Why battery metals are going flat

Summary: The slow adoption of electric cars is negatively affecting the battery-metals boom.

Key take-out: The prices of some battery-making metals are falling.

Do you know many people who own an electric car, or are planning to buy one? If you don't, then according to one of Warren Buffett's investment tests, the boom in battery metals is not as strong as some people imagine.

The argument from the man lauded as the world's best investor is that one of the first tests of a new investment should be to ask whether you would buy it, trust it, or use it. If you have doubts, then don't invest in it.

Coca-Cola is a classic case of Buffett's philosophy. He drinks it and trusts it, and the company he heads – Berkshire Hathaway – owns 9.2 per cent of the giant drinks maker, a stake valued at $US16.6 billion.

That same idea of investing in assets he has personally tested or trusts (a sort of investment pub test) is prevalent in other Berkshire Hathaway holdings, such as an $US11.5 billion stake in American Express, $US28 billion in Kraft Heinz, and $US28.2 billion in Apple.

Electric cars – which are highly likely to eventually become a mainstream competitor to conventional petrol and diesel vehicles – are not yet a big hit with consumers, and that's shaping as a problem for Australian mining companies operating in the battery-metal sector.

‘Too far, too fast', is the easiest way of describing the battery metals boom which has seen multiple new sources of lithium developed, along with graphite, another key metal in batteries.

Cobalt has also been enjoying a revival, as have a number of other metals used in the production of batteries such as vanadium, copper and nickel.

An early hint that the battery metals sector had become overheated earlier this year was the absence of leading miners in the sector, with copper the primary exposure to batteries for BHP and Rio Tinto. BHP also has a nickel asset in Western Australia, which is recovering from a downturn but is also for sale.

What's happening in battery metals is a rerun of earlier metal booms, such as a promised surge in demand for magnesium, because it is lighter than aluminium.

Magnesium was the subject of great excitement in Queensland in the 1990s, but failed to go far. This is because car makers – who were seen as the primary market – did not see an advantage (just higher costs) in switching over from metals they had used for decades, such as aluminium and steel.

The ‘pub test' for battery metals is the question of who's buying electric cars, and whether sales are strong enough to support a sharp increase in the raw materials used in their production.

China – which has been leading the electric car revolution – has recently hit a speed bump which led to a 10 per cent fall in sales in June after the removal of government subsidies for electric vehicles. This mirrors what happened in Denmark after a government handout was withdrawn.

Another hiccup for electric vehicles is the inability of Tesla – the sector leader – to meet its delivery promises, along with the propensity of founder Elon Musk to confuse the market with his management style.

The issues of government incentives and uncertainty surrounding Tesla are just two of the challenges facing electric cars. Others include the high initial cost, range anxiety, a lack of charging points and the absence of a battery recycling solution as demanded by governments in most countries.

In time, electric vehicles will be more competitive and more mainstream as conventional auto manufacturers – such as Ford, Toyota, Renault, BMW and Mercedes – offer electric alternatives to their existing range of cars.

Three recent investment bank reports have raised questions about the battery-metals boom, and whether it has been a premature event given the downturn in car sales.

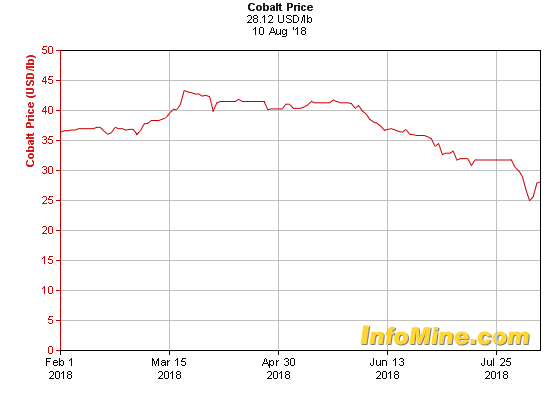

A Morgan Stanley research note entitled Battery metals' reality check identified that prices for battery metal raw materials were falling, with cobalt down 30 per cent from its mid-March peak, and lithium carbonate down 41 per cent.

Cobalt price chart over the last six months

One possible cause for the sharp price correction is that battery makers had been building stocks of metals earlier this year and had more recently been drawing down on their stockpiles, though other factors suggested lower prices might persist.

In a telling comment about pressure in the electric car sector, Morgan Stanley noted that: “Smaller players are bearing the brunt of the subsidy cuts. Optimum Nano and Yinglong New Energy, have both suspended production.”

One of the challenges for Australia's fast-growing lithium industry is that China is boosting domestic supplies of the metal. Meanwhile, other countries – such as Chile – are also expanding.

In its latest lithium research note, Macquarie Bank incorporated an analysis of the global lithium industry of three years ago, when just four producers dominated the business, collectively producing 150,000 tonnes of lithium carbonate.

This year – according to Macquarie – worldwide lithium production is expected to total 405,000 tonnes, coming from 12 producers.

That 170 per cent increase in supply – with more to come as new mines and processing plants are completed – could see the lithium carbonate price plunge from $US12,625 a tonne this year to $US7,375 a tonne next year.

Delegates to last week's Diggers & Dealers mining forum in the Western Australian mining capital of Kalgoorlie also rang the lithium warning bell.

A survey of delegates at the conference by investment bank UBS found that lithium was expected to be the worst performing metal over the next 12 months, followed by gold and iron ore.

While UBS surveyed a small group of delegates, the response was significant given lithium's star status of the past two years.

Of all the evidence pointing to a slowdown in the battery metals sector, the most important point is what's happening in car dealerships, where consumers are being asked to make a significant change in their buying habits.

For investors, car buyers are part of a Warren Buffett pub test because if consumers are reluctant to buy without a government subsidy, then future sales growth has to be questioned.

In the long run, it is likely to be a different story, with electric cars certain to gain in popularity as today's problems are fixed – though as Lord Keynes famously said, “in the long run we are all dead”.