What to Tell the Kids When They Ask About Crypto

Our Gen-Z offspring are the first to live entirely in the digital age – they barely remember a world without Facebook, Tik Tok and Instagram. So it’s inevitable that they’ll be exposed to crypto and/or digital assets of some kind or another.

As crypto and digital assets emerge and evolve, teaching our kids how to navigate the opportunities and dangers is especially important. As parents, we can play a critical role in helping to shape our kids’ beliefs, values, attitudes, and behaviour.

Teaching our kids about money and investing should be a key part of their preparation for the real world. While the mechanics of managing crypto differs from traditional bank accounts or share parcels, we can adopt a similar framework to think about how best to approach things.

Getting started

Even before thinking about how to buy and what to buy, the first question to consider is: who is buying? This decision is driven by tax considerations and the extent to which minors under 18 can readily obtain crypto.

For most people, the easiest way to buy crypto is on an exchange. Australians can either use a local exchange or an international exchange that permits Australians to open an account.

Some international exchanges offer services to Australians under a degree of local compliance oversight, whereas others do not. Using a local exchange that is subject to local laws and regulations is likely to be the safest way to go. This site lists certified local crypto exchanges.

Most local crypto exchanges will only extend accounts to adults, that is, someone over 18. Exchanges based outside Australia might have lower minimum age thresholds or are less rigorous in verifying ID, but then the custody risks increase.

If the exchange only permits adults to open an account, then an adult can either open the account solely or as trustee acting on behalf of a child.

The ATO typically treats a sale of crypto as a taxable event for the purposes of capital gains, and the earning of crypto via staking, “air drops” or yield generation as declarable income for tax purposes. This may influence the decision about whether any crypto is held by the adult solely or as trustee on behalf of the child.

Custody or self-custody?

Keeping crypto on-exchange is simple and provides flexibility to trade at the expense of the security that comes from self-custody. It’s valuable to learn how to open and navigate a crypto account at an online exchange, bearing in mind the custody risk.

Crypto exchanges are custodians of any owner’s crypto, much like a bank is the custodian of fiat currency on-account. The exchange holds the private keys to the crypto tokens on the blockchain on the owner’s behalf. If the exchange were to be hacked and/or the private keys to any crypto stolen, then the crypto is gone.

As a learning experience and for modest sums, retaining crypto on-exchange is convenient. If the value held becomes material, then crypto can be withdrawn to personal wallets for safe-keeping or held with a “multi-signature” custodian (both you and they hold private keys for security and redundancy).

Crypto wallets

Self-custody means possessing the private keys that secure the crypto tokens on the blockchain in question. As the saying goes “not your keys, not your coins”.

Understanding how to self-custody crypto is an important skill to learn at this stage of crypto’s evolution. The easiest and safest way to self-custody is to use a hardware wallet that connects to a PC or mobile phone. Hardware wallets from the likes of Ledger or Trezor can be bought for as little as $70, and provide a user-friendly way to secure your private keys and manage your crypto assets.

Learning how to set up a wallet, create a back-up seed, create wallet “accounts”, and transfer crypto is equivalent to learning how to manage an online bank account. Anyone comfortable with navigating an online banking account will likely be able to setup and manage a crypto wallet. (Mobile and game console savvy teenagers should have little difficulty and may end up teaching their parents how to do it!)

A back-up recovery “seed” (or phrase) is typically a list of words in a set order that can be used by compatible wallets to restore access to the apps (and crypto assets) secured by the wallet. It’s equivalent to a password or PIN to a bank account, so should be safely secured. Bitcoin’s “BIP39” (Bitcoin Improvement Standard # 39) defines 2048 words to be used in this way, and most popular wallets support back-up recovery phrases.

Wallet users should record the recovery phrase (usually 24 words) offline and securely store the record away from the hardware wallet itself. If the hardware wallet were to fail, the user can use the recovery phrase on another wallet to restore access.

The recovery phrase should be secured so that it can’t be stolen, lost, or degraded. If stored digitally, then offline is safe; online isn’t. Pen and paper is crude, but effective. Storing a paper backup in a fireproof, waterproof safe is a good idea, as is using a product like a Cryptosteel to secure it. Whatever method is used, your kids will appreciate the importance of this step if they record and secure the recovery phrase themselves or do it with you.

Safety first?

Crypto assets are volatile and subject to significant price falls. Since the objective is education, the amount bought is not important. Crypto currency assets are divisible so buying a whole coin isn’t necessary. Spend appropriately for the child’s age, interest, and ability.

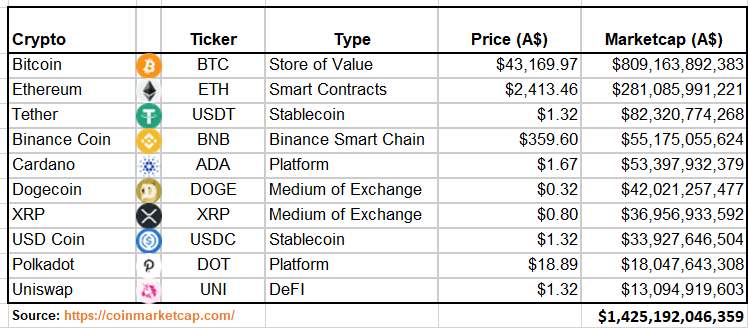

Staying with the main crypto assets reduces risk. There are no risk-free options, but Bitcoin and Ethereum are arguably the “safest”. Risk then increases significantly.

Teaching kids about identifying, acknowledging and managing risk is a critical aspect of crypto education, if not education for life.

Dogecoin has rocketed from nowhere into the top 10 crypto assets by market cap over the last few months, ably assisted by Elon Musk’s tweets and apparent support for the coin. Any teenager who follows social media will likely know about Dogecoin even if they have little awareness of its dubious investment grade.

So is buying Dogecoin a good idea if a child is interested? If education is the priority, then being engaged may offset the risk of a more volatile asset. There’s probably no better crypto asset as of writing to teach a young keen enthusiast about how markets respond to human fear and greed. If this seems like a good idea, just be prepared for significant price volatility, and remember that education is the objective.

Employing a portfolio approach can demonstrate diversification to manage risk. Bitcoin and Ethereum could be considered “core” holdings, with some other choices for fun and learning. Some could be self-custodied on a wallet and the remainder held on exchange. Transferring crypto between exchange and wallet for practice will build confidence and is a great way to learn about crypto as a secure digital means of exchange.

Digital piggy bank

Cash has always been used for pocket money, payment for chores, birthday gifts or other rewards. So why not digital money for the digital age?

A sensible allocation in crypto on a regular basis will build engagement over time and teach many valuable lessons:

- Practical skills in managing wallets, exchanges and security.

- Dollar-cost averaging.

- Diversification.

- Low time preference.

- Market dynamics.

Some parents might favour a more sophisticated approach than the DIY method. A UK business called Strive is offering a kind of digital “piggy bank” to teach younger kids about crypto. It’s designed to work with Coinbase, the US crypto exchange that recently listed on NASDAQ, and so can be used by anyone, including Australians.

Strive aims to engage kids in learning about crypto by “making digital currency, physical”. An accompanying app allows a parent to monitor their child’s activity and manage pocket money. The physical piggy bank has a digital display that syncs to the Coinbase wallet, and acts like an old- fashioned piggy bank to engage the child’s interest. It’s due for release in August 2021.

While it’s by no means certain that Bitcoin, Ethereum or any of the current crypto assets will survive longer-term, crypto is arguably an emerging asset class that is here to stay. Crypto is a $1.8 trillion asset class as of writing, and the crypto community likens crypto to the Internet circa-1995. The dramatic growth of other digital technologies and services over the last two decades shows how quickly adoption can happen on a digital network.

Today’s crypto networks are showing the fastest rate of adoption of any previous technology in history. Preparing our kids for a digital future that likely involves digital money may prove to be one of the most valuable life skills we can impart as parents and guardians.

Frequently Asked Questions about this Article…

Teaching kids about cryptocurrency is crucial because it prepares them for a digital future where digital assets are likely to play a significant role. Understanding crypto helps them learn about managing money, investing, and the risks and opportunities in the digital economy.

Parents can help their kids get started with cryptocurrency by opening an account on a local crypto exchange, teaching them about the importance of security, and guiding them through the process of buying and managing crypto assets. It's also important to discuss tax implications and the responsibilities of holding digital assets.

Keeping cryptocurrency on an exchange poses risks such as potential hacking and loss of funds, as exchanges hold the private keys to the crypto. For better security, it's advisable to learn about self-custody using hardware wallets, which allow users to control their private keys.

A crypto wallet is a tool that allows users to store and manage their private keys, which are essential for accessing and controlling their cryptocurrency. Learning to use a wallet is important for securing digital assets and understanding the mechanics of digital transactions.

Cryptocurrency can be used as a digital piggy bank by regularly allocating small amounts to teach kids about saving, investing, and market dynamics. Tools like Strive offer a digital piggy bank experience, syncing with a crypto wallet to engage kids in learning about digital money.