The worst question to ask yourself: "Is now a good time to invest?"

Continually questioning whether you are picking the ‘right’ or ‘wrong’ time to invest is a sure path to procrastination. It can mean never getting around to investing at all, which can see your wealth suffer in the long run.

That’s why asking if now is a good time to invest can be the worst question to ask yourself this year.

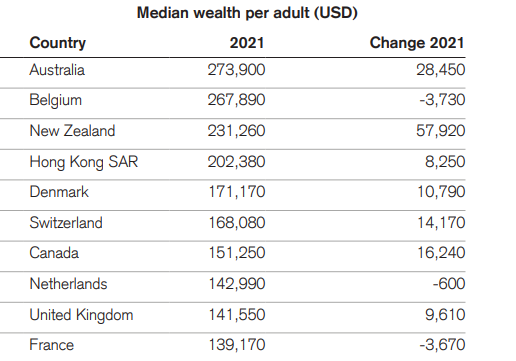

The fact is, Australians are among the wealthiest people in the world. Credit Suisse’s 2022 annual global wealth report found we had median net worth per adult of about $USD274,000 at the end of 2021, putting us ahead of Belgium, New Zealand and Hong Kong[1].

Remarkably, as Table 1 shows, our wealth rose by $USD28,450 per adult between 2020 and 2021. Who would have thought a pandemic would provide such wealth-building opportunities?

But that’s the challenge of asset markets. They can move remarkably quickly, and often in unexpected ways. So it’s almost impossible to know when the best returns will occur, or the worst.

|

Table 1 Mean and median wealth in 2021, top 10 countries |

|

|

|

Source: Global Wealth report 2022, Credit Suisse |

Long term returns call for a long term commitment

Let’s look at this another way. As I write, Australian shares have delivered total returns (dividends plus capital growth) averaging 8.52% annually over the last 10 years [2]. That’s a fantastic result! But if we look at the returns for each financial year as shown in Table 2, it’s clear that no single year has recorded gains even close to this long term average.

So how would investors have earned that average return of 8.52% each year? The answer is by staying invested for the long term.

|

Table 2 Financial year total returns Australian shares 2013-2022 |

|

|

Financial year |

Total returns – Australian shares |

|

2013 |

20.7% |

|

2014 |

17.6% |

|

2015 |

5.7% |

|

2016 |

2.0% |

|

2017 |

13.1% |

|

2018 |

13.7% |

|

2019 |

11.0% |

|

2020 |

-7.2% |

|

2021 |

30.2% |

|

2022 |

-7.4% |

|

Source: Vanguard[3] |

|

If you’re not convinced about this, Vanguard have looked at the total returns on Aussie shares for each financial year from 1993 to 2022 – that’s a lengthy 30-year period. Some years were absolute shockers. Like 2009 when shares dropped by 22%. Despite this, the 30-year average annual return was 9.8%.

The cost of missing the best days

Instead of waiting for whatever signs you believe point to a good time to start investing, it’s a lot easier to just begin when you have the funds available.

Yes, there’s a chance the market could tank the next day. There’s also a chance it could skyrocket. When you’re a long term investor, you can expect to experience all sorts of market conditions – highs, lows and a whole lot in between. It doesn’t matter though because your returns will be smoothed out over time to approach the long term average.

Fidelity[4] has done some interesting research here, looking at the cost of missing the best days in the market over a given timeframe.

The basic starting point is that an investor with $10,000 in a diverse portfolio of Australian shares in October 2003, would have seen their portfolio grow to $48,878 by January 2023[5].

However, an investor who missed just the 10 best trading days of that entire 20-year period, would have ended up with a portfolio worth $28,963. In other words, missing the 10 best days would have cost the investor $19,915 in long term gains.

If our investor missed the 20 best days of trading, those lost returns blow out to $29,701. And if the 30 best days were missed, the end portfolio would be worth just $13,290, meaning our investor missed out on $35,588 in long term returns.

Who would have picked when those best trading days occurred? Not many people. And the best days often follow some of the worst days. You only need to look back to early 2020, when Aussie shares had a stinker of time at the start of the pandemic. The market dropped by more than 30% in the space of a month between February and March[6]. But by early August 2020, shares had gained a whopping 57%[7].

There are always risks, headwinds and downsides

Of course the past is no guide for future returns. And the sharemarket is sure to dish up its usual run of highs and lows. Like all asset markets, it’s a cyclical beast.

Even so, history tells us that markets recover, and the sharemarket will go on to reach new highs in time. The upshot is that when you are a long term investor, there is no reason to worry about the ‘right’ time to invest. The ideal time to get into the market can be when you have the funds available – and it doesn’t take a lot to get started.

As we head into 2023, it’s easy to procrastinate over investing. There’s plenty going in the world to be concerned about. Rising interest rates, high inflation, and geopolitical risks matter to all of us.

This is nothing unusual though. There are always risks on the horizon. I cannot recall a time when there haven’t been issues of concern somewhere in the world. And a year from now, we will likely be facing new and very different challenges.

I can’t predict the future. What I can say is that by diversifying your investments, being prepared to invest for the long term, and keeping a close eye on the fees you pay (as these apply regardless of returns), you are well placed to earn healthy returns over the long term. And why delay? Tomorrow could be one of 2023’s best trading days.

Are you ready to get started? InvestSMART has a range of diversified portfolios that all come with a capped management fee. If you would feel more comfortable talking with someone first just use the chat box in the bottom right to speak with the team.

[1] https://www.credit-suisse.com/media/assets/corporate/docs/about-us/research/publications/global-wealth-report-2022-en.pdf

[2] https://www.spglobal.com/spdji/en/indices/equity/sp-asx-200/#overview

[3] https://intl.assets.vgdynamic.info/intl/australia/documents/resources/2022-Index-Chart-A4-Flyer-For-Web.pdf

[4] https://www.fidelity.com.au/learning-hub/markets/timing-the-market/

[5] Based on the daily returns of the ASX/S&P 200 Accumulation index

[6] https://www.spglobal.com/spdji/en/indices/equity/sp-asx-200/#overview

[7] https://www.spglobal.com/spdji/en/indices/equity/sp-asx-200/#overview

Frequently Asked Questions about this Article…

Asking if now is a good time to invest can lead to procrastination and missed opportunities. Markets are unpredictable, and waiting for the 'perfect' time can result in never investing at all, which can harm your long-term wealth.

Long-term investing is crucial because it allows you to ride out market volatility and benefit from the average returns over time. For example, Australian shares have delivered an average annual return of 8.52% over the last decade, despite yearly fluctuations.

Missing the best trading days can significantly impact your returns. For instance, an investor who missed the 10 best days over a 20-year period would have seen their portfolio grow much less compared to staying invested throughout.

Timing the market is risky because it's nearly impossible to predict when the best or worst days will occur. Markets can change rapidly, and missing key days can lead to substantial losses in potential gains.

Diversification helps spread risk across different assets, reducing the impact of any single investment's poor performance. This strategy can lead to more stable returns over the long term.

Before investing, consider your financial goals, risk tolerance, and the fees associated with investments. It's also important to have a long-term perspective and be prepared for market fluctuations.

Starting to invest as soon as possible is important because it allows you to take advantage of compound growth over time. Delaying investments can mean missing out on potential gains.

If you're unsure about starting to invest, consider speaking with a financial advisor or using resources like InvestSMART's diversified portfolios, which offer capped management fees and support to help you get started.