US employment's soft underbelly

The United States labour market improved in September, including upward revisions for both July and August, which will put increasing pressure on the Federal Reserve to lift rates early next year. But with the gains during the recovery unequally distributed, economic conditions remain a struggle for many US households.

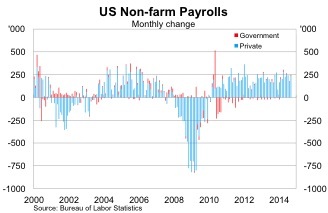

Non-farm payrolls rose by 248,000 in September, following what was widely considered a poor outcome in August. But with job growth revised up considerably in July (up 243,000 compared earlier estimates of 212,000) and August (up 180,000 compared with an initial estimate of 142,000), that concern seems somewhat misplaced.

The strong result pushes annual job growth to its highest level since April 2006. The US has created over 200,000 new jobs in seven of the last eight months. If the recent trend persists until the end of the year, 2014 will post the strongest job growth since 1999.

Private non-farm payrolls rose by 236,000 in September, while government payrolls were up by 12,000. State governments drove public sector employment in September but over the past year it has mostly been local governments who are hiring. Government payrolls – at all levels – remain well below their peaks.

The services sector continues to drive the recovery, gaining a further 219,000 jobs in September. Over the past year, the services industry has accounted for almost 85 per cent of job growth, which is a little below its share of total employment.

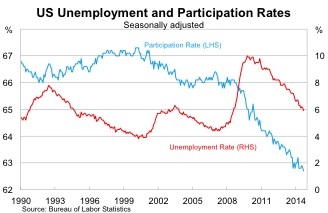

The unemployment rate dipped to 5.9 per cent – its lowest level since July 2008 – but much of the improvement has reflected falling labour force participation. The participation rate is at its lowest level in 35 years, reflecting a combination of retirements and disgruntled Americans leaving the labour force after a prolonged period of unemployment.

As a result, the labour market isn't as strong as conventional measures such as the unemployment rate suggest – a point which Federal Reserve chair Janet Yellen has noted on numerous occasions.

Wage growth also remains subdued with average hourly earnings largely unchanged in September and only 2.0 per cent higher over the year. This begs the question: how many of the new jobs are reliable, well-paying positions?

And the answer is probably not enough. Analysts don’t talk about it much, but the composition of job growth matters almost as much as the sheer number of jobs created. High paying jobs lost during the recession have been replaced by lower-paying part-time positions during the recovery.

According to a report by the National Employment Law Project, lower-wage sectors accounted for 22 per cent of job losses during the recession but 44 per cent of employment growth through to February this year (Cautious consumers aren’t helping the US recovery, September 1).

It’s hardly an ideal situation for strong growth and it goes a long way to explain why US household spending remains relatively soft. But there is still cause for optimism and I expect conditions to improve further over the next year.

Spare capacity continues to ease and that will eventually translate into higher wage demands. Admittedly some of these gains will be eaten by higher inflation but, on net, the household sector will be in a much better position.

US households will also receive a boost from a stronger US dollar. Following the labour data, the US dollar rose to its highest level in four years and with the Federal Reserve set to end its asset purchases at the end of this month, I expect the dollar to remain at a reasonably high level (at least compared with where it has been throughout the recovery).

That may not be ideal for US exporters but it will increase the purchasing power of US households. Expect consumption to begin to pick up over the next twelve months and imports will also begin to recover. It could prove a boon for the likes of Europe, Canada and China who supply a range of goods for US consumers. Australian exporters may also benefit indirectly (Australia’s export potential is all in the supply chain, August 13).

The Federal Reserve will meet at the end of this month and it is all but certain to end its asset purchasing program which began in September 2012. Expect a few hiccups – the end of previous rounds of quantitative easing was not without its complications – but the market will quickly turn its attention to when the Fed will raise rates.

That remains a good question and we should remember that the Fed is not on a pre-set course. If recent employment growth proves persistent, pushing the unemployment rate towards 5.5 per cent by March next year, then I’d expect the Fed to act in early 2015.

But that remains far from certain and it’s hardly a surprise that most analysts are more pessimistic. At the very least I’d expect that Fed to take a more bullish tone in their speeches over the next month, reflecting the recent improvement in data.