Where the top 1% invest

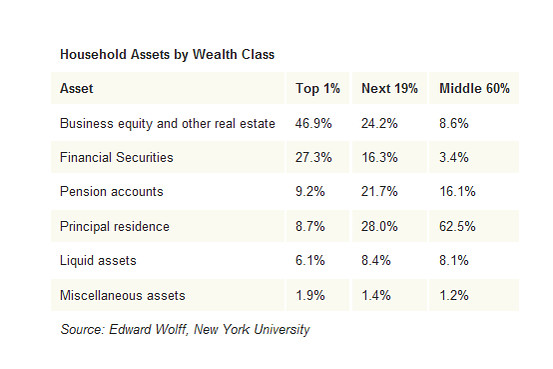

Summary: America's wealthiest keep most of their assets tied up in their businesses, and also hold a higher proportion of their wealth in financial securities than the average American. Meanwhile, the middle class relies mainly on their primary residence to make them wealthy, research from economist Edward Wolff has found. |

Key take out: For the best returns, invest in your own ingenuity and hard work, the research suggests. |

Key beneficiaries: General investors. Category: Investment portfolio construction. |

Don't invest in your home, don't even invest heavily in the stock market, but invest instead in yourself and the fruits of your work. That's the path to serious riches – and what America's wealthiest do.

That at least is what emerges from the research of Edward Wolff, the economist at New York University. His study, based on Federal Reserve stats, shows that the top 1% – worth $7.8 million or more – keep nearly half of their wealth tied up in their closely-held businesses. This is not an entirely novel revelation. The Wolff study underscores what Barron's previously noted in the blog post “Globe's Wealthiest Invest in Themselves.”

The middle class, with a net worth topping out at $401,000, relies instead on their primary residence to make them wealthy, parking 63% of their wealth in the roof over their head. But the wealthiest Americans diversify further still. The top 1% also keeps 27% of their assets in financial securities, including stocks, bonds and mutual funds, versus just 3.4% for the average American.

Including retirement accounts and financial securities, the rich hold 36% of their assets in financial markets versus just 20% for the middle class. But the middle class is better for financial intermediaries. They are more likely to own stocks indirectly, through IRAs, 401ks and pensions, and buy life insurance than their well-heeled counterparts.

That difference in asset allocation, between top earners and the average American, also helps to explain rising wealth inequality in recent years. Between 2007 and 2010, the median American saw their wealth plummet 44%, as the value of their primary homes fell off a cliff. Meanwhile, the net worth of the top 1% dropped just 16%. Since then, the rich have overwhelmingly enjoyed the American recovery, their wealth rising by 7.4% between 2010 and 2013 alone, while Federal Reserve data shows that median net worth for middle income families stayed stuck at $96,500 over the same time period.

So, there is wisdom in such stats, for anyone who cares to tap it – invest in your own ingenuity and hard work. You won't find a better return anywhere else.

This article has been reproduced with permission from Barron's.