beings thinking about the impact of a global pandemic on business cash flows and economic output, they won’t be suddenly persuaded to change their minds if interest rates are lower or more money gets pumped into the banking system, at least for the time being.

Apart from that, quantitative financial conditions are still below levels that have drawn action from the Fed in the past.

In fact a rate cut would probably make matters worse, because according to Morgan Stanley’s New York based strategist, Michael Wilson, “the equity risk premium is sensitive to real rates below 0.”

Here’s a chart of the equity risk premium (earnings yield versus bond yield). It’s basically a shorthand way of comparing share prices with bonds – what extra do you get by taking the risk of investing in equities?

.png)

Here’s more of Michael Wilson on the subject:

“We've been watching 450 bps as the line where equity risk premium has held in past growth scares, with some modest overshoots in the recent past (Exhibit 2). We've been holding around that level through the day today, which is encouraging, but it also means the market is precariously close to moving to a point where lower rates are no longer enough to calm the market and support valuation.

“For example, with the 10Y at current levels (1.25%), an equity risk premium of 500 bps is 16x on the S&P's earnings. On current fwd 12 month numbers, that is about 2850 for the S&P. That assumes stable forward earnings, but a realistic bear case would see forward earnings fall, hence our bear case of 2750.”

The S&P 500 is at 25,409.5 this morning, which implies a further decline based on the ERP and a possible decline in earnings.

But that’s just a guess. Times like this aren’t very susceptible to quantitative analysis.

What about Gold?

I have never really understood gold’s appeal as a safe haven “currency” but I must admit it exists, and lately gold has been by far the best performing of the safe-haven currencies (yen and Swiss franc).

In fact as Goldman Sachs’ Mikhail Sprogis wrote in a note this week, it has been the only safe haven currency during the coronavirus outbreak:

.png)

As the year began, gold was a “sell”: volatility was down, the global economy was recovering, jewellery demand was down and central bank buying was slowing.

That has now turned around entirely and it’s now up 12% calendar year to date and 28% since January 1 2019 – 37% in Australian dollars. Goldman Sachs’ 12-month forecast is now US$1800, and if the Aussie dollar keeps falling, the AUD price will rise even more.

There are two important background elements to gold’s current bull run – first, the price is positively correlated to the amount of negative-yielding debt in the world, which has been rising (the reason, simply, is that the more negative yielding debt there is, the less the opportunity cost in holding zero-yielding gold):

.png)

As average bond yields fall towards zero now, there is only going to be more negative-yielding debt.

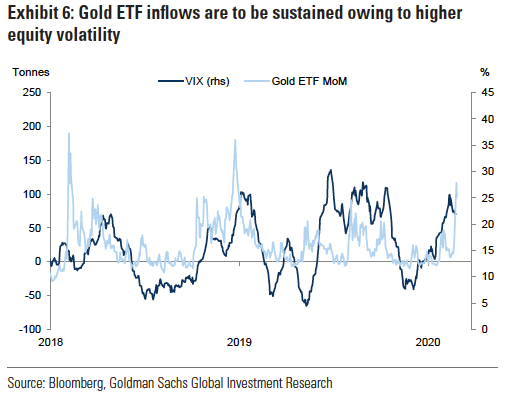

… and second, physical demand for gold by central banks to put in vaults and for jewellery has become virtually irrelevant. It’s now all about exchange traded funds (ETFs):

.png)

What’s more the ETF flows are closely correlated with equity market volatility:

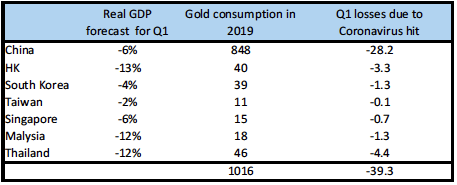

The coronavirus is causing a physical demand shock, especially in China, but it’s been limited, and has been outweighed by the increase in investment demand:

Goldman’s Mikhail Sprogis says that the surge in ‘fear-driven’ investment demand has been significantly larger than the consumer demand lost owing to any negative wealth shock to EM consumers as a result of China’s shutdown.

“We estimate that gold purchases fall 2.6% for every 1% hit to Chinese real GDP growth. Therefore, our Economists’ forecast of a 6% contraction in Chinese GDP in Q1 implies only a 28 tonnes loss in gold demand. Adding losses for other East-Asian countries implies a total loss of 40 tonnes.

“This is small relative to 130 tonnes of additional demand from gold ETFs since January 12. If it continues at this pace total ETF demand could reach 200 tonnes by end of Q1. The actual increase in gold investments could up to be twice as large owing to non-transparent purchases. Therefore, for gold, the fear-effect from Covid-19 more than offsets any wealth shock as the result of quarantines.”

What about Bitcoin, or “digital gold”, as some people call it? Well I understand bitcoin even less than gold, and it has run up this year in sympathy with real gold, and a lot of people are starting to see it as a safe haven.

I don’t think so. Maybe after it’s been around for a few more decades, as opposed to just one, it can be regarded as safe. Also the bitcoin price has corrected US$1600 or 15% in the past fortnight, while gold has spurted US$100, so the recent action suggests it’s not all that reliable.

Bottom line: these times are as about as uncertain as times get, so an allocation into a gold ETF would be far from stupid.

If not Gold, what?

Cash, obviously. No capital gain possible, but at least it pays a yield and is still government guaranteed up to $250,000 (more if you spread it around).

Apart from that, stick to your theme ideas and QAGC (quality at a good price).

Whatever happens with the virus, the world’s energy system is still going to be transformed to deal with climate change.

This has actually been a difficult theme to invest in up to now because of an oversupply of both lithium and renewable energy, so Orocobre and Galaxy Resources have been shocking investments, and renewables producer Infigen Energy has underperformed.

The best way to play climate change and ESG generally has been through Australian Ethical Investments, which has been crunched this year but is still almost four times its price of a year ago.

The best-performing stocks of the past 12 months have been technology and health care growth stocks, but the fate of WiseTech this month is a reminder of what can happen with stocks like that with bulging PEs (it has halved). PolyNovo is also a cautionary tale, down from $3.15 to $2.30 or so, and the other high-flying skin repair business, Avita Medical is also down 23% in not long.

Are these things buying opportunities? Maybe, but it doesn’t yet feel like a good to be loading up on expensive stocks that require either a leap of faith or everything to go right, or both.

Which brings me to Rio Tinto, Australia’s traditional mining bridesmaid (BHP is the bride).

It does not require a leap of faith or everything to go right.

The company yields 5.5% fully franked. In 2019, cash flow, or EBITDA was US$21.2 billion and free cash flow yield (per share) was 11%. Net debt is just US$3.65 billion. Assuming spot prices and a 70% payout ratio, dividend yield next year will be 7%.

Despite all this the stock has fallen from well over $100 to less than $90 is the coronavirus rout, which is understandable and is now selling for 11 times earnings.

As for the impact of the coronavirus on iron ore, there will be some impact clearly, but China is the main buyer for construction steel and it is now starting to recover, so the demand shock may be short-lived.

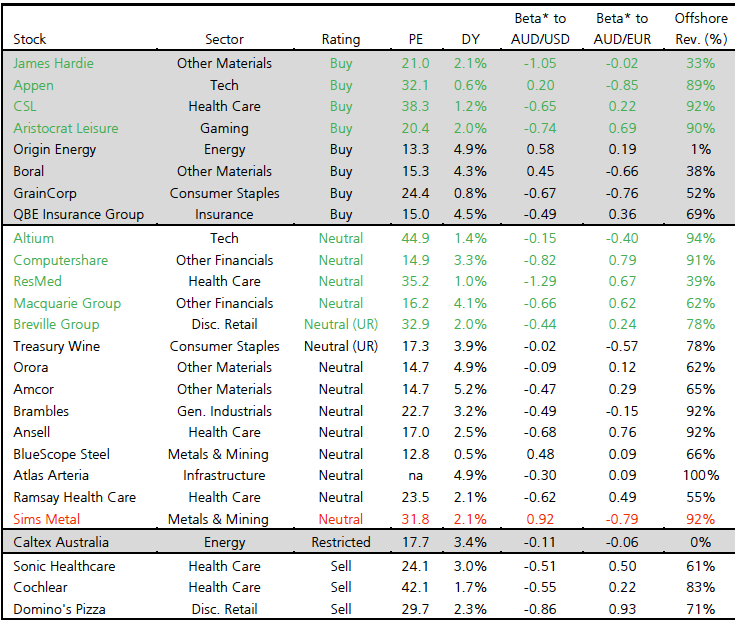

Another theme to consider for when you feel the time is right to buy (ie not yet) is offshore earners, since the Australian dollar is likely to stay weak, and in any recent falls have not yet made it into earnings upgrades by these companies.

Here’s a list of offshore earners, thanks to UBS (note that they’re mostly on the expensive side of good value) (also, I’m not sure why Origin Energy and Caltex are there):

Zoono Group

One stock that did not fall yesterday was Zoono Group, in fact at one stage it was up 28 per cent, and closed 16.98% higher.

As it happens, I interviewed the CEO of this company, Paul Hyslop, on Monday and we published the podcast and transcript on Tuesday. Here it is.

Yesterday Hyslop announced that Zoono’s Microbe Shield product is “99.995 effective against Covid 19”:

“Two separate tests were completed to EN Standard 14476:2013 A2:2019. The first was against Vaccinia, sometimes referred to as the ‘mother ship’ of double enveloped viruses (that are particularly hard to inactivate); with the subsequent test against the nominated (and globally accepted) surrogate for COVID-19, feline coronavirus.

EN14476 is the European Standard that applies to products within the medical area including hygienic hand rubs, hygienic hand wash, instrument disinfection by immersion, surface disinfection by wiping, spraying, flooding or other means.

RESULTS:

The test against Vaccinia confirmed efficacy of > 4Log (greater than 99.99% efficacy) for Zoono Z-71 Microbe Shield (the same Zoono technology used in Zoono Hand Sanitiser).

The second test against the COVID-19 surrogate, feline coronavirus, confirmed efficacy at 4.33Log (greater than 99.99% efficacy).”

Chinese Chernobyl?

I subscribe to a technology newsletter called Stratechery, and its editor Ben Thompson had an interview this week with another newsletter publisher, Bill Bishop of Sinocism, which is about China. Bishop lived in Beijing for 10 years and has a lot of good sources there apparently.

It’s not worth republishing the whole interview, but here's a section worth reading. It’s in answer to a question from Ben about whether this is China’s Chernobyl, that is whether it will shake confidence in the Government:

Bill Bishop: "There is a lot of anger about how the beginnings of this outbreak were handled and how there were the eight folks including at least one doctor who died who were reprimanded for posting in a WeChat group for medical professionals at the end of December that there was something like SARS going around Wuhan. And then obviously there was a bit of a coverup, there was a period where no new cases were announced, people went about their daily lives in Wuhan when other people in the Chinese system were aware that this virus was a real problem. And so there’s a lot of anger about how it was handled at the beginning.

What you’re seeing though, where I think it’s not the Chernobyl moment, is that actually the PRC and the CCP are still a highly functioning system and Xi Jinping and the Communist party have spent decades learning the lessons of the fall of the Soviet Union and specifically, Xi has one quote from a few years ago where when he analyzes why the Soviet Union fell and Gorbachev failed, was that no one was man enough to stand up. So I think what we’re seeing now is the propaganda is in overdrive. The entire system, every sort of facet or component of the CCP in the PRC system has been mobilized. And, they clearly have made, I think, a lot of progress against this virus. Even yesterday, Xi Jinping held a teleconference for 170,000 cadres and made it very clear that the battle’s not won yet, but they’re making progress.

But I do think what we’re going to see out of this is there are a lot of people who are pretty pissed off. There are people, especially when the doctor, Dr. Li Wenliang, died who were pissed off, but the propaganda organs, security services, they’re all going to be working in concert to, on the one hand, spin this as this great and glorious victory for the superior system of Chinese socialism under the leadership of Chairman Xi or General Secretary Xi, and at the same time, the security services will use whatever course of necessary measures necessary to silence and clean up anybody who would sort of try and argue with that narrative. And so I think that in many ways it could have been a Chernobyl moment, but I think the odds are that the CCP is actually going to pass it unlike what happened in the Soviet Union. Early on, I said this looked like an existential crisis. And I think, you can survive an existential crisis. I think this is the biggest crisis that the party has faced in many decades. But I think there’s a reasonably good chance that they’ll be able to come out of this declaring victory and, and being able to convincingly declare that victory both using effective propaganda and what they call public opinion management and control as well as bringing to bear whatever needs to be brought to bear on the coercive side.

The reality is if this virus really takes root in South Korea, Japan, or other countries, a couple months from now, we may look back and especially in China and people say, “Hey, you know what, actually we did a pretty good job.” Right? And so it’s just this thing spreads globally. It actually benefits the party."

The Show Must Go On

In the midst of all this, I hope Big Hit Entertainment Co, the company behind the Korean boy band, BTS - which it describes modestly as “the Beatles of the 21st century” – goes ahead with plans for an IPO to raise nearly US$1 billion.

I note that the company has cancelled some concerts due to the global coronavirus outbreak. According to a post on the group's mobile fan platform Weverse, the concerts planned for April 11, 12, 18 and 19 at the Jamsil Olympic Stadium in Seoul." So I wonder whether the float will go the same way.

The company’s website describes its mission as “Music and Artist for Healing”, which is just what we need right now.

On the other hand: here’s a music video of one the band’s hits, “On”. It left me unhealed, I must admit, which may not be helped by the fact I couldn’t understand a word of the Korean lyrics (although I doubt that it’s Norwegian Wood or A Day In The Life, somehow). They sure spent some money on the video, though.

Eureka Report Filter Tools

By the way, if you haven’t already done so, make sure you check out the research tools on the Eureka Report website, which I think are second to none. Apart from the pioneering capped fee investment funds, this is one of the main reasons I was delighted to return to Eureka Report under InvestSMART’s ownership – they’re great!

There’s a full set of research data and filter tools for ASX-listed companies, managed funds, ETFs, and listed investment companies. They’re all there, and able to be screened and researched in full.

There’s also a unique property investment tool, providing a whole lot of research and data on every postcode and suburb in the country.

These things are all free to Eureka Report subscribers, making it a far richer resource for investors than it was before coming under InvestSMART’s ownership.

I suggest bookmarking these pages and using them routinely whenever you’re interested in looking into an investment idea.

Roadshow

The great InvestSMART roadshow continues into the week ahead. CEO Ron Hodge, Liz Moran and I will be in Adelaide on Tuesday and Perth on Wednesday – love to see you there.

Click here to find out where and when.

We hope you enjoyed this edition of Alan Kohler's Weekend Briefing. We are currently offering one month's free access to Eureka Report, including Alan's Weekend Briefing. Sign up here.

Frequently Asked Questions about this Article…

The recent 10% drop in the S&P 500 and ASX200 was triggered by the 'Coronavirus Correction' or 'Pandemic Panic' of 2020. This is a unique event as it is the first correction caused by a viral pandemic, leading to significant market volatility.

Historically, the Federal Reserve has responded to market corrections by slashing interest rates. However, this time, there is less room to cut rates, and the effectiveness of such measures is uncertain due to the unprecedented nature of the pandemic.

Gold is often seen as a safe haven during market volatility because it is a tangible asset that retains value. During the coronavirus outbreak, gold has been the best-performing safe-haven currency, with increased demand from exchange-traded funds (ETFs) driving its price up.

The coronavirus has caused a significant disruption in global supply chains, particularly because China, a central hub in the global industrial system, has been heavily affected. This has led to a cash flow drought and simultaneous demand/supply shock worldwide.

The pandemic has highlighted vulnerabilities in the global supply chain, particularly with China's central role. Combined with geopolitical tensions, such as efforts to disengage the US from China, this could fundamentally disrupt globalisation.

During uncertain times, investors might consider allocating into gold ETFs, holding cash for its yield and government guarantee, and focusing on quality stocks at a good price. It's also wise to consider themes like climate change and offshore earners.

Zoono Group announced that their Microbe Shield product is 99.995% effective against COVID-19, which has led to a significant increase in their stock price. This highlights the potential for healthcare stocks to outperform during the pandemic.

Central banks, including the Federal Reserve, are expected to ease monetary policy significantly if mass quarantines cause economic dislocation. However, the effectiveness of such measures is uncertain given the unique nature of the pandemic.