Tough conditions persist for NRW

NRW Holdings (NWH) exemplifies the dangers when bargain hunting in the challenged mining services sector. The stock has declined from $1.00 when we had a “sell” recommendation last year to today's price of $0.19 – six-year lows.

NRW has a long history as a Perth based contractor in the mining and civil construction industries. Since inception in 1994 it has expanded its mining and civil service offerings and in 1998 established iron ore mining services in the Pilbara region. Since this time management has attempted to diversify across other resources and infrastructure.

The company listed in 2007 and has a client list including BHP, Rio Tinto, Fortescue Metals Group, Samsung C&T for Roy Hill and Chevron. In 2011 they diversified into coal with a five year contract in the Bowen Basin.

At $1.00 in September last year the company was on a trailing price-earnings (PE) multiple of 5, and dividend yield of 9 per cent. The chief executive Jules Pemberton had given guidance for FY15 revenue of between $1 billion and $1.2 billion. Pemberton also stated he was confident the pipeline was strong enough to support revenue at around $1bn for the next few years.

Although Pemberton was happy to provide revenue guidance he wouldn't forecast margins due to the uncertainty and pressure from competitors, who, in desperation, are happy to take on work at close to break-even margins. Last year's FY14 result produced decent margin compression with a 17.5 per cent drop in revenue to $1.1bn, translating to a 40 per cent drop in net profit to $44.2 million.

The lack of margin guidance was an early warning of the pain to come. Since this time the stock has fallen over 80 per cent to $0.19. With the company having a large exposure to iron ore, its order book has not surprisingly continued to decline to $900m. This includes the recent $300m extension for Middlemount to 2020.

The major negative surprise in the recent first half result was the contract dispute with Samsung C&T over the Roy Hill rail formation project. NWH recognised zero margin but stated negotiations are ongoing for a potential profit to be reported at the full year result.

Any contractor with fixed priced contracts is taking on huge risk in the current environment. The reason why there have been so many contract disputes in recent times is a reflection of the power that the resources companies have over contractors. Not only are margins low but contract conditions are heavily in favour of resource companies.

The reported first half loss of $120.6m included $134.9m of impairment charges. Underlying earnings before interest, tax, depreciation and amortisation (EBITDA) of $2.7m was down 95 per cent on the same period last year and well below market expectations of around $50 million. Due to the poor result the interim dividend was also cut to zero.

Net debt of $27.9m declined from $34m at the full year result last year. Due to the balance sheet strength there shouldn't be any further negative flow on effects from the FY15 net loss of $15m we are forecasting.

Moving past this year we expect the weak operating conditions to continue with significant uncertainty around margins and whether management can replenish the order book with work outside the iron ore sector.

For FY16 and onwards revenues will be closer to $500m than the guidance last year of $1bn plus. Our forecast net profit range of $10-15m over the next couple of years means the stock is on a FY16/FY17 PE of about 5 to 6 with a dividend yield of 7 per cent plus.

There is a fair bit of weakness priced in, and the stock is closer to a “hold” than a “sell”. But we are ceasing coverage because there are other mining service companies that have less risk and priced on similar multiples.

Having said that, we are still very cautious on the sector given the weak mining capital expenditure outlook and the surplus of services companies that is ensuring margins remain depressed.

But with the majority of mining services companies trading at depressed levels, we will continue to look for contrarian opportunities. Other than Monadelphous (MND) and WorleyParsons (WOR), the difficulty we are finding is most don't have a strong enough competitive advantage to grow their order book and maintain margins in the current weak environment.

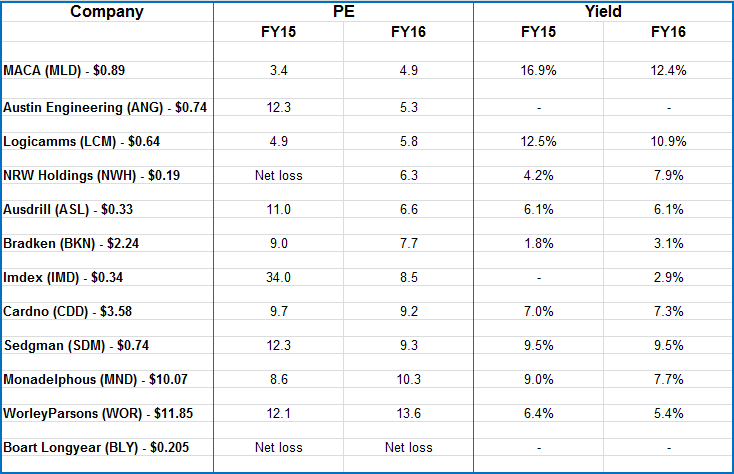

Some of the contractors we are monitoring are in the table below. The PE ratios and dividend yields are based on consensus estimates.

Please note: There is downside risk to these estimates given the deteriorating environment, particularly for dividend yields.