The Ticker: Modern business life

On today's blog:

- Jacqui Lambie's unfortunate bill debate gaffe

- Three graphics that explain everything you need to know about the China-Australia FTA

- Don't fear: executives believe the robotics revolution is still a while away

- CLSA's 'most hated' Aussie stocks

- OPEC's oil dilemma, in charts

- The best representation of Australia's obsession with China

- Interesting reads from around the web

Got something you would like to add to the blog? Email (harrison.polites@businessspectator.com.au) or get in touch on Twitter.

2.10pm – Jacqui Lambie's unfortunate bill debate gaffe

Though, hardly anybody was around to hear the mix-up. Image: AAP

By AAP

Outspoken Palmer United Party senator Jacqui Lambie has stood in parliament and launched into a spiel against planned government changes to university fees.

Unfortunately that wasn't the bill before the upper house.

The Senate was debating the Australian Education Amendment Bill - minor legislation that provides a small boost in funding for indigenous boarding schools and closes loopholes in education policy.

Legislation to change university fees isn't on the Senate schedule for Tuesday.

After a Liberal senator noted the mistake, acting deputy Senate president Cory Bernardi politely pointed out the error to Senator Lambie.

She ignored him briefly and continued, seemingly confused by what was going on - but soon sat down.

The mistake won't affect the way she votes.

The Tasmanian senator has vowed to vote against all government legislation until a defence force pay deal is reconsidered.

The move has put her at odds with PUP leader Clive Palmer who has labelled her a "drama queen".

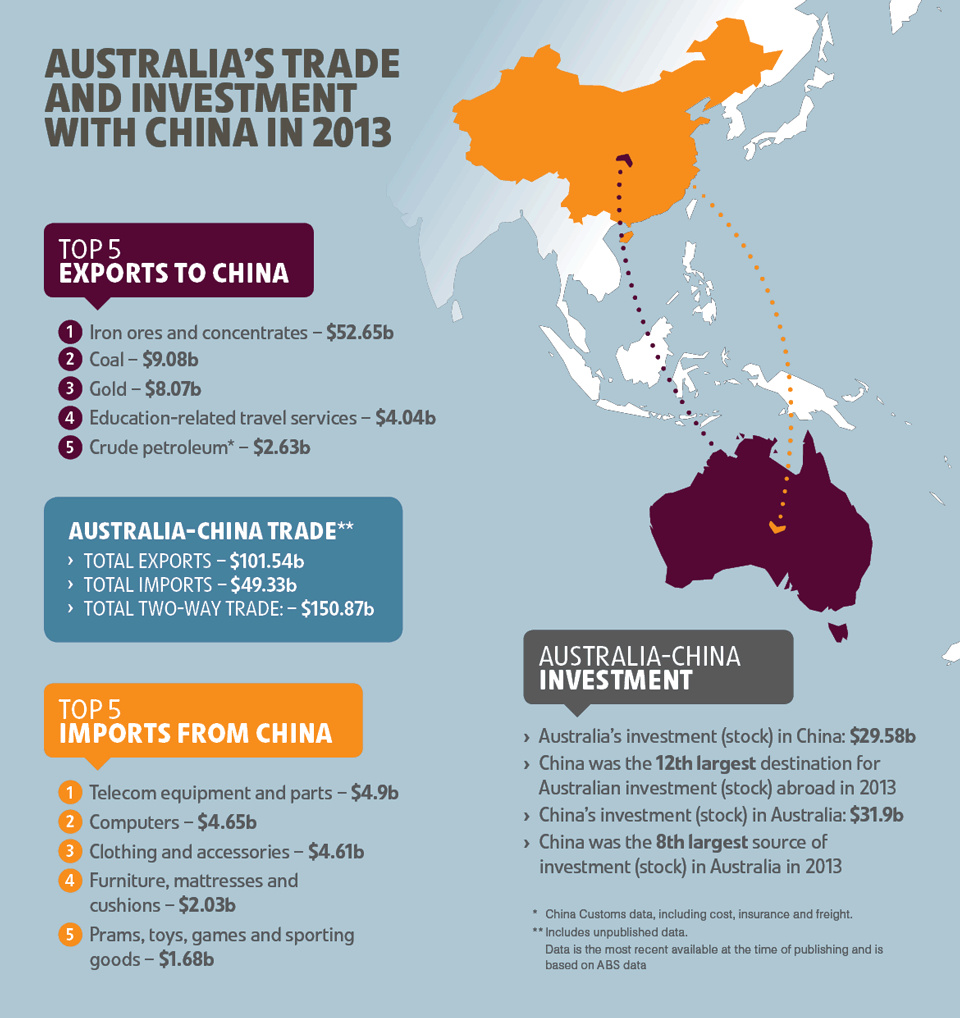

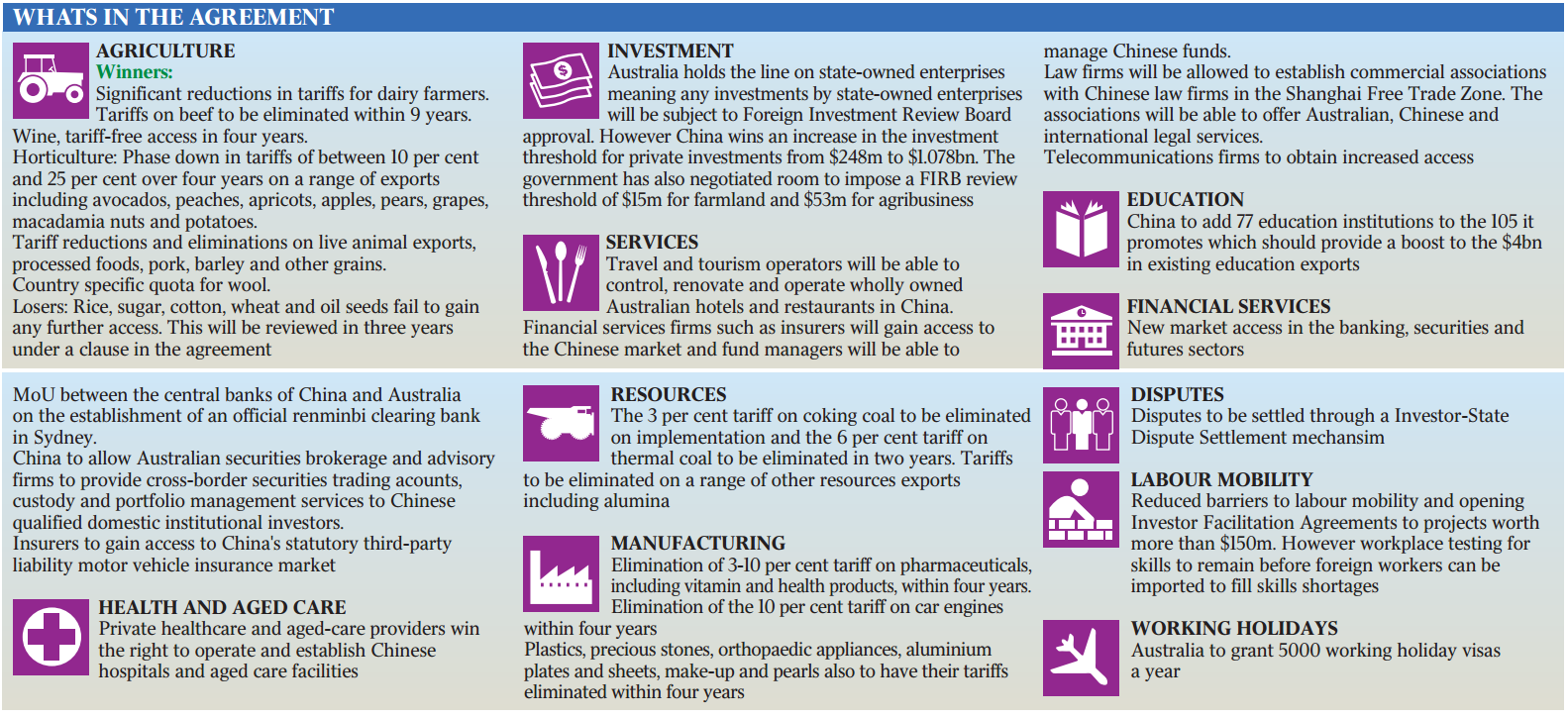

2.05pm - Three graphics that explain everything you need to know about the China-Australia FTA

How big is Australia's trade relationship with China? There's a graphic for that.

The consumer benefits of the deal? Well, Trade Minister Andrew Robb's Twitter account has that covered.

— Andrew Robb (@AndrewRobbMP) November 17, 2014And if you are looking for something a little more detailed, here's a comprehensive graphic from The Australian.

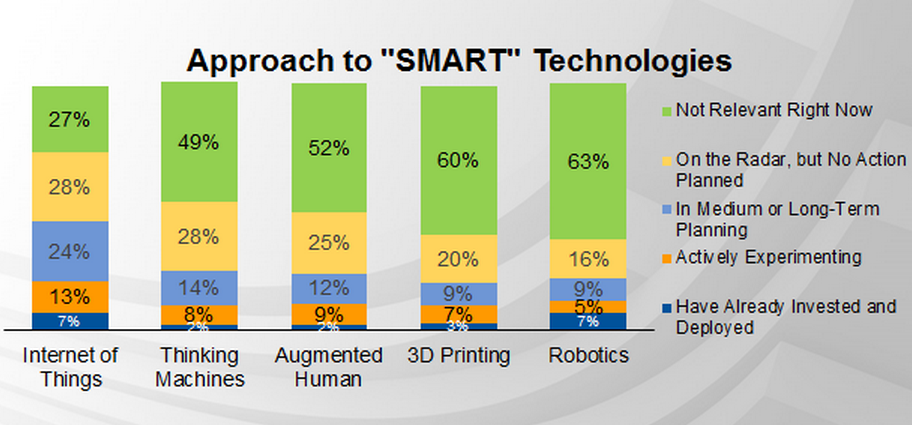

12.50pm - Don't fear: executives believe the robotics revolution is still a while away

Hold your horses, ASIMO. Image: AAP

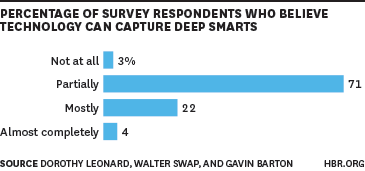

Scared that robots will one day steal your job? It may still be a while off. Here are some sobering graphs from Gartner and a study published in the Harvard Business Review.

First up, here's how many companies are considering robotics and other future technology projects. It's from Gartner's annual CIO survey, which polls over 2800 CIOs and executives from around the globe.

And here's a chart from a study published in the Harvard Business Review. Researchers polled CIO, CEOs and HR managers on their views on artificial intelligence. They asked whether they believed robots could currently replace an employee's ‘deep smarts' or their experienced-based knowledge.

12.40pm - CLSA's 'most hated' Aussie stocks

By David Rogers, BusinessNow

In the spirit of The Grinch who stole Christmas, CLSA's equities sales desk has come up with a list of the “most hated” stocks in the Australian sharemarket, based on their analyst feedback and quantitative work.

Within that list, the most hated stocks based on sell side recommendations are: Cochlear, Leighton Holdings, Charter Hall Retail REIT, Sigma Pharmaceuticals, Monadelphous, Cabcharge, Novion Property, BWP Trust, Metcash, and Ten, while the most hated stocks based on those with the biggest discount to their five-year historical PE relativity to the market, are: Monadelphous, Metcash, ALS Ltd, Myer, Woodside, SCA Property, Newcrest Mining, Evolution Mining, Ansell, Trade Me, Computershare & SAI Global.

CLSA also notes the most shorted stocks as Charter Hall Retail, Sigma Pharmaceuticals, Monadelphous, Cabcharge, BWP Trust, Metcash, Coca-Cola Amatil, UGL, Atlas Iron, GrainCorp, Cromwell Group, Pacific Brands, Spark New Zealand, Evolution Mining, Trade Me, Mount Gibson, TPG Telecom, InvoCare, Bega Cheese, Woolworths.

While there isn't much light at the end of the tunnel for sectors such as small cap resources and mining services, some of the best bargains are the among the most beaten up stocks.

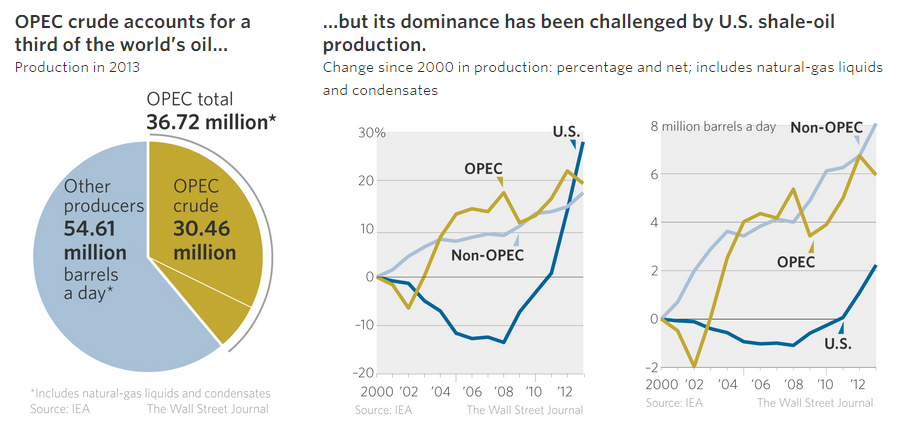

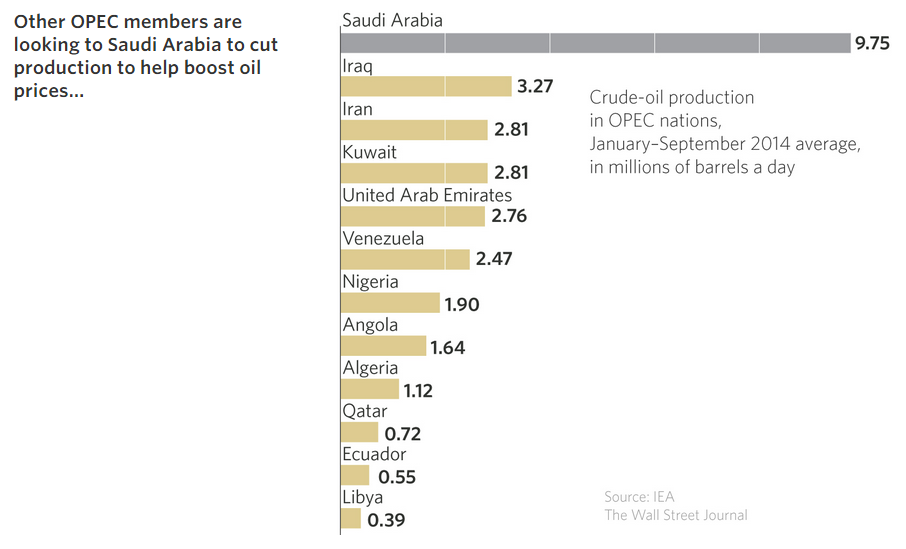

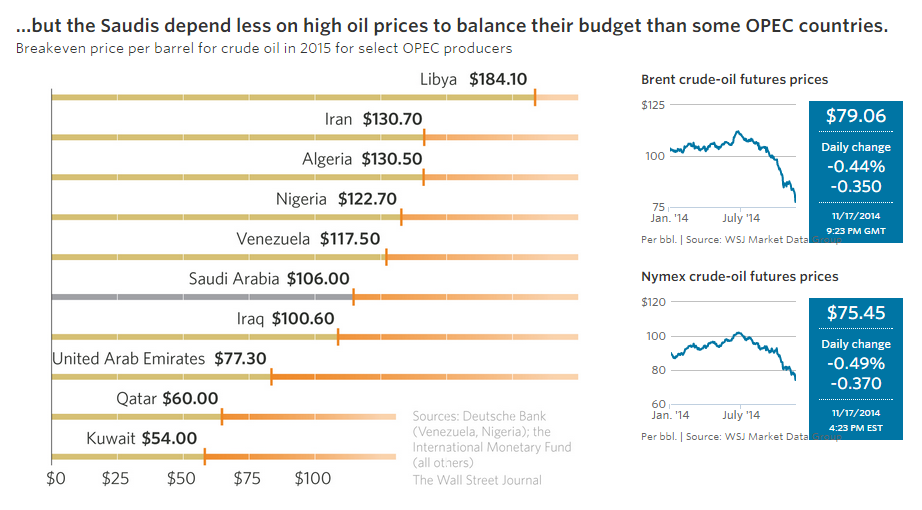

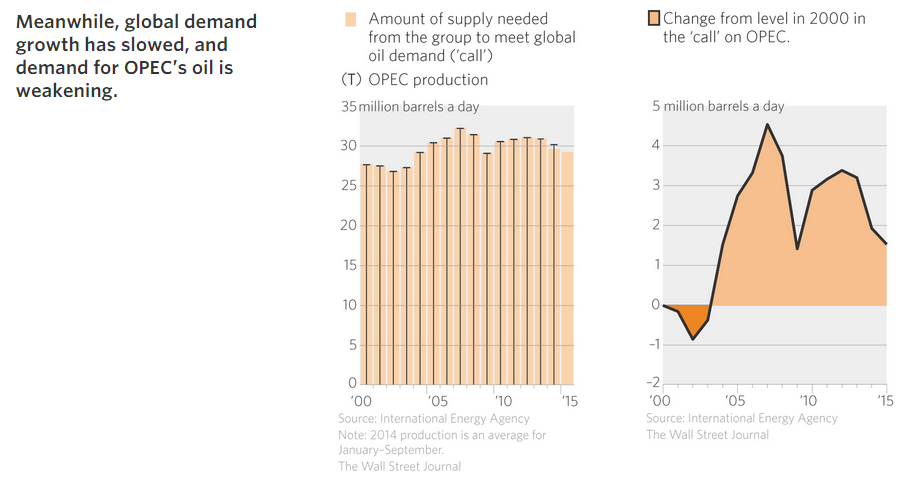

10.40am - OPEC's oil dilemma, in charts

By Pat Minczeski and Sarah Kent - WSJ

These charts first appeared in The Wall Street Journal, read the full story here.

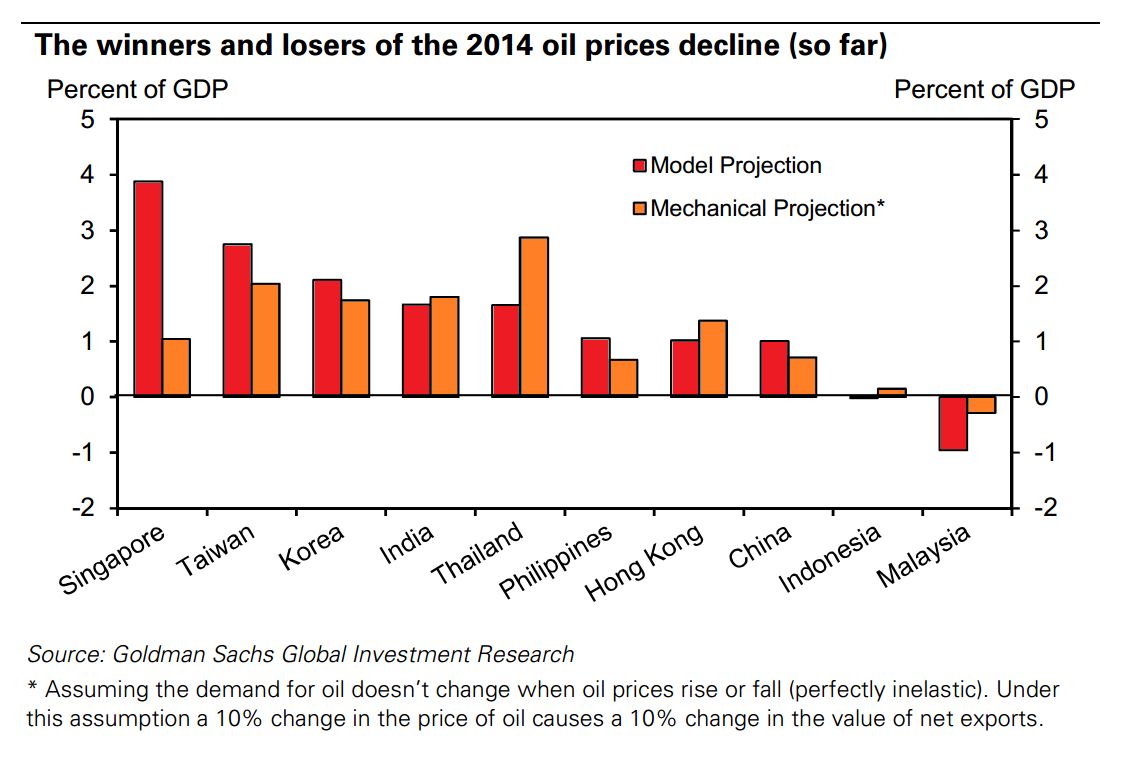

Also, a bonus graph from today's Goldman Sachs research. The APAC winners and losers from falling price of oil.

10.30am - The best representation of Australia's obsession with China

Here are today's newspapers.

And here's a snap of the crowd at Indian Prime Minister Narendra Modi's first public address in Australia at Sydney's Allphones Arena.

Despite the event drawing a reported 250 accredited media and a crowd of 20,000 people from all around the country, it garnered little attention from the media.

In a wide-ranging, hour-long speech covering everything from cricket to economic growth, Modi said he wanted to boost tourism to India, and wanted make it easier for Australians to attain an Indian visa. This would be a huge boon, given the growing economic opportunities in the country's ongoing quest to raise living standards.

Australia's free trade agreement with China is big news. But the way it has been splashed across the press today is a clear representation of our myopic obsession with China, which could come at the expense of other major players in the region.

While we have long lauded China's economic supremacy, India, for instance, is showing impressive growth. Earlier this month, Morgan Stanley forecast India's GDP growth in 2015 at 6.3 per cent, up from 5.3 per cent this year.

Australia is wedged between several emerging economic superpowers, including India and perhaps even Indonesia. Keeping an open mind, rather than focusing on one country at the expense of another, will be the real key to our future prosperity.

9.10am - Interesting reads from around the web

It's not all about gender equality: The financial reasoning behind why Australian business needs another Gail Kelly.

The science behind why you don't trust the science: Cult psychology and how it's filtering into the climate change debate.

Prepare to feel inadequate: Meet the 18-year-old genius who started a hedge fund from his dorm room.

A disruptive disconnect: The phone call isn't dead yet, but it's certainly in the process of dying out.

Not the future of journalism: As a cost cutting measure, reporters at a local paper in the US are being asked to write the paper during the week and then hand-deliver it on weekends.