Nathan's View: Selling AMP and why I'm bullish on US housing

It’s a new year but investors aren’t excited. While a new year gives you the opportunity to free yourself from bad past behaviours with a list of new year resolutions, the financial markets seem to be doubling down on the soured expectations from late 2018.

The difficulty with last quarter’s falls is that it hasn’t drowned us with excellent buying opportunities in Australia, as you might expect. In fact, the market is acting very rationally.

The very high growth stocks haven’t fallen far in most cases, and most stocks that did trade on excessive price-to-earnings ratios are still trading at valuations that require a perfect future to make satisfactory returns.

The stocks that do trade on statistically cheap valuations are typically highly risky and deserve their low multiples. Our response so far has been to stick to quality, keep exposure to cyclical companies low, keep our return expectations modest and arm ourselves with lots and lots of patience.

We’re hopeful that reporting season during February will toss up at least one opportunity or two, despite the fact that companies expecting bad news have likely already announced it.

A US home building renaissance?

Far from being pessimists, though, there is at least one theme that we believe will be very positive for Australian investors over the next decade i.e. the US home building market, which has been slowing of late.

I’ve copied the relevant section from our recently published quarterly report below. If you, a family member or friend is looking to invest, we also explained our investment process in a style that we hope you will find easy to read. It also has lots of charts for those who’d rather be reading a book at this time of year.

SMAs

We’ve also had a couple of queries from investors questioning some of our recent sales in the portfolios, particularly a couple of stocks that weren’t owned for long when we’re supposed to be long-term investors. It’s a topic that I will explain in detail in the January monthly report due for publishing in a couple of weeks.

Over the past few months we’ve sold a stock for every reason I can think of except for tax reasons. For now, I thought it might be useful to publish one response regarding AMP that helps explain our investment process.

This issue also got me thinking about separately managed accounts, or SMAs. The beauty of SMAs is that you own the shares in your own name and see all trading activity, while outsourcing the stock picks to a fund manager.

SMAs are relatively new and should grow dramatically in popularity. They are much cheaper to manage these days, which is why they only used to make sense for wealthy individuals.

But I’m also wondering whether for some people it’s a good thing to see the trading activity. It’s bad enough that people have their focus drawn to monthly performance numbers, when you need to be invested for five years or longer to judge the performance of a fund manager through a full cycle.

Now that you can see every trade, the focus on the short term is even greater. The increased transparency is great, but if it comes at the cost of reducing people’s investment horizons then the benefits will be wasted.

Research into the individual returns of investors in Peter Lynch’s famous Fidelity Magellan Fund suggested the average investor lost money despite Lynch compounding returns at an astounding 29% per year from 1977-1990.

A mix of short-term investment horizons and trying to time the markets ups and downs no doubt. I wonder how much worse the performance would’ve been if investors had instant access to Lynch’s trades.

It will be interesting to see how people react when we go through a downturn, as very few people had SMAs during the GFC.

US Residential Property Market

Stocks related to the slowing US residential property market have been some of the market’s worst performers over the past year or so. Although it only accounts for 4% of US GDP, the industry is a bellwether for the US economy.

It’s also an important sector for Australian investors, as numerous Australian companies, such as Boral, Reece and Reliance Worldwide, have recently made large acquisitions with varying exposure to the US housing market.

As we own the latter two names and would also like to own James Hardie at the right price, it’s an important sector for us as well. Note Reece and Reliance earn most of their profits from repairs and maintenance, which can provide more stable profits than other companies more directly exposed to new home building, such as homebuilders.

While the market has clearly slowed recently, and higher property prices and higher interest rates have sunk the sharemarket’s expectations, there are three reasons why we’re long term US housing bulls.

Weak recovery

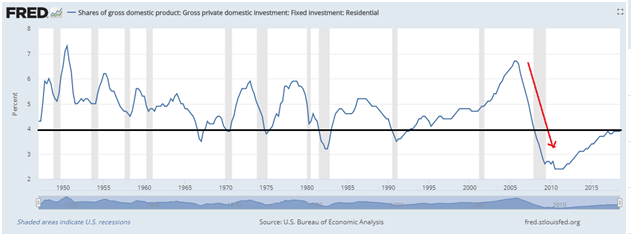

First, after being decimated during the GFC, annual new builds haven’t even recovered to the long-term average of ~1.4m. In fact, new starts have only recovered to a level consistent with historical lows (Chart 1). This suggests America will need plenty of new homes in future as the population grows.

Chart 1: Shares of gross domestic product: Gross private domestic investment: Fixed investment: Residental

Fears about higher interest rates, and therefore affordability, also seem over done in light of history, as Bill Smead of Smead Capital Management explains, ‘Stand-alone residences were the most affordable to buy in 2011 as in any year of my adult life. We built 320,000 in the year 2011. They were the least affordable in the 1970s and 1980s, and we built 1m homes many of those years with 65% of the existing population base. There is an inverse correlation between home building and affordability.’

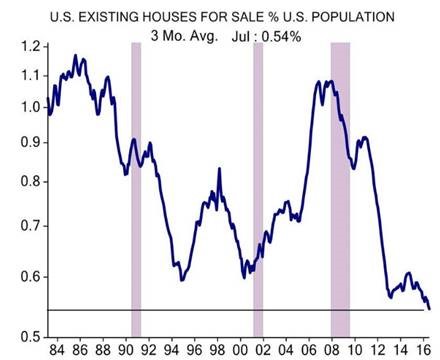

‘From 2009 to 2013, homes were the most affordable in my lifetime (60 years). As you can see from the chart below, the availability of homes for sale, coming off five years of negligible home building, was the lowest in 60 years:’

Chart 2: U.S. existing houses for sale % U.S. population

Source: ISI Group

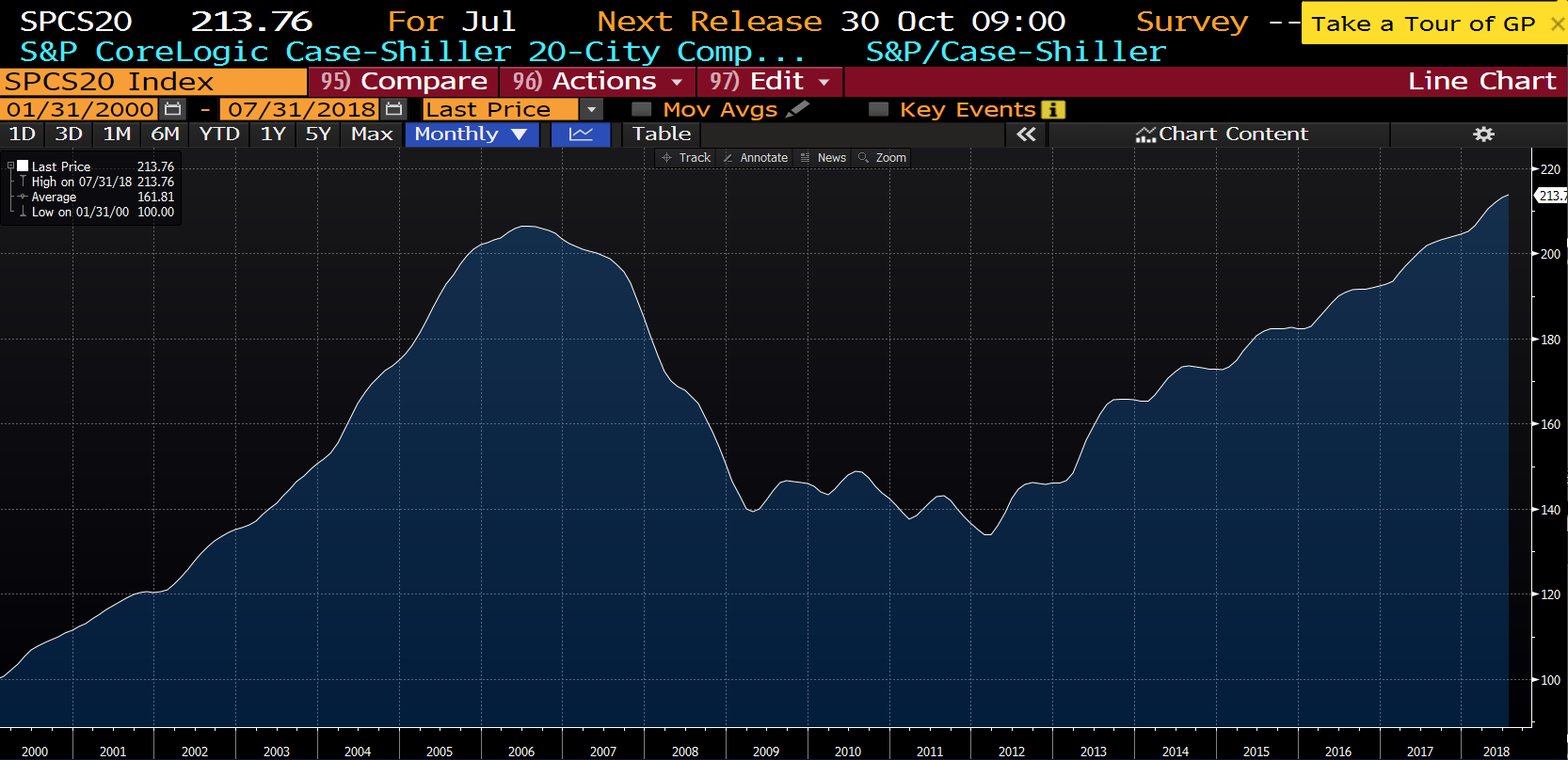

‘This chart shows that there is a severe lack of supply in homes and the owners (primarily boomers) are staying in their home much longer than prior generations. How would you have done if you bought home builders at the low points on this chart in 1994 and in 2000? The Case-Schiller chart below answers the question:’

Chart 3

Source: Bloomberg

Source: Bloomberg

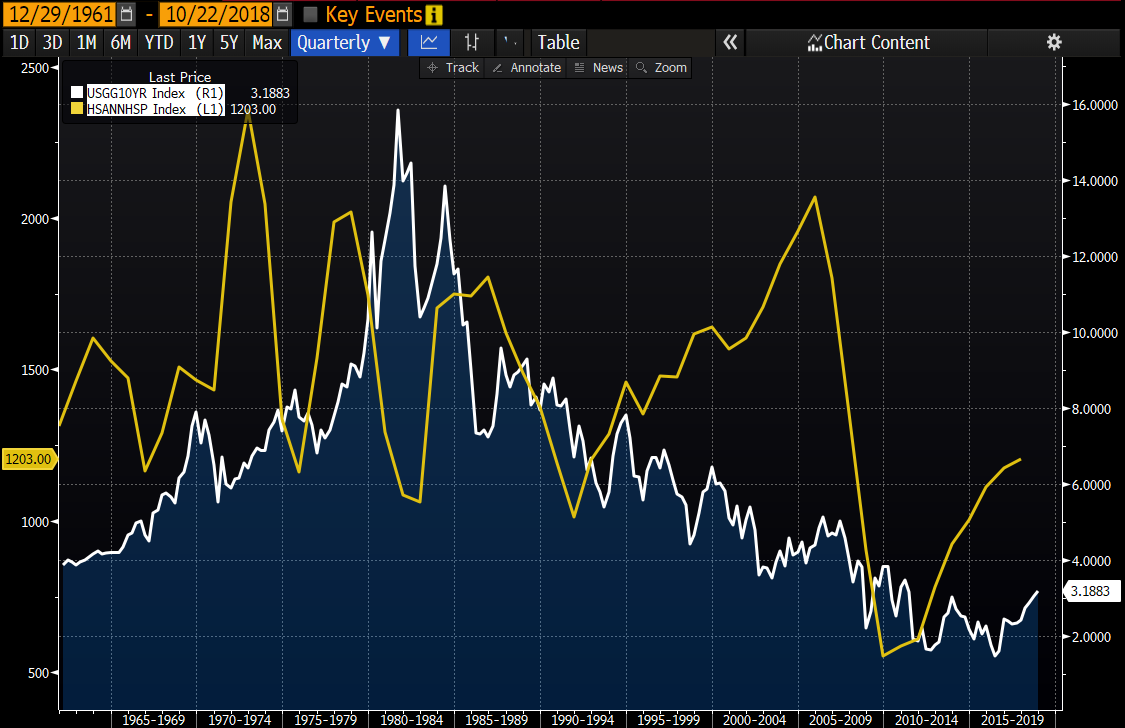

‘In fact, the biggest home building phases outside of the 2003-2006 mania were in the early 1970s, the late 1970s and the mid-1980s. Two of those intervals peaked at ten-year Treasury rates above 10% and everything on this chart happened at mortgage rates far higher than today’s rates. What was the cause of this huge demand in the face of high mortgage rates and very unaffordable homes? We had the largest population group hitting first-time home buyer status constantly from 1970 to 1986!’

Chart 4 Source: Bloomberg

Source: Bloomberg

‘The chart of housing starts versus Treasury interest rates is not population adjusted the way the prior chart was. There were 180m people in the U.S. in the early 1960s, 225m in the 1980s and America is approaching 330m residents now. Don’t 330m people need more homes than 225m did?’

Selling AMP

Dear XX,

I wish investing was easy and markets, industries, companies, and CEOs were highly predictable. Unfortunately, that is not the case. Things can change rapidly and sometimes we need to act quickly, particularly when we think we've made a mistake.

I'm not sure if you've followed Intelligent Investor in the past, but I learned the hard way about admitting mistakes and moving on quickly with QBE Insurance. I was the third Research Director to cover the stock and I, like my predecessors, gave management the benefit of the doubt and was focused on the $1bn of cash it was producing.

Every six months it would announce another profit warning, I would remain focused on the $1bn of cash it was producing, and expected management would eventually fix the problems. After several years I gave up, and the stock trades at the same price today.

While every time we buy a stock we plan to own it for a long time provided the valuation and performance of the business and management stack up, the reality is that we make mistakes, and often those mistakes show up very quickly.

You've seen my explanation for reversing course with James Hardie, which has been the right call so far. Downgrades typically come in twos and threes, and when a company's revenues and profits lose momentum, it can take many years to recover. Not always, but most of the time. So, there's no value hanging on in hope, as at best you have dead money and usually worse, the losses increase.

With AMP, I had a valuation of over $4 when I bought it at $3. A month or two later and the board (acting under the auspices of acting CEO Mike Wilkins), very unusually, sold the life insurance business and a few other bits and pieces for a sum that was way less than I or anyone expected. So low was it, that some investors threatened legal action against the board.

After the deal, my valuation dropped to $3, so yes, it was a mistake to buy it at $3 in the first place. But in response to the deal, the share price fell below $2.30, which was well below my $3 estimate of value, so I hung on.

More recently, the share price increased back within almost 10% of my value estimate (and remember a valuation is only an estimate), so I decided to sell. The Hayne Inquiry report gets handed down on 1 February, and no one knows how it will go.

If it sticks with the status quo, then perhaps the share price will pop to $3, as the company has capital to return to shareholders or for the new CEO to invest in the business to grow earnings. But if it's a worst-case scenario for AMP, where Hayne recommend a split between product sellers and financial planners, then the share price will probably head back to $2.

So, at a stock price of $2.60, the downside outweighed the upside and I sold for a small loss while we wait to see the outcome of the Hayne Inquiry and CEO De Ferrari's strategy for the next five years.

AMP was never more than a ~4% position, so even at a 15% loss that's only 60 basis points. Given the upside could've been well above $4 based on my original estimates, it was a risk worth taking. It's important to understand that it's valuation and business and management quality that guides our decisions, and nothing else.

I thought there was a low risk of losing a large amount of money buying at $3, and for the time being at least that proved right. Even with a terrible sale price for the life insurance business, your loss was still small.

Keep in mind that a company like 360 Capital could easily double or more over the next few years if things work out, so that would make up for the 60 basis-point loss more than six times over. It's very important not to get hung up on small losses given you own a portfolio of excellent companies, run by competent managers, with safe balance sheets and the potential to increase dividends substantially in both the short and long term.

I've only been back at InvestSMART since mid-August and there has been more buying and selling than would usually be the case as I shift the portfolio to what I'm comfortable with. I will explain this in more depth in the monthly update along with the explanation for the sale of AMP.

I wish investing were easier XX, but if it was there wouldn't be great opportunities at times to earn very high returns. It's my view that if I'm not making a few mistakes here and there, then I'm not trying hard enough. If I only bought what felt safe and obvious, then our returns would be pitiful. We only make high returns when we go against conventional wisdom.

This approach suits us as we don't get emotional about the stocks. They owe us nothing and don't care whether we own them or not. But investing is highly competitive, and we wouldn't have it any other way. Short term losses are the price you pay for long term returns that beat the market, and very, very few people are prepared to pay that price.

I hate to cite Mike Tyson, but he once said that everyone has a plan 'til they get punched in the face. It's the same for most would-be value investors. Everyone is a patient, long-term investor until they're forced to deal with the first sign of trouble and they throw out their plan faster than my seven-year old makes homework magically disappear.

I hope that provides more insight in to our process XX, but if you've still got questions or reservations please call me directly on XX.

Kind Regards,

Nathan

We hope you had a happy and safe Christmas break, and please call us on 1300 880 160 or email us on support@investsmart.com.au if you have any questions about the funds. This year promises to be full of opportunity, even if it doesn’t feel like it at the time.

Ready to invest?

Click here for more information about the Equity Growth Portfolio

Click here for more information about the Equity Income Portfolio

Frequently Asked Questions about this Article…

The US housing market is seen as a positive investment opportunity because it has not yet recovered to its long-term average of new builds, suggesting a future demand for homes as the population grows. Despite recent slowdowns, historical trends indicate that high demand can persist even with higher interest rates.

Investing in SMAs allows you to own shares in your own name while outsourcing stock picks to a fund manager. They offer increased transparency and are now more affordable, making them accessible to a broader range of investors.

While transparency in SMAs is beneficial, it can lead to a focus on short-term performance, potentially reducing investors' long-term investment horizons. This could result in missed opportunities for long-term gains.

The author sold AMP shares because the valuation dropped significantly after the company sold its life insurance business for less than expected. The potential downside of holding the shares outweighed the upside, especially with the uncertainty surrounding the Hayne Inquiry.

The US residential property market is significant for Australian investors because several Australian companies, like Boral and Reece, have made large acquisitions with exposure to this market. The sector's performance can impact these companies' profitability.

The article suggests that acknowledging and quickly addressing investment mistakes is crucial. Holding onto underperforming stocks in hope can lead to increased losses, so it's important to reassess and make informed decisions based on current valuations and market conditions.

The author's bullish outlook on US housing is based on the historical low levels of new home builds, the growing population, and the inverse correlation between home building and affordability. These factors suggest a strong future demand for housing.

Patience is emphasized because financial markets can be unpredictable, and long-term investments often require time to realize their full potential. Short-term market fluctuations should not deter investors from their long-term goals.