The super threat in MYEFO

Summary: The Mid-year Economic and Fiscal Outlook shows the Government does not plan to cut spending. This makes it more likely that it will focus on further revenue collection in coming years. It will be very tempting for the Government to turn to easy revenue options. |

Key take-out: Investors should not be alarmed, but keep an eye on commentators' calls for an end to tax concessions on compulsory super or changes to capital gains tax exemptions. |

Key beneficiaries: General investors. Category: Economy, superannuation and tax. |

A lot of the press on the Government's mid-year review is extremely dire. Needlessly so. On that view, the budget deficit has blown out and this is the direct result of a weakening economy – the slumping terms of trade. That this comes at a time the share market is down 9% from this year's high reached on September 3, 2014, and is down 3.3% since early January, just adds to the sense of foreboding.

Fortunately, this isn't what the review actually shows. The budget deficit is blowing out, certainly, yet this has got nothing to do with a sustained shortfall in revenues from the terms of trade.

Firstly, about 70% of the decline in the terms of trade to date had occurred by the end of the 2012 fiscal year – two years ago. Despite this, revenue growth was 9% in that year, followed by 6.5% the following year. The one off exception was 2013-14 – but on the balance of probabilities I think that's an outlier. Revenue growth will continue to be strong in the future. The reason 2013-14 revenue growth is a one-off is that there was a lot of volatility around the change in government. It's unlikely that this volatility was due to the changing economic backdrop as the underlying economy remained solid – unchanged.

It's more likely that any softness in reported revenues for that year was largely the result of the election cycle. That is, it would be standard procedure for a new government to front load expenses into the current year so they can blame the previous government and then delay revenues into the next so they can take credit. That's not a political statement, they all do it – but as investors we just need to be aware of it – and I don't think we can take those numbers seriously.

In any case, that one year doesn't change the fact that revenue growth was very strong in the three years prior. A surplus was easily achievable over that period. The problem is and was – spending. There has been no attempt made at correcting the post-GFC spending splurge and, consequently, the country now runs deficits and is accumulating debt. Unfortunately this government has acknowledged that they aren't going to do anything about that. That is they're not planning to cut spending because – and while they noted the economy was solid – they still didn't think the economy could handle it.

Now as much as I think that is bad policy, the fact is that's a fairly begin program for investors. Modest budget deficits for the foreseeable future, with little scope of spending cuts, against a backdrop of trend to above trend growth. All very friendly for the share and property markets from a macro perspective – rates are unlikely to go higher any time soon and there will be no spending cuts. Just don't be concerned about a slump in government revenues from the collapse in the terms of trade. It simply isn't happening that way.

Indeed the official view is that growth will accelerate over next two years as non-mining expansion picks up – although admittedly they are still forecasting trend growth. Not an aggressive acceleration. But overall, since the GFC, growth has been little different from trend.

That's not to say that there aren't some alarm bells ringing though. The fact that the government has given up on spending restraint makes it more likely that the focus, in coming years, will be on further revenue collection. Unfortunately this is where things could get nasty.

The mid-year review outlines where the Department of Treasury and the bureaucracy more generally feel they are “losing” money.

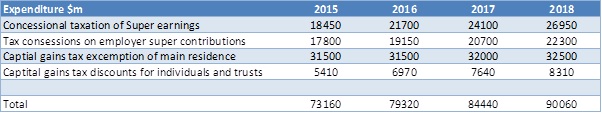

Table 1: Treasury's estimate of ‘Tax Expenditures'

More specifically, “Tax expenditures provide a benefit to a specified activity or class of taxpayer. They can be delivered as a tax exemption, tax deduction, tax offset, reduced tax rate or deferral of tax liability.”

Now I don't want to misrepresent what the above table is about. These estimates get published regularly and so there is nothing new in what this review has done. Yet I can't help but think that there will be a renewed focus on these items, given the substantial amounts of money that are “spent” on them and the inability of the government to restrain spending. It would be very tempting for the government, too afraid to cut spending, to turn to easy revenue options. Especially when they know they are more likely to gain Senate support.

I've already seen a number of commentators in the press advocate just that – demanding that tax concessions on compulsory super end. But what's next? Capital gains tax exemptions? Of course it would be means tested. Values over $1 million perhaps, or death taxes? And of course we already hear repeated demands that negative gearing should be put to rest – how long till the rate of capital gains tax on investment is increased?

Investors shouldn't be alarmed about it at this stage, but it needs watching. Politicians on both sides are simply too weak to restrain spending. That means the only other alternative is to lift taxes.