Why Krugman needs a new school of thought

In his latest blog, Paul Krugman slings off at non-mainstream economists -- and the students at Manchester University campaigning for change to the economics curriculum -- for wanting fundamental change in economics. The status quo is fine, he reckons: move along folks, nothing to see here. Says Krugman in his latest post, Frustrations of the Heterodox:

“Here’s the story they tell themselves: the failure of economists to predict the global economic crisis (and the poor policy response thereto), plus the surge in inequality, show the failure of conventional economic analysis. So it’s time to dethrone the whole thing -- basically, the whole edifice dating back to Samuelson’s 1948 textbook -- and give other schools of thought equal time.

“Unfortunately for the heterodox (and arguably for the world), this gets the story of what actually happened almost completely wrong.

“It is true that economists failed to predict the 2008 crisis (and so did almost everyone). But this wasn’t because economics lacked the tools to understand such things -- we’ve long had a pretty good understanding of the logic of banking crises. What happened instead was a failure of real-world observation -- failure to notice the rising importance of shadow banking.

“Economists looked at conventional banks, saw that they were protected by deposit insurance, and failed to realise that more than half the de facto banking system didn’t look like that anymore. This was a case of myopia -- but it wasn’t a deep conceptual failure. And as soon as people did recognize the importance of shadow banking, the whole thing instantly fell into place: we were looking at a classic financial crisis…

“Events have also reflected very badly on the style of economics that prizes 'microfoundations' based on ultra-rational behavior over evidence, and rules any kind of ad hockery out of bounds. But the heterodox want more than that; they want to interpret recent events as a refutation of the kind of economics Simon Wren-Lewis, or Janet Yellen, or Larry Summers (as economist, not public official), or yours truly does. And that interpretation just doesn’t work. By all means, advance heterodox ideas if you believe they’re right. But don’t claim vindication from events that didn’t actually follow the script you wish they did.”

Thus does Krugman trash what he accurately sees as “an upwelling of frustration on the part of heterodox economists” like Tom Palley, and students at the University of Manchester (A post-crash manifesto to rebuild economics) about the failure of economics to change after the financial crisis.

No need for change, boys and girls: mainstream economics has everything under control. We missed the crisis just because we failed to observe the shenanigans in the shadow banking system. Once we realised our observational errors, we had all the necessary tools and knew what to do. (Oh, and what the rebels said would happen didn't anyway, so there!)

As usual, Krugman’s reasoning is neat, plausible, and wrong. The main reason that mainstream economics survived the challenge of the Global Financial Crisis is not because of its strength, but because of its irrelevance.

We don't need economics to build economies: they have evolved and would function (and malfunction) even if economic theory (mainstream or heterodox) did not exist. Most of the time, the key role of economic theory is simply to provide a self-justifying narrative for the social system itself: mainstream economics does a pretty neat job there. This gives economic theory enormous inertia, because only when the economy really malfunctions does most of the public give a damn about economic theory.

On the other hand, we do need engineers to build bridges, cars, airplanes and so on. If there were something fundamentally wrong with engineering theory, then the public would pretty rapidly realise the need for change -- and demand it.

So the real frustration heterodox economists feel is the frustration that comes from trying to make an almost immoveable intellectual object move. In the 1960s, critics successfully exposed fundamental flaws in Neoclassical economics, as Samuelson himself admitted:

“If all this causes headaches for those nostalgic for the old-time parables of neoclassical writing, we must remind ourselves that scholars are not born to live an easy existence. We must respect, and appraise, the facts of life.”

But what happened? Nothing!

Decades later, the same childish parables are still taught in textbooks like Krugman’s that are derivatives of Samuelson’s original, with no evidence that these “old-time parables” were ever even challenged.

My take from this history was that the only real chance to cause fundamental change in economics comes during crises. But the experience of the Great Recession has shown that even that isn’t necessarily enough to dislodge the orthodoxy.

A major factor here is the existence of progressive economists on the fringe of the orthodoxy, especially mainstreamers like Krugman himself.

How can someone be mainstream and fringe at the same time? Because the core of the orthodoxy is the Chicago school, with its vision of perfectly competitive firms, hyper-rational agents, and a pervasive fantasy that “the economy is always in equilibrium, even during a Depression”.

That orthodoxy was the source of the arguments that Krugman describes as “exotic doctrines” that led to bad policy, like imposing austerity in the belief it was expansionary. Krugman claims that “policymakers weren’t basing their decisions on conventional economics. On the contrary, they decided to blow off textbook macroeconomics and embrace exotic doctrines like expansionary austerity…”

Oh yeah? Sorry, but “that’s all wrong”. These “exotic doctrines” came not from left (or rather right!) field, but straight from the intellectual centre of orthodox economics.

Expansionary fiscal austerity can be traced back to Robert Barro and his argument that people respond to an increase in government spending today by spending less now, so that they can save money to leave their heirs a bequest that will enable them to pay higher taxes in the future. Barro wrote in 1989:

“A network of intergenerational transfers makes the typical person a part of an extended family that goes on indefinitely. In this setting, households capitalize the entire array of expected future taxes, and thereby plan effectively with an infinite horizon.”

(By the way, if that sounds like delusional bullshit to you, that’s because it is.) Krugman might rightly rail against this nonsense in print and sensibly argue for expansionary policy during a deleveraging crisis, but apart from the IS-LM model itself, the tools he uses were first developed by ultra-orthodoxers like Barro: rational expectations, “Dynamic Stochastic General Equilibrium” models, the whole kaboodle.

Had these ultra-orthodoxers been the mainstream, then the need for drastic change to the core of economics would have been obvious. But instead, the far more reasonable Krugman is the public face of orthodox economics. He still uses the orthodox core, but is skilled at adding kinks -- imperfect competition, “frictions” that slow down the march to equilibrium, and so on -- to better match real world data. The impact is that once the crisis passes, the core of economics survives the crisis, with a few added kinks.

This is what happened in the Great Depression, when John Hicks played the role of the acceptable mainstream face of unacceptable orthodox economics with his IS-LM model (which he later disowned).

After that crisis passed, the orthodoxy worked to remove Hicks’ kinks, so that by the time today’s crisis came along the core of economics was even more delusional than the guff Keynes railed against in the 1930s.

Today, Krugman is reprising Hicks’ role. His slightly kinky orthodox economics acts as an intellectual friction to stop economics abandoning the core model.

So is history repeating itself? Will the orthodoxy use the breathing space after this crisis to remove Krugman’s kinks?

They’ll try, but I doubt that they’ll finish the job, since as Mark Twain observed, history doesn’t repeat -- though “it sure does rhyme”.

After the Second World War, the orthodoxy had six decades of relative tranquility in which to resurrect the vision of capitalism as a self-righting ship, in place of Keynes’ vision of a system “subject to sudden and violent changes”.

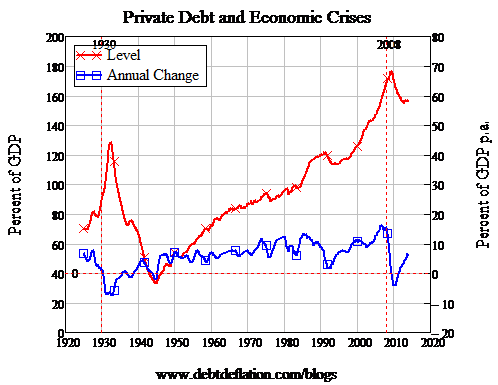

They won’t get six decades this time, because the private debt bubble whose bursting caused this crisis -- and which the orthodoxy and the mainstream ignored -- is gigantic, more than four times the level that applied at the beginning of the post-war period even after the deleveraging of the last six years (see Figure 1).

Figure 1: Private debt today is four times the level of 1945

Krugman’s backhander of “don’t claim vindication from events that didn’t actually follow the script you wish they did”? The crisis very much followed the heterodox economic scripts.

Working from sectoral balances, Wynne Godley and Randy Wray argued that a severe crisis had to follow what mainstreamers like Ben Bernanke called "The Great Moderation" and what Godley and Wray named "The Goldilocks Economy". Working from Minsky’s focus on private debt, I argued that the crisis would begin when the rate of growth of private debt slowed down (see the blue line in Figure 1).

That won’t matter for now. The economics orthodoxy has survived the challenge of the Great Recession, and it will go back to ignoring its heterodox critics, as it has always done, except during times of crisis. But given the economic fragility that comes from excessive levels of private debt, I don’t think it will be too long before the battle is joined again.

Steve Keen is author of Debunking Economics and the blog Debtwatch and developer of the Minsky software program.