The Ticker: Modern business life

On today's blog:

- CEO Tim Cook tackles all of those burning Apple questions at #WSJDLive

- The 23 countries that are beating Australia at gender equality

- One graph on why we should all expect petrol prices to fall, not rise

- Forget automation, we could improve productivity if we just held better meetings

- ANZ shares due to resume trading after halt and accidental results leak

- Meet the windowless planes of the future

- Interesting reads from around the web

Got something you would like to add to the blog? Email (harrison.polites@businessspectator.com.au) or get in touch on Twitter.

2.50pm - CEO Tim Cook tackles all of those burning Apple questions at #WSJDLive

Apple CEO Tim Cook is still talking at the event. Tune into BusinessNow for live coverage, otherwise here are some highlights.

On the prospects of creating an Apple TV set:

Tim Cook: There's a lot to do in TV because the 'interface is 30 years old.'Not saying what Apple is up to though. #Apple #WSJDLive

— Connie Guglielmo (@techledes) October 28, 2014When asked what Apple will do with TV, Cook was coy. "I believe something great can be done." #WSJDLive

— Nickleback Lee (@nicole) October 28, 2014"You go in your living room and step back in time... What we will do I won't be so clear on," Cook says about Apple's TV plans. #WSJDLive

— Joanna Stern (@JoannaStern) October 28, 2014On Apple Pay and the rebellion US retailers are holding against it:

"In the first 72 hours after launch, Apple Pay already has had more than 1,000,000 activations." Tim Cook at #WSJDLive

— Bill Gross (@Bill_Gross) October 28, 2014Apple Pay is in "a skirmish" with retailers like CVS pulling out, says Cook. But the "early ramp looks fantastic." #WSJDLive

— Geoffrey Fowler (@geoffreyfowler) October 28, 2014Cook says he and Jack Ma "are going to talk about getting married later this week" ... for Apple Pay and Alipay. #WSJDLive

— Geoffrey Fowler (@geoffreyfowler) October 28, 2014On the Apple Watch (and its battery life):

Apple's Tim Cook says the "watch is profound." Excited about new constituencies looking at it -- health, fashion. #Apple #WSJDLive

— Connie Guglielmo (@techledes) October 28, 2014The Apple Watch battery question. " "You're going to wind up charging it daily,” Cook admits. #WSJDLive

— Brian Allen (@brianallen2014) October 28, 2014On the end of the iPod:

Interesting - @tim_cook said classic 160gb iPod was discontinued, because it couldn't get the parts anymore. #WSJDLive

— Daisuke Wakabayashi (@daiwaka) October 28, 2014And on privacy:

“We're designing a Fort Knox kind of thing and users don't want us to have the data either.” @tim_cook on apple's view on privacy #WSJDLive

— Daisuke Wakabayashi (@daiwaka) October 28, 20142.15pm - The 23 countries that are beating Australia at gender equality

We found this data in today's global gender index from the World Economic Forum. We're being let down on two fronts: equal opportunity at work (including wage inequality) and also political opportunities for women.

What's worse, Australia has actually tracked backwards since 2006, when we ranked 15th in the world. You can see the data in the interactive map from the WEF below.

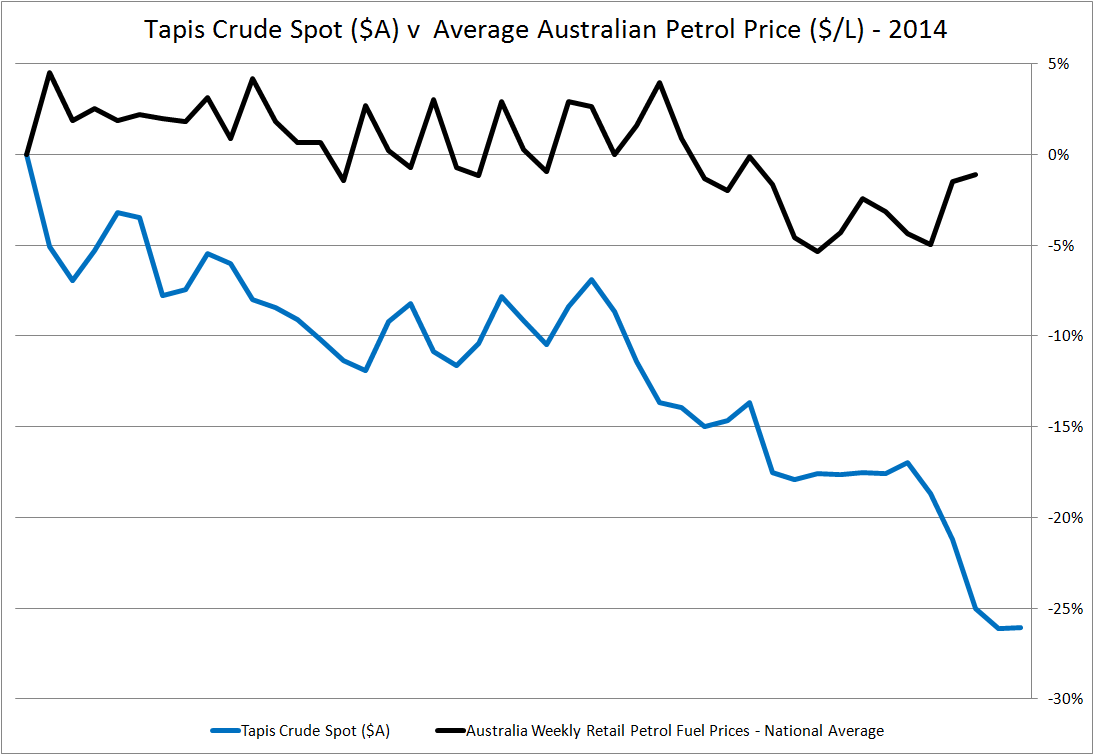

12.45pm - One graph on why we should all expect petrol prices to fall, not rise

We've featured this petrol graph from market strategist David Scutt before, but it's suddenly more relevant given the government's latest announcement about petrol.

The government is set to increase the fuel excise on November 10 from 38.143 cents to 38.6 cents. This, in turn, is expected to lift national petrol prices. If the price hike is purely based off the tax rise -- a 1.1 per cent increase -- then you should barely notice it.

As Scutt's graph shows, the decline in global oil prices has had very little impact on Australia's petrol pump prices. So it's worth questioning whether petrol companies will play this tax the other way, and come November 10, increase bowser prices beyond the 1.1 per cent increase mandated by the government.

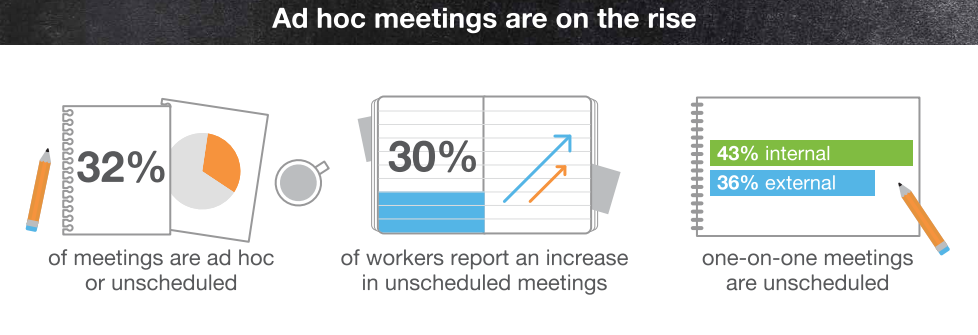

11.40am - Forget automation, we could improve productivity if we just held better meetings

A new global study by analyst firm Ovum and IT services firm LogMein has identified a new culprit for Australia's productivity woes: poor meeting practices. According to the study, we endure useless meetings that often run late and achieve little in terms of tangible outcomes.

The solution? Well, according to Andy Farquharson, the Asia Pacific VP at LogMeIn, Australian businesses would be better served by holding more targeted ad hoc meetings. Which, oddly enough, are also on the rise.

Sound familiar? Both ad-hoc and stand-up meetings have become all the rage across the Australian IT sector as more and more teams adopt what is known as an agile work methodology. It's just another way that the IT industry is having a flow-on impact on the rest of business.

9.50am - ANZ shares due to resume trading after halt and accidental results leak

By David Rogers, BusinessNow

ANZ shares are due to resume trading today after a brief trading halt late yesterday when the company realised it Excel result template late Friday contained numbers from its FY14 result. While the actual results were blank, growth rates on the template allowed FY14 Cash NPAT and divisional results to be determined.

UBS analyst Jonathan Mott says ANZ's growth rates imply FY14 Cash NPAT of $7.11-$7.14 billion, about 1 per cent above consensus. Australian NZ banking divisions did well, with respective growth rates 2.5 per cent and 4.5 per cent above UBS estimates, Mr Mott adds.

UBS has a buy rating at $A34.30 target, based on the view that ANZ is not expensive, on a FY15 PER of 12.6 times.

“However, the payback from its Asian expansion continues to disappoint in an environment of ultra-low rates, excessive liquidity and low volatility,” Mr. Mott cautions. “Until this environment changes we do not believe ANZ will be able to achieve its started targets.”

He says ANZ must choose between slowing its Asian growth to reduce capital utilisation and return on equity drag, or move its dividend payout ratio down towards 60 per cent to improve organic capital generation and accept lower returns until the environment improves.

9.20am - Meet the windowless planes of the future

Overnight, the Centre for Process Innovation in the UK launched a new design for planes that reduce weight, increase fuel efficiency and abolish windows. That's right; these new planes will have no windows.

Instead of windows, the walls of the fuselage will be covered with an organic light emitting diode (OLED) screen. You can watch the group's video explaining the new planes below. It tipped they could be in the air in less than ten years.

This is big news both for Australia and the aviation industry. Air travel both in and out of Australia has boomed since the 1950s.

Though given the tough times being facing the global aviation sector, one can't help but think that this tweet about the news makes a very good point.

“we'll be right back after this important message” MT @BENT_TALK: @darth @qz I see airlines selling ad space pic.twitter.com/iCtUfwzt5h

— darth™ (@darth) October 27, 20149am - Interesting reads from around the web

Beyond Watson: Here are the three technologies that have helped us unlock the potential of artificial intelligence.

Why Amazon is doing the world a favour by crushing book publishers. Thanks to the tech giant, both writers and readers will be better off.

The worst kind of innovation. New speed cameras in 40km and 50km zones have proven to be a massive fine windfall for the Victorian state government.

Why stock ownership is becoming another indicator of wealth inequality. Owning shares isn't just for the rich, but it's trending that way.

The two trends that could eventually topple Google. It seems that the company that lives and breathes information has a communication problem.