Capturing Ambarella's disruptive technology

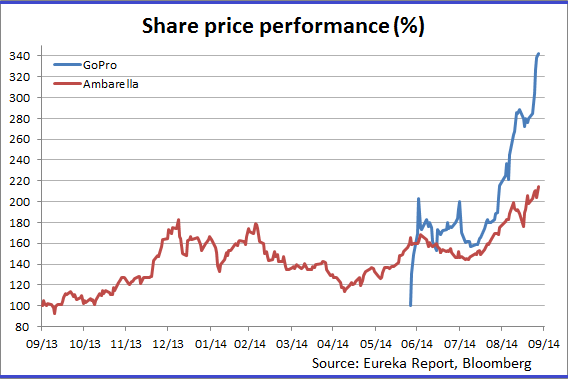

One of the hottest initial public offerings (IPOs) of 2014 has been wearable sport camera maker GoPro.

After a 30% pop the first day of trading, the stock is up 227% from its $US24 IPO price. But at 70 times forward earnings and six times sales I'm not going to chase this one in spite of an impressive growth profile.

I'm also usually reluctant to buy “hardware” because it is eventually easily duplicated and undergoes commoditisation, lacks patent protection, and can be negatively impacted by the vagaries of fashion.

Sometimes it's better to play the component side of the product, particularly when it involves a patent protected disruptive technology which has other applications and markets. That is what led me to Ambarella.

Ambarella, Inc. (NASDAQ: AMBA), is a leading developer of low-power, high-definition (HD) video compression and image processing semiconductors. The company's products are used in a variety of HD cameras including security IP-cameras, sports cameras, wearable cameras, automotive video camera recorders and mobile phones. Ambarella compression chips are also used in broadcasting TV programs worldwide.

Ambarella was founded in 2004 and became a public company in 2012. Originally focused on broadcast infrastructure, the company broadened its focus on the consumer camera market where its small form factor solutions, low power consumption, and storage efficiencies captured a sizable share with major consumer electronics companies like GoPro.

The investment case for Ambarella certainly revolves around its success with GoPro but also with the multiple opportunities in the security camera market, “wearables” and dashboard cameras. New areas such as 4K video and UAV (unmanned aerial vehicles, also known as drones) will also provide future growth for the company.

Ambarella reported “blow out” earnings on September 4. Revenues, gross margins and net profit were well above consensus and the company's own guidance.

More importantly, Ambarella said it expects current quarter revenue to come in at $US60 to $US62 million – well above consensus estimates of $US52 million. Year-on-year that's a 31-39% rate of growth and a reacceleration of last quarter's 24.6% growth rate.

The company admitted that this reacceleration in growth was primarily coming from the consumer product area. Reading between the lines one has to assume most of it is coming from being a supplier to GoPro. Given the success of the GoPro product, I expect this will be a nice tailwind over the near term, however, there is a caveat here.

In its pre IPO S-1 filing, GoPro has stated “we incorporate video compression and image processing semiconductors from one provider, Ambarella, Inc., into all of our cameras, and we do not have an alternative supplier for these key components”. While this may be indicative of Ambarella's technological lead over competitors, it also tells me that GoPro will find other suppliers at some point – it's only a matter of time.

That being said, Ambarella could certainly remain as GoPro's main supplier given they have worked together closely for the last five years. Currently GoPro is estimated to be about 25% of Ambarella's sales.

Ambarella's other growth opportunities

If Ambarella's growth was only coming from GoPro and similar products, I really wouldn't be interested; high dependence on one customer and one product is a recipe for disaster.

As it is, Ambarella has a number of other growth opportunities and that's in security cameras – not just head-mounted gadgets for adventure junkies such as snowboarders, mountain bikers, divers and surfers. In the recent earnings call chief executive Fermi Wang summarised new product launches:

"We anticipate continued growth in the IP security cameras, from both professional and the consumer markets. We expect that the transition from the older generation of [standard] definition analog cameras to HD IP security cameras to continue as prices converge. Additionally, based on the strong demand for higher resolution and advanced features, we expect continued revenue growth for our S2 and new S2L camera SoCs that enable Ultra HD panoramic viewing and advanced analytics capabilities."

IP security cameras currently account for 45% of Ambarella's revenues and analysts estimate the market is growing at 25% plus.

The security/surveillance camera is also crossing over to the wearable space; in the same call Wang also pointed out he was also seeing revenue growth opportunities from wearable police cameras.

“This body-worn security camera support a continuous video recording of events, offering protection and documentation for both the police and the public. Ambarella's A7LW SoC (system on a chip) solution provides full HD recording with a clear images even in low light conditions, and low-power operation to enable extended battery life," he said.

The unfortunate events in Ferguson, Missouri prove there is need for such devices and recently the New York City police department has initiated a pilot program to test wearable cameras. I expect many other police departments to follow suit.

There are other new and interesting end markets as well such as the unmanned aerial vehicle (UAV) market, where manufacturers are integrating cameras directly into products that require very high definition, high resolution and fast frame rate video capabilities.

Ambarella is gaining share in this new and expanding market and has also flagged the growth potential of its dash camera products, particularly in Asia and Russia (where dash cameras are an absolute necessity due to the difficulty of dispute resolution).

To tap this market, Ambarella has set up a joint venture with Thinkware, a key supplier of automotive camera recorders in Korea. Thinkware recently launched its QSD 900 two-channel dash cameras, leveraging the power of Ambarella's A7LA automotive camera SoC. This is a cutting-edge product that can gain traction in the market and not just in Asia. The QSD 900 supports full 1080p resolution video recording through both the windshield and the rear window. It also supports an extensive set of advanced features, including super night vision, warning system, voice recognition, and wide angle video recording of up to 140 degrees. Very neat.

The technology

Ambarella's products are video processing “SoCs” or system on a chip, which is an integrated circuit that may include all the electronic components used in computing (digital, analog, mixed signal and RFID).

The company adds algorithms and software in order to offer a complete system or platform that is scalable across applications in the camera. Without getting too technical it's Ambarella's proprietary algorithms that allow video and compression with high storage capacity but at a reduced bit rate.

Paired with its own programmable DSP (digital signal processing) the result is high performance with very low power consumption – perfect for small cameras.

Management

The core management team has been together for over 15 years, which is unusual for a technology company.

Ambarella founder and chief executive, Fermi Wang, had worked previously at C-Cube Microsystems with his current chief technical officer Les Kohn and executive vice-president Didier LeGall (a co-founder of C-Cube).

Prior to founding Ambarella Mr. Wang was chief executive of Afara (purchased by Sun Microsystems). The track record of this team in the SoC video compression space is impressive with multiple “firsts” including the first power optimised multi core multi- threaded SoC and the first Andriod camera processor application processor.

Valuation and target price

Ambarella has a solid balance sheet with no debt and $166 million in cash.

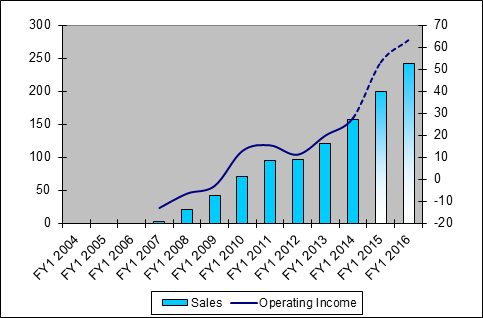

I expect the company will grow earnings per share (EPS) at a 25% compound annual growth rate from 2014 to 2016.

The stock trades on 23 times 2014-15 for a forward price-earnings growth multiple of .90 times.

The target price is a growth multiple of one times the medium term growth rate of 25% on a 2015-16 EPS of $US1.86 or $US46.00. The one times growth rate is probably too conservative for a profitable, multiple opportunity, high growth company like Ambarella and the GoPro phenomenon over the next few quarters could well drive the stock into the $US50s.

Ambarella is therefore a “buy” at current prices. It is a volatile stock just like previous recommendations FireEye and Splunk. Use the volatility to your advantage. Try to build positions in the mid-to-high $US30s if possible. Over the past 45 days Ambarella has traded as low as $US28 and as high as $US40.

Growth and earnings profile

Ambarella has strong sales progression with $US3 million in sales in 2007 and an estimated $US160 million in sales in 2014.

The company has also been profitable since 2010, a rare feat in high growth semiconductor companies.

Risks

- While Ambarella has a significant technological lead, traditional semiconductor manufacturers such as Broadcom, Qualcomm, and Texas Instruments could well enter Ambarella's market.

- Consumer products over their lifecycle traditionally decline in price. Ambarella must continually optimise manufacturing costs in line with ASP declines.

- Changes in product mix can affect margins and will vary quarter to quarter. Consumer products have the lowest margins with broadcast and infrastructure the highest.

- Third party wafer foundry suppliers could fall short of meeting Ambarella's product demand.

- The GoPro phenomenon may not last. Most customers are under thirty and are fickle.

To see Ambarella's forecasts and financial summary, click here.