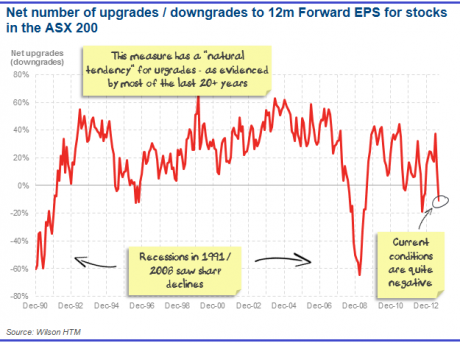

Where are the earnings upgrades?

| Summary: Consensus earnings forecasts are still in downgrade mode. |

| Key take-out: The net number of downgrades in the market signals that current conditions are still negative. |

| Key beneficiaries: General investors. Category: Strategy. |

There is a theme in the market suggesting that the earning downgrade cycle has ended in Australia. The point I wish to make is that if you have that view you need to recognise that it is a “faith” based view that earnings will pick up – evidence is still saying the opposite and consensus earnings forecasts are still in downgrade mode.

Additional Thoughts:

- What I am showing is the net number of upgrades vs downgrades for stocks in the ASX 200. I am measuring the change over three months in the 12-month forward EPS (which is a blend of the next two years forecasts – right now for a June year end company it is 9.5/12 x 2014 EPS 2.5/12 x 2015 EPS).

- Because I am showing 12 months forward data you should expect a level of “natural upgrades” as each month there is more of later years included in the number – i.e. it’s a moving target. This is different to when you pick a static year, say tracking 2013 forecasts over time; then you will see “natural downgrades” as analyst forecasts are on average optimistic.

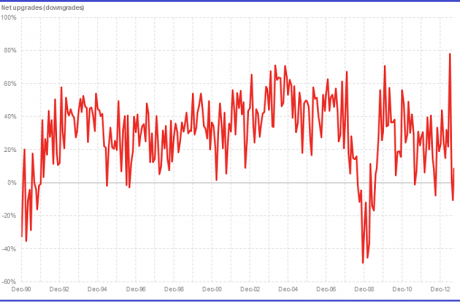

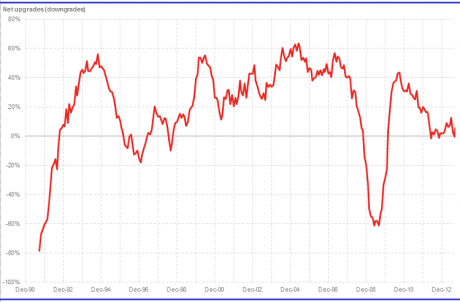

It’s also worth looking at the figures over different time ranges….even if it is only to prove a point. Looking at the changes over one month in the chart below…..you will see no change. Similarly if you look at the figures over 12 months there is no real change either – indeed neither time frame makes any difference to the conclusion.

Damien Klassen is head of quantitative strategy at Wilson HTM Investment Group.