Why the world will change next week

Robert Gottliebsen

Why the world will change next week

If you are like me, you've become rather sick of the daily episodes of the Donald Trump serial. And so, this week, I vowed that I would write about something else.

But when Trump announced that he would be introducing his tax package next week it was clear that this will be so important to global markets that no other subject really makes sense for this week, so please forgive me.

To underline the close links between the tax measures and the market, on Friday (our time) Treasury Secretary Mnuchin said he wanted significant tax reform before August, which made the market nervous because traders felt the Trump Administration was softening its line, deferring the corporate tax cuts for five months. The greenback fell, copper fell back and US growth stocks slipped.

But the importance of this tax statement really came home to me when I was yarning to a few BHP people who are almost on the edge of their seats with excitement. If Trump actually does what he says he will do they will be able to get started on developing one of the world's biggest untapped copper mines – the Resolution mine in Arizona.

To date Trump has made many fundamental errors, but basically he has been carrying out the promises he made to the electorate. If he continues to do this in tax, and in particular embraces also what the House Republicans want, then by the end of next week the world will be a different place assuming he can pass the legislation. He probably will gain congressional approval because the Republicans support most of the measures.

In Australia we tend to simply describe what is ahead as a reduction in the US tax rate from 25 to between 15-20 per cent. If that is all that is involved the global impact will be greatly restricted. But there is much more in the Trump tax package. In the election campaign he vowed to give companies an immediate write-off on all capital expenditure, but then to make interest non tax-deductible.

A new American economy

You saw earlier this week that BHP was using its spare cash to buy back bonds. It was doing that for long-term safety reasons, but thousands of cash-rich American companies will want to buy back their debt if interest is not tax-deductible. Accordingly, we are going to see fundamental changes in the way American and global businesses are structured. The private equity people in New York are pressing Trump to give them a choice between no interest deductibility and capital expenditure write-offs, and the present system.

We will need to see if they win, but if their pleas are rejected then the highly leveraged equity capital structures become yesterday's story. There will also be a tax incentive for American companies to bring their money back home – probably a tax of 10 per cent on the profits as they come in. Again, no one is quite sure how effective this will be, but there is a chance that it will suck a lot of money out of the rest of the world. Certainly that is the plan – and the US is hoping the extra revenue will help pay for the tax cuts.

The market has been really excited by these plans believing they will kickstart the US economy. If Donald Trump's tax package is substantially different to the above, then there is likely to be great market disappointment.

And there is also another part to the package. Trump wants to impose tariffs to raise a substantial amount of the money outlaid in the above measures. But the House Republicans don't like tariffs and they want a scheme whereby companies that import goods will not get a tax deduction. And so, under this scheme, if you are retailer you will not get a tax deduction on your imports. You will get a tax deduction if you buy American goods.

If all your purchases are imported then your turnover less labour and other domestic costs becomes your taxable profit. If Trump does this it will cause an enormous global revolution. It will boost American inflation because retailers and all other companies will have to raise their prices. There are signs of labour shortages in the US already, so wage rates will rise. In turn that will lift American interest rates and almost certainly increase the American dollar (I am always nervous about predictions regarding dollar values).

I don't know if Trump will introduce this last leg of his tax plan but it is absolutely essential because, in rough terms, the outlays finance about half the cost of the other measures. It is important for Eureka readers to equate the above expected measures to what Trump actually does. And naturally, of course, we will help with the process.

Trump and the railways

And just before I leave the subject of Trump, let me relate a fascinating story which underlines the market enthusiasm for the new president. In the US there are two railroad companies; Kansas City Southern, which operates north-south with a large amount of goods travelling to and from Mexico, and Union Pacific Corporation, which carts goods east to west including a lot of coal and minerals.

Over the years both stocks have moved roughly in line with each other. But since the election of Trump as president suddenly Union Pacific Corp has jumped 21 per cent while Kansas City Southern has fallen 6 per cent on the expectation of less goods coming from Mexico. The accompanying graph explains it all and I publish that graph because it does underline that the market is expecting big changes from Donald Trump.

I am telling you this story because it is an indication that the market may have gone too far with their enthusiasm for Trump. Imports from Mexico are not going to suddenly cease and it will take time before the taxation measures are converted to action. But that tax package will be the key to movements in the market.

Chart: Kansas City vs Union Pacific, past 12 months

Source: Bloomberg, Eureka Report

BHP and the dollar

Now returning to BHP. The "big Australian" actually called it wrong when it comes to iron ore and oil. Last year BHP was a bull on oil prices because, firstly, it believed there would be a production constraint agreement within OPEC and, secondly, that underlining demand would cause longer-term shortages.

Conversely, it was very nervous about iron ore prices. As we know oil has improved in price but nowhere near the substantial price enjoyed by iron ore. In this week's preliminary profit, BHP again expressed nervousness about iron ore and remains a long-term bull on oil.

It is backing the bullishness with substantial investment in US oil and gas. If BHP is right and iron ore falls, then the Australian dollar is very vulnerable. And just to underline that BHP takes its belief seriously, the group's bond buyback was decided after BHP stress-tested its business with a substantial fall in the iron ore price. We have an exciting week ahead.

Readings and Viewings

There was a lot going on this week during our own reporting season, with results from big banks, miners, Telstra and others, and the announced resignation of highly-paid Australia Post public servant Ahmed Fahour.

Yet, as always, there was lots going on overseas as well.

Firstly, Winston Churchill must be rolling in his grave over the thought the London Stock Exchange could be moving to Frankfurt. Some British MPs have threatened to fight off the German invasion.

But at least Barclays' boss Jes Staley believes London will remain Europe's key financial centre, even after Brexit.

There's a lot to be said about honesty in the world of economic forecasting. Just ask the Bank of England, which has admitted its forecasts will always be wrong.

Hold the stage coach. The fallout from the Wells Fargo loans scandal is far from over, with more heads rolling this week.

The FT also had a good article on why selling treasuries (or government bonds) is not a viable political threat. 'China is not going to seize the Brooklyn Bridge as collateral if the US's debt burden gets too high.'

Rising input prices at Chinese factories are expected to flow through to the price of much of our stuff.

Is it back to the future for Carl Icahn, the feared corporate raider of the 1980s? With a personal fortune somewhere north of $US16 billion, 81 year-old Icahn – who's described as an activist investor these days – has just built up a holding in pharmaceuticals group Bristol-Myers Squibb.

In Australia, the latest retail revival story is all about Woolworths regaining ground over Coles. In the US, it's about Walmart versus Macy's.

Over in Uganda, the opening of the country's first gold refinery this week has sparked concerns over the prospect of dirty minerals entering the country.

Think mobile money and one's immediate thoughts lean towards Apple, Samsung and Google. But before them all was a little-known Kenyan company that now boasts around 30 million customers.

How costly is a security breach? Very. Just ask Verizon, which has dropped its takeover price for Yahoo by $US350 million after security breaches that were disclosed last year.

Which world leaders have the biggest social media followings? 'The trend of using the selfie as a digital diplomacy tool for leaders has spread.'

This could be just a bad April Fool's joke, but according to US website SFGATE Donald Trump's 2007 Ferrari F430 F1 will be auctioned off on April 1 and is expected to fetch $US250,000-350,000. It seems the new US President doesn't need to drive himself around anymore.

Lastly, want to snare a property bargain? This two-bedroom flat in Mayfair, London, is going for a steal at just £500,000.

Last Week

Shane Oliver, AMP Capital

Investment markets and key developments over the past week

Shares in the US, Europe, Japan and China rose over the last week helped by more good economic data but Australian shares retreated as profit results became more mixed towards the end of the profit reporting season. Bond yields generally fell and commodity prices were generally up with gains in both oil and iron ore. Despite a rise in the US dollar, the Aussie pushed back above $US0.77.

While shares have generally continued to push higher they remain at risk of a short term correction being technically overbought again and with short term investor sentiment at levels often associated with corrections. A major misstep on economic issues by Trump, worries about eurozone politics, policy tightening in China or signs of faster Fed rate hikes could all be a trigger. Trying to time this remains difficult though and we just see it as a correction (say with a 5 per cent decline) rather than something more severe with the profit outlook (both globally and in Australia) continuing to improve.

Business conditions PMIs remain strong in February with Europe and Japan up but the US down slightly albeit remaining strong. This is good news for a continuation of the global profit recovery going forward, with profits needed to take over as a key driver of the bull market in shares as shares are no longer dirt cheap or under loved.

Eurozone break up risks continued to remain a focus over the last week with: the risks easing a bit around the French election (as the prospects of combined Socialist/far left presidential bid receded, an investigation around Le Pen's use of European Union funds hotted up and centre left candidate Macron and another centrist candidate agreed to work together); Greece edging towards a deal with the IMF and EU on its latest bailout review; but the risks around a break-up of the governing Democratic Party in Italy remaining. There is a long way to go on the Eurozone break up risk soap opera so lots could go wrong (including more rioting in French suburbs boosting support for Le Pen), but a break up still seems far from imminent so spikes in fears around Europe should be seen as buying opportunities. Particularly with Eurozone shares still clearly cheap and underlying economic conditions in Europe looking good.

On the interest rate front in Australia, a speech and Parliamentary testimony by RBA Governor Philip Lowe has reiterated that the RBA is trying to balance the risks of inflation staying lower for longer versus the threat to financial stability that may flow from ever higher household debt if the RBA cuts rates again. Governor Lowe is clearly happy with another “period of stability” in rates and in other words is prepared to run a higher risk in terms of inflation remaining lower for longer to head off the risk of higher household debt. Fair enough. As this points to a relatively high hurdle to cutting rates again – eg, worsening unemployment or a further leg down in inflation – the risk that we may not get the rate cut we have been looking for is high.

Major global economic events and implication

The key message from the minutes from the Fed's last meeting was that the Fed is on track to raise interest rates again "fairly soon" providing economic data is in line with or better than their expectations. Of course the term "fairly soon" is a bit vague and could mean any of its March, May or June meetings. Since the last Fed meeting though strong payrolls data and CPI inflation suggest a risk of a March move but slow wages growth and a desire to remain consistent with three hikes this year point to a move around May or June. This is our base case but we see a 40 per cent chance of a March move if the next payroll report is stronger than expected. Meanwhile, data over the week added nothing new with business conditions PMIs falling slightly in February but remaining strong, existing home sales rising strongly, home prices continuing to rise and jobless claims remaining low.

Eurozone business conditions PMIs – both manufacturing and services – improved further in February pointing to acceleration in growth. For now the ECB is committed to quantitative easing through to the end of the year at the rate of €60bn a month, but debate about when it will announce a taper will likely to continue to hot up. Nothing is likely to be announced till later this year though, at least not until after the French election is out of the way.

Japan's manufacturing conditions PMI also improved further in February continuing a recovery since May last year and pointing to stronger growth ahead.

Australian economic events and implications

The news on the Australian economy over the last week was on balance a little bit disappointing with wages growth remaining at a record low and investment coming in weaker than expected. Low wages growth adds to the risk that inflation will stay lower for longer and soft business investment data will constrain the expected rebound in December quarter GDP growth after the September quarter contraction. However, while investment plans for the financial year ahead are yet again below those of a year ago the rate of decline has slowed (see the next chart) and its all driven by mining investment (which is falling at the rate of around 30 per cent p.a.) whereas plans for non-mining investment are about 7 per cent stronger than was the case a year ago. What's more, the drag on overall growth in the economy from the mining investment slump is diminishing as it's now a much smaller share of the economy and in any case it's getting back to levels that are close to as low as it ever goes.

Cuts to penalty rates – good or bad? The Fair Work Commission's decision to cut Sunday and public holiday penalty rates by 25 per cent or so has created much contention. But it basically comes down to a trade-off between wages for those in relevant industries with jobs and the 1.8 million people without jobs or who are underemployed. Yes it will cut wage income for those affected and will weigh further on average wages growth, but against this the decision partly reflects the fact that Sunday's and public holidays are no longer sacrosanct like they used to be and it will make it possible for employers to employ more people or have them for longer hours (unless you believe that demand for something goes down when its price goes down). So the decision is no disaster for the economy and if anything by injecting a bit more flexibility into the labour market will help boost productivity and employment. It also maintains the hope that Australia can still get through a bit of economic reform, despite the scare campaign around any proposed economic reforms that dominates the media 24/7 now.

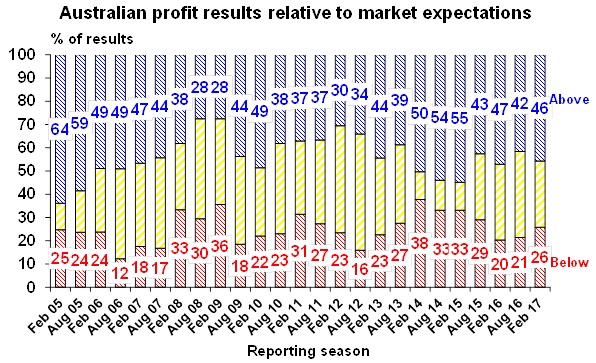

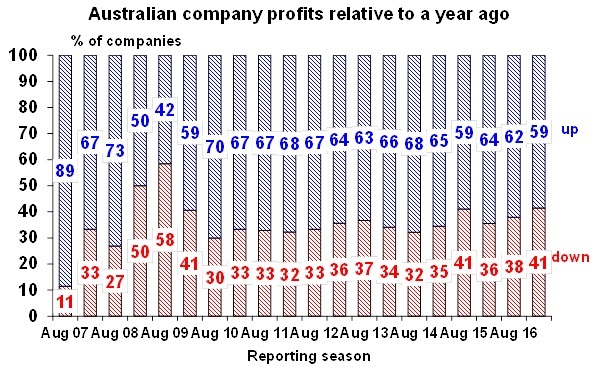

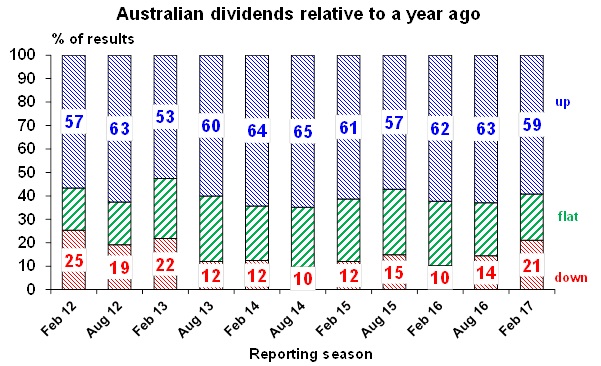

The Australian December half profit reporting season is now just over 90 per cent done. Results remain consistent with a strong return to profit growth but as always we have seen more soft results as the reporting season has progressed. 46 per cent of companies have exceeded earnings expectations compared to a norm of 44 per cent, 59 per cent of companies have seen profits up from a year ago and 59 per cent have increased their dividends from a year ago. But reflecting the strong rally in the market ahead of the results only 50 per cent of companies have seen their share price outperform the market on the day they reported as a lot of good news was already priced in. Consensus profit expectations for the overall market for this financial year have been revised up by around 2 per cent through the reporting season to a strong 19 per cent. This upgrade has all been driven by resources companies which are on track for a rise in profit of 150 per cent this financial year reflecting the benefits of higher commodity prices and volumes on a tighter cost base. Profit growth across the rest of the market is likely to be around 5 per cent with mixed bank results and constrained revenue growth for industrials. Outlook comments have generally been positive and as a result the proportion of companies seeing earnings upgrades has been greater than normal. The focus has remained on dividends with 79 per cent raising or maintaining their dividends.

Shane Oliver is chief economist at AMP Capital.

Next Week

Craig James, CommSec

Autumn avalanche

The seasons are changing. So this means that investors can expect another barrage of economic data to be released in Australia. Welcome to the autumn avalanche where a dozen economic events are scheduled over the coming fortnight.

The week kicks off on Monday with the release of the Business Indicators publication from the Bureau of Statistics (ABS). The publication contains estimates on profits, sales, wages and inventories.

On Tuesday, the quarterly Balance of Payments data is issued – the broadest measure of our trading performance. The estimate of net exports plugs straight into the calculation of economic growth for the quarter.

Similarly the government finance data on Tuesday gives an idea of how much the government sector contributed to economic growth in the quarter.

Private sector credit (effectively outstanding loans) figures are also released on Tuesday. Business loans are at record highs with firms taking on more debt at current low interest rates.

Also on Tuesday the weekly consumer confidence data is released. Consumer sentiment eased by 2.3 per cent last week.

On Wednesday, the ABS releases the National Accounts publication which includes the latest estimates of economic growth. The economy went backwards in the September quarter in response to myriad influences. The UK Brexit vote, Federal Election and US Presidential election caused consumers and businesses to delay spending, investing and employing. And poor weather lead to delays in construction work.

We expect that the economy bounced back in the December quarter, growing as much as 1 per cent after the previous sector's fall of 0.5 per cent.

Also on Wednesday, Corelogic releases its estimates of home prices for February. By all accounts home prices are continuing lift in response to firm demand.

On Thursday, the ABS will release the January estimates of international trade (exports and imports) together with estimates of building approvals for the same month.

On Friday the Federal Chamber of Automotive Industries releases February data on new vehicle sales. We are edging closer to the point where sports utility vehicles outnumber cars.

US housing sector under the spotlight

In the US, there is no standout indicator to be released over the week. But both US and China will issue gauges of activity in manufacturing and services sectors.

The week kicks off on Monday with the release of US data on durable goods orders – goods that are meant to last three years or more like cars and aircraft. And on the same day the US pending home sales index is issued.

On Tuesday, the second estimate of US economic growth for the December quarter is issued. Economists expect the growth estimate to be upgraded from 1.9 per cent to a 2.1 per cent annual pace.

Also on Tuesday data is released on home prices (from CaseShiller) and consumer confidence and the activity gauges or surveys from Chicago, and regional Federal Reserve regions of Richmond and Texas. The usual weekly data on chain store sales is also issued.

On Wednesday in the US, data on personal income and spending is released for January. Apart from the estimates of income and consumption growth, investors will closely watch the inflation measure from the spending series (core private consumption deflator).

Also on Wednesday the ISM gauge of manufacturing activity is released with construction spending data.

On Thursday, the Challenger series of job layoffs is released in the US together with the usual weekly data on new claims for unemployment insurance (jobless claims).

And on Friday, the US ISM services gauge is released with estimates on new vehicle sales during February.

In China, gauges on manufacturing and services sector activity are slated for Wednesday and Friday.

Sharemarkets, interest rates, exchange rates and commodities

The Australian profit reporting season grinds to a close on Monday and Tuesday.

On Monday, earnings results include those from QBE Insurance, Harvey Norman, Lend Lease, Village Roadshow, Vocus Group and Bellamy's.

Amongst those expected to report earnings on Tuesday are AWE Ltd, Beadell Resources, Select Harvests and Boart Longyear.

Craig James is a senior economist at CommSec.