Dipping Aussie dollar yet another good reason to invest in US stocks

Investors in top US stocks have been rewarded this year.

Australian investors in US stocks have achieved some spectacular returns over the past year, thanks to the effects of the so-called ‘‘Trump bump’’.

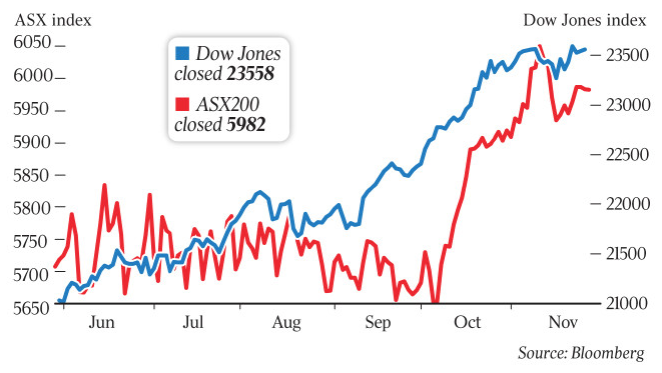

The Dow Jones Industrial Average has gained more than 28 per cent since the election of Donald Trump on November 8 last year, while the technology heavy Nasdaq index is up more than 32 per cent.

That’s where the biggest US stock gains have been occurring, and where Australian investors including self-managed superannuation fund trustees and members have been most focused.

Although Australian equities investors retain a heavy home bias, preferring the relative safety of the domestic market, a growing number are broadening their portfolio horizons.

Australian Taxation Office data shows SMSFs collectively held more than $4.3 billion in overseas shares at June 30, with the US market the favoured destination.

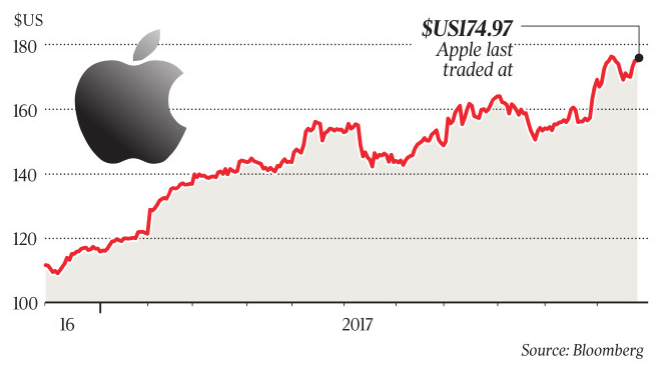

Recent data from software group Class noted that more than 11 per cent of the SMSFs owning international shares have holdings in Apple. A similar percentage hold Alphabet (Google), while Microsoft and Amazon are also among the top holdings.

For those who have ventured offshore, the journey has been very worthwhile in many cases.

Investors in top US stocks such as Amazon and Apple have seen their shares jump by more than 47 per cent and 58 per cent respectively since the US election.

Other technology heavyweights such as Facebook, Alphabet and Netflix, which together with Apple and Amazon are widely referred to as the FAANG stocks, have delivered price returns of between 33 per cent and 60 per cent over the year.

Then there’s the electric carmaker and energy storage company Tesla, whose shares have surged close to 70 per cent in 12 months.

Even those who have used the exchange-traded funds on the Australian Securities Exchange to gain access to the US market have done well.

BlackRock’s iShares S&P 500 ETF, listed on the ASX under the code IVV, has about $2.3bn in funds under management, while the Vanguard US Total Market Shares ETF (VTS) has about $1.06bn.

IVV units have increased 22.3 per cent over the last year, while VTS units also are up more than 22 per cent.

It’s the stuff that share dreams are made of, especially when compared with the mediocre returns by many of Australia’s top companies over the same time period.

Our biggest, Commonwealth Bank, has gained about 11.9 per cent, while second on the ladder Westpac has risen a much more modest 4.5 per cent.

Telstra, now considerably further down the list of Australia’s largest companies than a year ago, has suffered a 29 per cent price fall.

Will dollar dazzle?

The medium-term returns spread between the top US and Australian companies could become even more pronounced if analysts from the global financial services firm Morgan Stanley are proved right.

They are tipping the Australian dollar is headed for a big fall which, if it eventuates, would provide a massive sugar hit for Australian investors in US stocks.

Over the past year, the Australian dollar has largely flatlined against its US counterpart. On the day of the US election, the Australian dollar closed at US76.1c.

Last week, it was at exactly the same level, almost to the fraction of a cent.

That isn’t to say it hasn’t done anything in between. Just a few days ago it fell to US75.3c, one of its lowest points for this year and, in early September, the cross-rate with the US dollar was at its high point for 2017 to date, at US81.24c.

It’s unlikely to be back at that level anytime soon, unless a major political or economic crisis unfolds in the US.

Yet, if an Australian investor had bought into any US stock at the exchange rate peak on September 8, they would be 6.3 per cent ahead now, just from the currency fall.

It’s an opportunity lost, for some. Yet, if our dollar does crash, as Morgan Stanley says it will, Australian investors in US stocks stand to be even bigger winners.

The investment bank’s London-based chief global currency strategist, Hans Redeker, believes the Australian dollar will slump to an exchange rate of US67c in 2018, and continue slipping to US65c in 2019.

That’s based on US interest rates continuing to rise, to the point where the Federal Reserve’s cash rate will eventually exceed that of our Reserve Bank’s.

As US interest rates rise, more capital will flow from lower-yielding economies such as Australia into those offering better returns.

If the Australian dollar does drop from current levels to US67c, domestic investors in US stocks stand to make almost 12 per cent just from the currency impact alone. Going a step further, a fall to 65c would deliver about 15 per cent — on top of any share price gains produced from the US market itself.

Westpac’s chief economist Bill Evans is another who expects the Australian dollar to come under strong pressure over time as a result of both the US-Australian interest rate differential and foreign investor confidence.

“Australia’s reliance on foreign investors to fund our large accumulated overseas debt is dependent on offering an attractive yield or a cheaper currency,” Evans said last week.

His forecast is that the US official rates will rise above Australia’s, with a yield differential of 38 basis points by the end of 2018, and that our cash rate will remain on hold in 2019 as well.

“This sustained period of a negative interest rate differential is expected to take its toll on the Australian dollar. By mid-2019 we are looking for the dollar to move down to US68c, with the risks pitched to the downside. Overall, around a cumulative US10c fall in the Australian dollar is expected.”

There are never any guarantees in financial markets.

Yet, if the economists are right, and the buoyant forecasts on US technology stocks by some fund managers hold true, Australian investors in US stocks can expect more good upside over the next year and beyond.

Tony Kaye is the editor of Eureka Report, which is owned by financial services group InvestSMART.

Frequently Asked Questions about this Article…

Australian investors are increasingly interested in US stocks due to the impressive returns seen in the US market, particularly in technology stocks like Apple, Amazon, and Tesla. The US market offers diversification and potential for higher returns compared to the domestic market.

The Australian dollar has largely flatlined against the US dollar over the past year, but any future decline could enhance returns for Australian investors in US stocks. A weaker Australian dollar means that gains in US stocks are worth more when converted back to Australian currency.

Top US stocks that have performed well include technology giants like Apple, Amazon, Facebook, Alphabet (Google), Netflix, and Tesla. These companies have delivered significant price returns over the past year.

Exchange-traded funds (ETFs) like BlackRock’s iShares S&P 500 ETF (IVV) and Vanguard US Total Market Shares ETF (VTS) provide Australian investors with an easy way to access the US market. These ETFs have also shown strong performance, with returns over 22% in the past year.

If US interest rates continue to rise, it could lead to a stronger US dollar and more capital flowing into the US market. This scenario would benefit Australian investors in US stocks, as their investments could gain additional value from currency exchange rate movements.

The 'Trump bump' refers to the significant rise in US stock indices following the election of Donald Trump. Since his election, the Dow Jones Industrial Average and the Nasdaq index have seen substantial gains, benefiting investors in US stocks.

Analysts, including those from Morgan Stanley, predict the Australian dollar might fall due to rising US interest rates and a negative interest rate differential between the US and Australia. This could lead to increased foreign investment in the US and pressure on the Australian dollar.

While there are no guarantees in financial markets, Australian investors in US stocks could benefit from both stock price gains and favorable currency exchange rates. However, they should also be aware of risks such as currency fluctuations and changes in global economic conditions.