Value Investor: Has Westpac hit the summit?

While delivering another solid result in the first half of 2014, our view is that Westpac appears to be entering the peak of its current earnings cycle and the bank’s present performance should not be extrapolated into the future.

Provisioning is at cyclical lows and earnings growth from core banking operations appear to be limited by restricted household credit growth and low business confidence and conditions.

In the first half of 2014, statutory net profit after tax was up 10 per cent to $3.62 billion, with earnings per share also up 10 per cent, outpacing equity per share growth of 5 per cent. Earnings that grow faster than equity are pleasing to value investors, as it demonstrates increasing profitability.

Credit quality improved over the period, and bad debt expenses fell 3 basis points to 0.12 per cent of loans. The theme of declining provisions continued, falling from 0.73 per cent in the previous half-year to 0.67 per cent of loans.

While these declines have been positive, bad debt expenses and provisioning have been falling for more than four years. This has been boosting profits, but we expect the end of declining provisions is near.

Provisions and impairment expenses have now reached 17-year lows. The downtrend is partly as a result of several years of work by the bank to manage credit quality carefully -- attributable to Westpac’s commitment to conservative risk management across all business areas, after its near collapse in the early 1990s. However, a large cyclical component remains, and the current lows can be expected to revert to a mid-cycle average at some stage.

With the contribution to profitability of tapering bad debts expense nearly over, loan growth and growth from non-banking businesses (via non net interest income) will have to accelerate to meet shareholder expectations of further dividend growth.

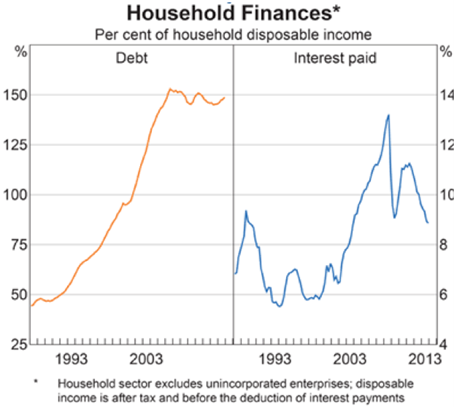

However, household credit growth appears restricted by a highly-indebted household sector, with the ratio of household debt to disposable income sitting at around 150 per cent.

Figure 1. Household Finances – Australia

Source: RBA chart pack

Business gearing levels appear unstretched, so a recovery in business credit growth may assist in driving incremental earnings for Westpac. However, business confidence and conditions are patchy and Westpac faces fierce competition from Australia and New Zealand Banking Group and National Australia Bank. Westpac’s Australian business lending was flat (excluding the Lloyds acquisition) over the year.

We forecast a sustainable return on equity of 20 per cent, marginally below consensus forecasts and the five-year average of 22.4 per cent. Our adopted required return is 11.5 per cent, which is low due to Westpac’s financial strength, large market cap and predictability of earnings.

Our fiscal 2014 valuation of Westpac is $31.60, which rises to $32.86 in fiscal 2015. Westpac is currently trading above valuation.

Figure 2: Westpac Banking Corporation, Price to Value Chart

Source: www.stocksinvalue.com.au

Banks are leveraged cyclicals exposed to changes in economic conditions, interest rates, exchange rates, unemployment and inflation. Investors should adopt a 15 per cent margin of safety when investing in a major bank at this stage of the cycle.

By Brian Soh and Amelia Bott of StocksInValue, with insights from Stephen Wood, Adrian Ezquerro and George Whitehouse of Clime Asset Management. StocksInValue provides valuations and quality ratings of 400 ASX-listed companies and equities research, insights and macro strategy. For a no obligation FREE trial, please visit StocksInValue.com.au or call 1300 136 225.