SMSF Alert: June 2015

Key Points

- Budget tightens age pension for wealthy

- Think twice before piling lump sum into primary residence

- Tax Office hot on holiday rentals

- Don't miss the contributions deadline

The Budget – Less offered to those with more

The headline changes from the Federal budget were to the age pension assets test thresholds and the rate at which the age pension is reduced when the thresholds are reached.

From 2017, homeowners who are single and have more than $250,000 in assessable assets will see the pension decrease by $3 for every additional $1,000 over that limit, up from $1.50 per $1,000. For homeowner couples the threshold will be $375,000.

The changes indicate the Government is serious about passing responsibility for retirement income back to retirees. Workers in their 30s or 40s with low super balances should not be complacent that the Government will be there to back them up when the time comes.

Restraint in spending on welfare to the aged is not a political issue. An ageing population and subdued economic and investment environments have conspired to make this a growing problem. Savers have to fend for themselves, or at least start to think that way.

Members of self-managed super funds – where the average fund is worth about $1 million and the median fund is worth about $600,000 – will most likely be affected by these changes (if they make it through the Senate).

The obvious way around them is to siphon off means-tested assets and somehow invest them into the family home, which is not assessable.

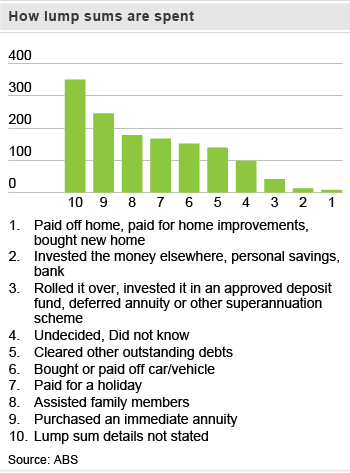

Australian Bureau of Statistics data show that’s exactly where most lump sum super payouts go. Of the 3.3 million people over 45 who were retired during the 12 months to June 2013, more than 353,000 used their lump sums from super to pay off a home, pay for home improvements or buy a new home.

The decision to take money from the means-tested funds bucket and place it in the excluded-from-means-test residential home bucket isn’t so straight forward.

Income from investments may be at historically low levels now, but will inevitably rise. The outlook on government generosity towards the aged, on the other hand, looks to be pointing only downwards.

As compensation to those that lose their pension entitlement under the changes, the Government will still issue them a Commonwealth Seniors Health Card or a Health Care Card for those under Age Pension age.

Defined benefits in the noose

Although defined benefit super schemes are heading the way of the dinosaur, nevertheless the Government felt impelled to move on them.

From January 1 next year, no more than 10% of payments from a defined benefit scheme will be excluded from the pension income test.

This budget proposal tightens a loophole in the legislation that saw some retirees drawing from defined benefit schemes also receive the age pension.

There must have been quite a few of them because Joe Hockey believes the new cap will save $465 million.

What Joe Hockey didn’t do

Some of the proposals from last year’s budget were dropped as the Coalition sought to reclaim lost ground in the polls.

Two ideas specifically designed to reduce Canberra’s liability to the aged were to change the rate at which the pension is increased each year and the rate of return Treasury expects Australians will earn on their liquid assets.

But that’s all been overturned. The age pension will not be indexed to inflation, as was put forward in last year’s budget, but remain linked to the slightly more generous living cost index or earnings index, whichever is higher.

And plans to lower the deeming thresholds used in the pension assets test have been scrapped. For couples with assets above $79,600, it’s the difference between the Government assuming about $30,000 of your balance earns 1.75% instead of the proposed 3.25%. In that case, it’s a $450 difference.

The budget may not have been too harsh on the digestive systems of Australia’s self-managed super funds, but the sentiment is there alright.

Tax focus on property deductions

The Tax Office is on the lookout for egregious deductions on rental properties, with holiday homes at the top of its list.

On May 27 it announced it will seek out:

-

Deductions claimed for holiday homes it deems are excessive,

-

Couples splitting rental income and deductions for jointly-owned properties,

-

Deductions for interest on private proportions of loans,

- Claims for maintenance work shortly after a purchase.

The average self-managed super is about 11% invested in non-residential real property, and trustees making claims for property expenses should be careful to keep all records and make sure they only claim deductions they are entitled to and for time the properties are rented out.

Records should be kept for rental income and all costs. Deductions cannot exceed income earned, even if the property is rented at below market rates to family of friends.

In 2013, about 77,000 Australians relied on rental property income as their main source of income in retirement.

Tax deadline

Super guarantee contributions must be paid by June 30 to qualify for a tax deduction in the current financial year.

Remember, funds that miss deadlines risk losing tax concessions enjoyed by DIY funds. New registrant SMSFs willing to prepare their own tax returns have until October 31.