The world's largest payment card company you've probably never heard of

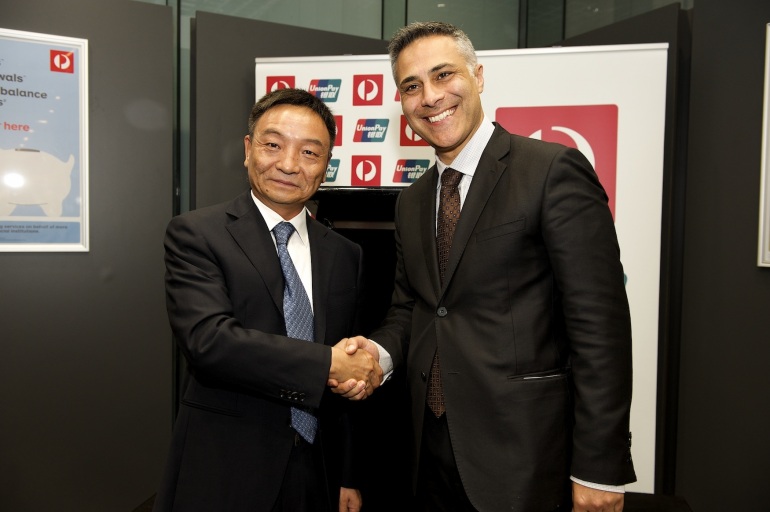

UnionPay's Shi Wenchao and Australia Post's Ahmed Fahour.

The next time you walk into an Australia Post office, you may likely see stickers bearing a discreet red, blue, and green-banded symbol with UnionPay in English and Chinese appearing on the tills. In fact, you can see them at a lot of places now, from upmarket retailers like David Jones to thousands of cabs in Australia.

There is no more potent symbol of the spending power of China’s globetrotting consumers than that of UnionPay, which is in fact the world’s largest payment card company according to the number of cards issued. It has more than 4.2 billion cards in circulation, including non-Chinese users in Southeast Asia, Korea and Japan.

Speaking at a signing ceremony with Australia Post in Melbourne this week, Shi Wenchao, the chief executive of the card company, said UnionPay cardholders transacted 32 trillion yuan or $5.5 trillion last year, which is more than Japan’s GDP for the same period.

In terms of transaction volume, China UnionPay is already the world’s second largest card company, behind industry leader Visa. UnionPay has 31 per cent of global market share compared to Visa’s 40 per cent. Mastercard is the third most accepted card, with 24 per cent of the market.

UnionPay’s business has expanded rapidly internationally on the back of a massive outpouring of tourists, students and business people. Chinese consumers spent about 500 billion yuan or $86 billion in 2012, according to the chairman of UnionPay, Su Ning, who visited Australia last year.

Chinese consumers spent roughly $1 billion on their UnionPay cards in Australia last year, including a single transaction of $500,000 at a luxury watch shop in Sydney. Point of Sales revenue increased 48 per cent, ATM transaction increased 98 per cent and UnionPay e-commerce increased 599 per cent over the year, according to the company’s internal data.

Australian businesses need to understand that UnionPay is a piece of critical financial infrastructure that we need to take full advantage of the booming tourism and education trade. The simple fact is that most Chinese don’t use Visa or Mastercard, preferring instead to use UnionPay, which enjoys a virtual monopoly in the country.

Businesses, universities, banks and even Australia Post are quickly coming to the realisation that having UnionPay enabled payment system is crucial to their businesses. NAB was the first major bank to seal a deal with UnionPay in 2006 and is using its first mover advantage to lure new business customers. However, all remaining big four banks have signed up UnionPay, making Australia the first western nation to have all its major banks accepting UnionPay.

Even Australia Post is keen to take advantage of Chinese consumers. Ahmed Fahour, the managing director and chief executive of Australia Post, said China was “crucial” to the company’s international strategy.

“There are a million Chinese visitors and hundreds of thousands of students here,” he told Business Spectator, “we see it [Unionpay] as really important and right up there with Visa and Mastercard. We are a retailer and have many Chinese people visiting us and doing transactions. We want to offer them easy options and UnionPay is growing very nicely and we want to participate.”

However, the Chinese card giant’s ambition does not stop at being accepted by banks and merchants; it wants to issue its own branded cards in partnership with Australian institutions such as banks and Australia Post.

“We want to issue our own cards here including debit card, credit card and prepaid card,” Shi told Business Spectator,” I am agnostic when it comes to who is going to be our local partner, as long as they can provide our cardholders with good experience and we are about to launch a pre-paid card with Australia Post.”

Issuing UnionPay branded cards is an important part of the company’s internationalisation strategy. Business Spectator understands the company is canvassing the opportunity with major Australian banks as well as retailers like Australia Post.

When asked about UnionPay’s competitive relationship with American giants such as Visa and Mastercard, Shi, who was a Chinese central banker, said the relationship was about competition as well as cooperation. “We work together on security issues, international technical standards, and user experience standards” he said.

However, the most important challenge for UnionPay and its international ambitions is how to promote its brand to non-Chinese customers. Of the 28 million UnionPay cards issued outside of mainland China, most of them are to be found in Hong Kong, Macau, Korea and Japan.

“I have been thinking about that problem and I don’t think I have a mature solution yet,” he told Business Spectator,” it is one of the most difficult tasks for me.”

The rise of UnionPay is similar to the story of the rise of China. The company has emerged as a serious challenger to Visa and Mastercard, and it was only founded less than 11 years ago. Australia must learn to accommodate this new force to take advantage of the booming services trade between the two countries.