Three small caps at a turning point

Summary: The latest reporting season will be a proving ground for many companies in the small caps sector. Three stocks on the re-rating radar are ThinkSmart, RungePincockMinarco and Mobilearm. |

| Key take-out: Re-rated stocks usually outperform the broader market for several months, if not longer. |

| Key beneficiaries: General investors. Category: Growth. |

Suddenly small caps are back in favour. The wider sharemarket rally of recent months initially lifted safer high-yielding blue chips such as banks and Telstra.

But now, as the index hovers around the 5000 mark, attention is spreading across the market. As blue chips have registered single-digit gains in recent months, selected small caps have enjoyed dramatic gains of 30% or more. But how do we find the shares ready to run?

Stocks typically reach an inflection point at each reporting season, but there are three small caps that are worth keeping a closer eye on this month as they are at a pivotal point in their path to recovery.

These junior companies have promised to deliver the first tangible signs of a turnaround in their operating performance and, if they keep to their word, their share prices are likely to run higher even though they have already risen alongside the broader market rally.

This is because these embattled companies are still trading well below their peers on valuation grounds, and a positive result will boost investor confidence in the future of their business. This lift in confidence, referred to as a “re-rating”, often triggers a sustained share price run over the medium to long term.

It all hinges on what the chief executives say when they release their results over the next week or two, and only investors with a tolerance to risk should contemplate following these stocks. But the reward can be worth the risk, as re-rated stocks usually outperform the broader market for several months, if not longer.

Recent examples of stocks that have enjoyed a re-rating after management fixed structural issues plaguing their businesses include automotive services and accessories supplier, AMA Group, and enterprise software developer for the resources industry, ISS Group.

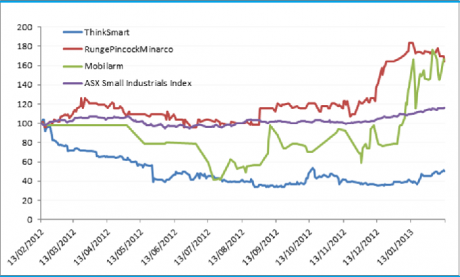

AMA has surged over 220% and ISS has jumped 75% over the past 16-months, compared to the 25% gain on the ASX Small Industrials Index.

Below are three more small caps potentially on the threshold of a re-rating.

ThinkSmart (TSM)

Equipment rental financing group ThinkSmart could be the next candidate for a re-rating this year.

While ThinkSmart is likely to post a loss when it reports its full-year to December results next Wednesday, investors will be looking closely at its second-half performance given that management had committed to showing a return to profitability in the latter half of 2012.

The fact that the $40 million market cap company has not revised its outlook before going into the “blackout” period (the period just before its result announcement, where the company is not allowed to release any financial details) and its retail partner JB Hi-Fi has just issued a robust interim result bodes well for this turnaround story.

ThinkSmart extended its agreement with the electronics retailer to offer ThinkSmart’s no-interest payment plan product, Fido, through JB Hi-Fi stores until late 2015.

ThinkSmart has been a woeful underperformer over the past two years due to the online shift in consumer spending and a change in the group’s funding model following the global financial crisis, which has negatively impacted on the way the group accounts for profits.

The stock has plunged 72% since April 2011 to 24.5 cents, which only reflects what ThinkSmart’s tangible assets are worth.

But investors shouldn’t expect to make quick stellar profits, even if the group says it succeeded in stemming its losses in the second half of last year, as it will probably take it another year or two to prove that the worst is behind it.

RungePincockMinarco (RUL)

Mining technology services company RungePincockMinarco is another worth watching as the company embarks on an ambitious plan to arrest its slumping profits.

It’s the company’s outlook and not its half-year result that is a nail biting event for investors, given that the $75 million market cap company effectively pre-announced its profit numbers in its November profit warning.

The market will be looking for fresh evidence that the company’s aggressive restructuring under a new chief executive is paying off.

It’s not enough for Runge to state how many millions of dollars it is on track to save from the cost-cutting exercise. Chief executive Richard Mathews also needs to outline a clear strategy on how he plans to lift sales and bolster its paltry net profit margin, which stands at under 5%.

“The company has not been selling their intellectual property well enough. They haven’t got the [pricing] right and they haven’t got the right product mix to get bigger deals,” said the fund manager of Microequities Asset Management, Carlos Gil.

“We really think the business should be turning $6 million to $7 million net profit – double what it is currently reporting – and this is not an aggressive target as it would mean a modest net margin of only 7% on a business with historical revenue averaging $100 million.”

Software sales constitute around 20% of total revenue, with the bulk of Runge’s business coming from technology consulting.

Runge is expecting operating earnings before interest tax, depreciation and amortisation (EBITDA) to plunge around 90% to between $500,000 and $1 million, and revenue to fall 15% to around $8 million for the six months ended December.

Its heavy exposure to the coal industry, which is facing a sharp slowdown due to falling coal prices, and the impact of resource nationalisation in its key markets of Indonesia and Mongolia, have been blamed for the poor result.

However, Runge’s very high operating leverage (as demonstrated by the sharp drop in earnings relative to revenue) leaves the company well placed to expand profits and margins when markets recover.

While the stock has rallied over 60% to 60 cents over the past 12 months, it is still well below the $1 price it was fetching back in 2009.

Mobilarm (MBO)

This woeful performer is arguably the most speculative proposition of the three, although Mobilarm has been gaining traction over the past few months after the Nigerian government mandated the use of its maritime-locating beacon in the life jackets of all working in Nigeria’s offshore oil and gas industry.

This is the first commercial order of any real significance for Mobilarm, which has failed to deliver to expectations over the past few years.

Investors will be keen to hear if Mobilarm is a one-trick pony and when it expects to see the cash from the $1.2 million Nigerian order flow to its bank account.

Unfortunately, a number of promising Australian-listed start-ups have found difficulty in collecting on large invoices from overseas governments in less-developed economies.

If its new chief executive, Ken Gaunt, can outline further milestones and flash some cash receipts, the stock will re-rate further even though it has more than doubled in value since the start of the year. Mobilarm shares are still trading below 9 cents.

However, the best outcome for investors is a takeover from a global maritime safety equipment manufacturer given that the $41 million market cap company lacks the distribution and manufacturing resources to become a significant player in the industry.

Mobilarm’s product, which allows rescuers to pinpoint the exact location of someone who has fallen into the ocean, is the only approved device in Nigeria.

The device is also the only one that has been successfully tested by the United States navy, although Mobilarm has yet to receive a commercial order. The Netherlands is the only navy that has bought a small number of these units for use.

| Company | P/E Ratio (x) | Div Yield (%) | Total one-year rtn (%) | Net profit pcp* ($m) |

| ThinkSmart Ltd | 12.9 | N/A | -49.5 | 6.8 |

| RungePincockMinarco Ltd | 12.0 | 3.3 | 76.7 | 3.7 |

| Mobilarm Ltd | N/A | N/A | 66.7 | -1.7 |

| *previous corresponding period | ||||

| Source: Bloomberg | ||||

Brendon Lau is the small caps writer for Eureka Report and may have interests in some of the stocks mentioned in the article.