Investing in your children's education

A recent report commissioned by the Australian Scholarship Group (ASG) which uses government data, revealed that putting a child born in 2019 through 13 years of private schooling in metropolitan Australia could cost an average of around $351,684.

While this figure may send shivers down the spine of parents or parents to-be, it only serves to reiterate how important it is to invest for the future of your family.

School fees vary from state to state and region to region and also fluctuate every year but regardless of the school you have in mind, planning well in advance and investing responsibly makes achieving your goal for your child’s education more manageable.

To highlight how this is possible, I’ve used examples of a variety of family circumstances investing in different InvestSMART portfolios.

Using InvestSMART’s ‘Kids Education Savings Calculator’, I’ve entered different starting investments and monthly contributions to reflect these hypothetical family situations, the aim being to exemplify how structuring your investments can help you achieve your financial objectives.

For the following three examples, we’ll keep constant the average Australian family of two children (aged two and four) and dual income earning parents (aged 34 and 35). Inflation and the cost of living inflator will remain fixed at 2.7 per cent over the period.

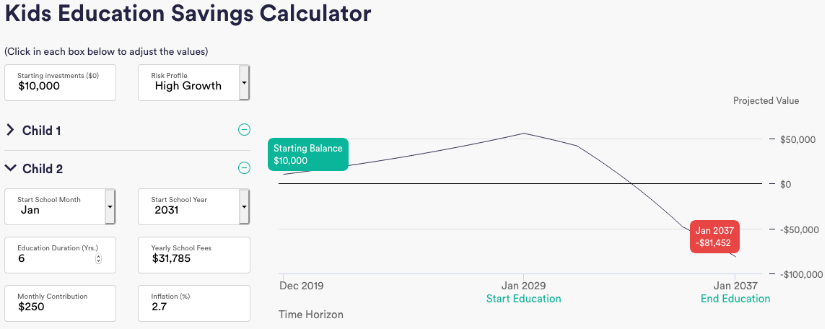

Example A

- Living in metropolitan Victoria

- Parents want to send both children to same private high school starting in year 7

- Using InvestSMART’s High Growth portfolio (avg return since inception of 9.1% p.a.)

- Starting investment $10,000, monthly contribution $250

Situation: Sending your child to a private high school in metropolitan Victoria is at the upper end of school fees in Australia. On average, ASG estimates that yearly school fees are $31,785 per child, which includes tuition fees and extra’s (uniform, school camps, transport etc). We’ve assumed the parents decide to contribute a starting investment of $10,000 today and over the time horizon ending in the youngest child finishing high school (2037), parents make a monthly contribution of $250 per child.

Result: As the graph shows, the parents’ investment over the next 10 years reaches $54,949 when their first child starts their private high school education in January 2029. A combination of the initial investment and monthly contributions mean they have achieved returns of $44,949. While the High Growth Portfolio has a high-risk profile, it has a suggested timeframe of over seven years, meaning it is useful for this family given they have 10 years to save before the first child starts.

Outcome: As you can see however, from February 2033 onwards, the parents don’t have enough money in their portfolio to pay school fees. By the end of the second child’s private schooling, they have to find another $81,452. This highlights the importance of budgeting to save a portion of income to add as monthly contributions, which will benefit parents in terms of compounding returns. In an ideal world, starting with a high initial investment would also work but if you don’t have enough savings, adding monthly contributions is the next best option.

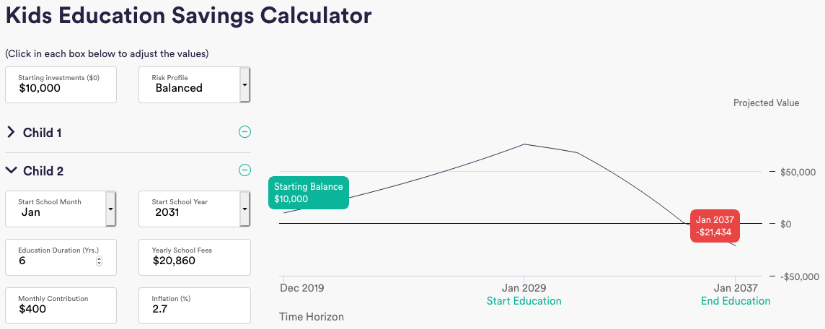

Example B

- Living in metropolitan QLD

- Parents want to send both children to same private high school starting in year 7

- Using InvestSMART’s Balanced portfolio (avg return since inception of 7% p.a.)

- Starting investment $10,000, monthly contributions $400

Situation: Sending a child to a private high school in metropolitan Queensland is estimated to cost an average of $20,860 per year. While this fee is less than Example A, we’ve also reduced the risk to InvestSMART’s Balanced Portfolio, which offers more of a medium-high risk measure given its combination of both defensive income assets and growth assets. While the initial investment remains at $10,000, we’ve upped the monthly contributions to $400 per child.

Result: The graph highlights an improvement on ‘Example A’. Why? Example B shows the importance of maintaining solid monthly contributions, which is a great alternative to having a high starting investment. Yes, the school fees are cheaper by comparison, but by budgeting to set aside $150 more per child than Example A, parents are now owing just over $21,000 by the time their second child finishes school.

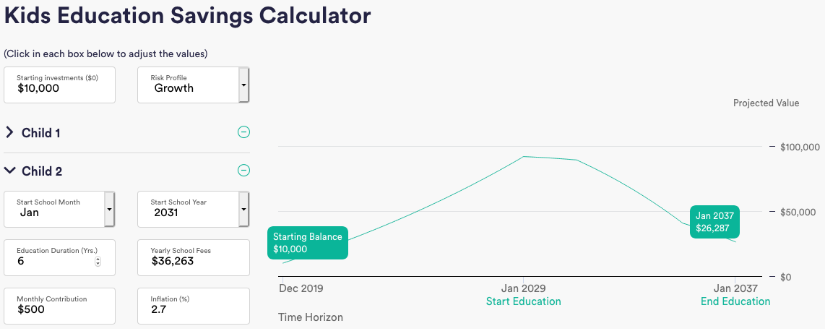

Example C

- Living in metropolitan NSW

- Parents want to send both children to same private high school starting in year 7

- Using InvestSMART’s Growth portfolio (avg return since inception of 8.7% p.a.)

- Starting investment $10,000

Situation: The average yearly cost of private high schools in metropolitan NSW is the highest in the country at $36,263. We’ve moved to InvestSMART’s Growth Portfolio, which sits between the High Growth and Balanced portfolio’s in terms of risk. We’ve kept the initial investment at $10,000 but have again, upped the monthly contributions to $500 per child.

Result: This final example highlights the difference monthly contributions into a slightly riskier portfolio makes over a long period of time. Despite school fees being nearly double those in Example B, making the monthly contribution increase $100 per child in this situation actually allows the parents to have made over $25,000 once both children have finished school. This reiterates the importance of either saving to start with a bigger initial investment or alternatively, contributing frequently throughout your investment’s lifetime.

*The information regarding average school fees are based on ASG’s planning for education index 2019 which can be accessed here. Below is a table of the average cost per state.

Average fees in 2019 for private high schools in Australia

|

|

Metropolitan |

Regional |

|

VIC |

$31,785 |

$18,208 |

|

NSW |

$36,263 |

$14,113 |

|

WA |

$17,117 |

$8,760 |

|

QLD |

$20,860 |

$16,534 |

|

TAS |

$21,422 |

$9,922 |

|

ACT |

$16,252 |

N/A |

|

SA |

$18,721 |

$13,179 |

Source: ASG Planning for Education Index 2019

Click here to use the InvestSMART Education Calculator & here for our capped fee portfolios.