Transmission access: More deadly than the RET Review?

While the renewables industry has been focused on the critical RET Review process, a much quieter but potentially more important market change has been progressing in the background.

While the RET influences renewables development over the next five to 15 years, there are plans afoot to change the rights existing versus new generators have to access transmission grid capacity, which could stymie the development of renewables in Australia over the much longer term.

The change, proposed by the Australian Energy Market Commission as part of its Transmission Frameworks Review, represents potentially the most significant change to the operation of the National Electricity Market since its establishment more than a decade ago. The manner in which it is implemented, and particularly the details of the transition to what they call the Optional Firm Access (OFA) model, could have critical implications for renewables.

What is OFA?

The OFA model aims to address market inefficiencies related to the fact that transmission network capacity, just like roads, is costly to provide and can sometimes experience congestion where generators find they can’t export all the power they’d like to sell. The OFA will work by allowing generators to acquire priority access to the network known as firm access which allows them to essentially bypass the congestion. When network constraints bind, generators that hold firm access rights will be paid compensation by those that do not hold firm access, giving greater revenue certainty and supporting contracting for generators with firm access. The price of firm access will depend upon the cost of providing network capacity at each node. This represents a significant change to the current arrangements, under which network is paid for solely by consumers, and all generators (new entrants and incumbents) compete for freely available network access in the dispatch process. For a more detailed introduction to the OFA model, see this earlier article.

Where’s the OFA process at?

The AEMC and AEMO are currently working out many of the details of how OFA will be implemented, with their final report to be completed in mid-2015. However, it is already clear that there could be some potentially highly problematic issues for new entrants (and therefore for the renewables industry) in the proposed transition process.

So what’s the problem for renewables?

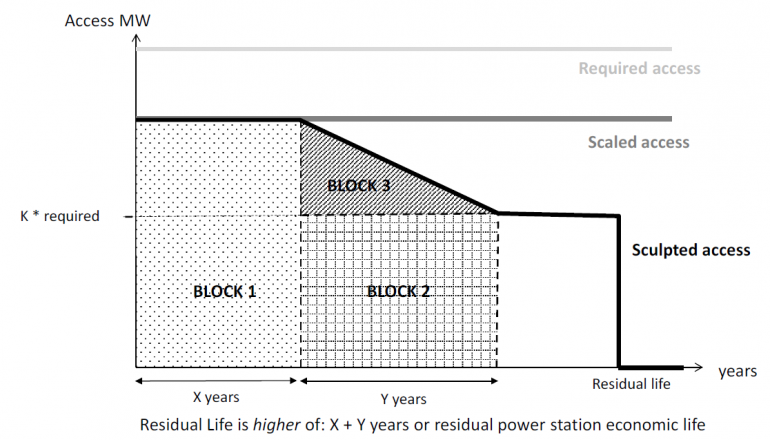

The AEMC’s Technical Report indicates that the intention is to allocate the whole firm capacity of the existing network to incumbent generators at the onset of the OFA model. This is then to be sculpted back over a period of time to some lower level, which existing generators would then retain for their “residual economic life”, as illustrated in Figure 1 below. This is intended to limit market shock, and also to provide incumbents with the level of access that they reasonably would have expected when they invested (minimising perceptions of regulatory risk).

Figure 1: Sculpting of transitional access for an incumbent power station (reproduced from AEMC Technical Report)

This proposal could have some serious problems:

Barrier to entry – competitive disadvantage for new entrants

Incumbent generators are given a significant proportion of their required firm access for free, while new entrant generators will need to purchase any firm access at a price reflecting its value. This creates a clear competitive disadvantage for new entrants. Therefore, these proposed arrangements could pose a significant barrier to entry, representing an externally imposed regulatory disadvantage for new entrants, most of whom will be renewables.

Rent seeking behaviour, barriers to exit, or windfall gains

The treatment of incumbent exit under the proposed arrangements will have a critical influence.

The first option is for the “Residual Life” remaining for each generator to be negotiated and decided individually with each market participant prior to implementation of OFA. Generators would retain access for this period of time, but could retire and sell their transitional access prior to that date if desired. This approach is likely to encourage significant rent seeking behaviour, since firm access will have substantial value. Rent seeking is likely to be most successfully implemented by the largest organisations, who are therefore likely to benefit the most, while smaller organisations are disadvantaged. Furthermore, information asymmetry creates high potential for windfall gains by incumbents, particularly given the current political disinclination towards rapid greenhouse emissions reductions (creating the perception of a long potential life for emissions intensive assets).

The second option is for each generator to retain transitional access until they actually retire. At this point residual access would be surrendered. This approach creates a clear barrier to exit if generators cannot retain valuable transitional access beyond retirement, closure and replacement of unprofitable assets is likely to be inhibited.

The third option is for generators to be allocated transitional access which never expires. This approach constitutes a significant windfall gain for incumbents. Incumbents would be given a large quantity of firm access with significant value, which they did not have or expect when they invested in those assets. This creates an unnecessary wealth transfer from consumers (who paid and continue to pay for the network originally through Transmission Use of System (TUoS) charges) to incumbent generators.

Increasing financing costs for renewables

These proposed arrangements are likely to represent a windfall gain for incumbents, providing them with confidence of a level of access beyond that under which they originally made investment decisions. Rather than reducing perceptions of regulatory risk, this favouring of emissions intensive incumbents at the cost of new entrants could actually increase perceptions of regulatory risk for low emissions new entrants. This could selectively increase the financing costs of the very technologies we need to enter the market in coming decades. Given that renewable generators are capital intensive, they are particularly vulnerable to these effects.

Gifting network access to incumbents

The present network has been paid for by consumers, through TUoS charges. Thus, it could be argued that consumers “own” the transmission network. The proposed OFA transition process would see the majority of the access to this network “gifted” to incumbents, many of whom are privately owned companies. It could be argued that this constitutes a form of privatisation of a publicly owned asset, with private companies being given access for free (no revenue is raised and returned to consumers in return for the sale of guaranteed access to this asset). This is philosophically problematic, particularly if firm access is being given away for free for an extended period of time (for example, the residual life of incumbents). It also creates a new obligation for consumers to maintain that network access, something that would currently only be done if it reduced total costs to consumers, potentially increasing future consumer costs.

Inhibiting the low carbon transition

Due to the potential for barriers to entry and exit, and the exacerbation of competitive disadvantage for new entrants, the proposed arrangements could actively inhibit the transition to a low carbon electricity system, working in opposition to policies such as the Renewable Energy Target and carbon pricing. It’s worth noting that most modelling studies indicate that many existing generators may still be operating in 2050, implying that the electricity system will remain in a state of transition towards implementation of the OFA model for the next 35 years to 2050 and beyond. Therefore, all of the transitional issues discussed here could persist for a very long time.

All of these issues pose significant problems for the renewables industry (and all new entrants), and the necessary transition to low carbon, as outlined in more detail in CEEM’s working paper. Given that the proposed transition to OFA could take many decades, these issues could prove more problematic for renewables over the long term than the removal of the RET.

Fortunately, there are better transition alternatives that avoid these problems, as will be outlined in an article next week.

Dr Jenny Riesz is a research associate at the Centre for Energy and Environmental Markets (CEEM), at the University of New South Wales. (jenny.riesz.com.au)