The New ETFs: Exposure to Fintech, Blockchain & Crypto

Fintech, blockchain and Decentralised Finance (“DeFI”) are some of the hottest themes amongst both retail and institutional investors looking for outsized growth opportunities. But most of the largest and/or fastest-growing companies in these markets are listed outside of Australia making it hard for investors, particularly retail investors, to tap into the growth.

ETF Securities aims to address this opportunity with a new exchange traded fund, the Fintech and Blockchain ETF (CHX: FTEC), which started on the Chi-x exchange in mid-October. This is the first of such ETFs that will broaden the range available to investors in Australia. Betashares recently announced that it also plans to issue an ETF focused on the blockchain space.

Investors wanting crypto exposure without the headache of self-custody, wallets and addresses can do so in part via FTEC. FTEC is currently the simplest way for investors to get some exposure to the crypto sub-theme in a locally-listed vehicle. Bear in mind, however, that FTEC is not a pure play crypto fund.

FTEC mirrors the constituents of the indXX Developed Markets Fintech & DeFi Index which comprises 75 companies equally weighted across nine sub-themes, with each sub-theme allowing up to 10 companies except the DeFI category, which permits up to 20. The sub-themes are:

- Digital Payments (eg. Visa, MasterCard, Paypal, Western Union).

- Trading and Capital Markets (eg. Interactive Brokers, London Stock Exchange).

- Financial Data Provider and Analyzer (eg. S&P, Gartner, Moody’s).

- Point-of-Sale (POS) (eg. Adyen, Global Payments).

- Personal Finance Software (eg. Xero).

- Tax Compliance Software and Backend Payment Processing (eg. H&R Block, Wolters Kluwer, Fiserv).

- Decentralized Finance (eg. Coinbase, Marathon Digital, Galaxy Digital).

- Financial Enterprise Solutions. (eg. Equifax, Experian)

- Peer-to-Peer Lending and Crowdfunding (eg. Lendingclub, Affirm).

To be considered, companies must have a market cap of at least $US500 million, a six-month average daily turnover greater than or equal to $US2 million and be traded on 90 per cent of the eligible trading days for the six months prior to selection. Exceptions are made for large cap IPOs such as Coinbase whose market cap is greater than half of the existing constituents as of the selection date.

This structure means that FTEC’s performance ultimately derives from the selection criteria and methodology devised and maintained by indXX. indXX is an established and credentialed provider of index solutions for ETF issuers and other investment management participants and employs a research-intensive approach to index creation.

Kanish Chugh, ETFS’ Head of Distribution, said that indXX’s Developed Markets Fintech & DeFi Index was attractive because of its broad diversification across the various sub-themes as well as its selection methodology, which classifies companies based on primary revenue deriving from the relevant sub-theme.

To illustrate, Tesla is excluded even though it accepts Bitcoin for payment and holds around $US2.5 billion of Bitcoin on its balance sheet, whereas Coinbase is a “purer” exposure to the DeFI space as a provider of crypto exchange services.

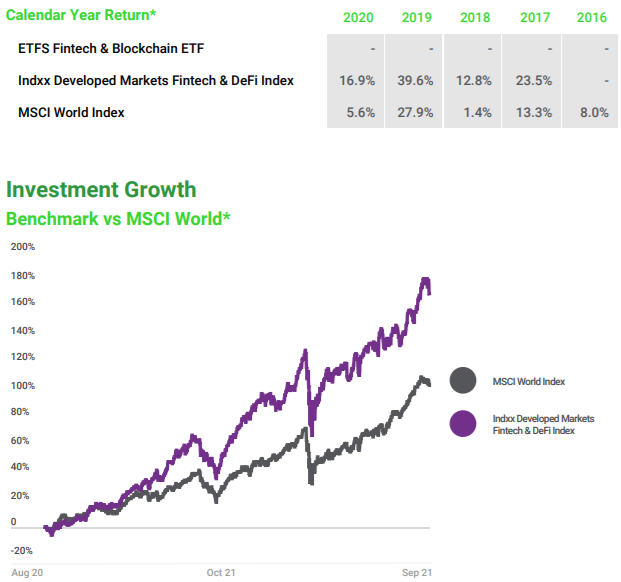

Reflecting the high growth of the Fintech, blockchain and DeFI space, the indXX Developed Markets Fintech & DeFi index has achieved an annualised return of over 21 per cent since its inception in 2016, and performed well against the MSCI World Index:

Source: https://www.etfsecurities.com.au/documents/factsheet/ftec.pdf

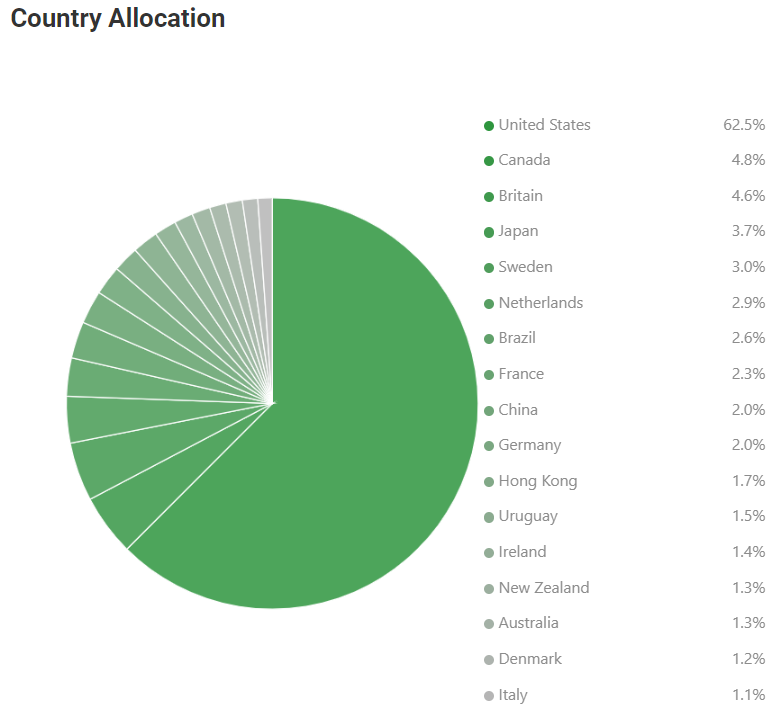

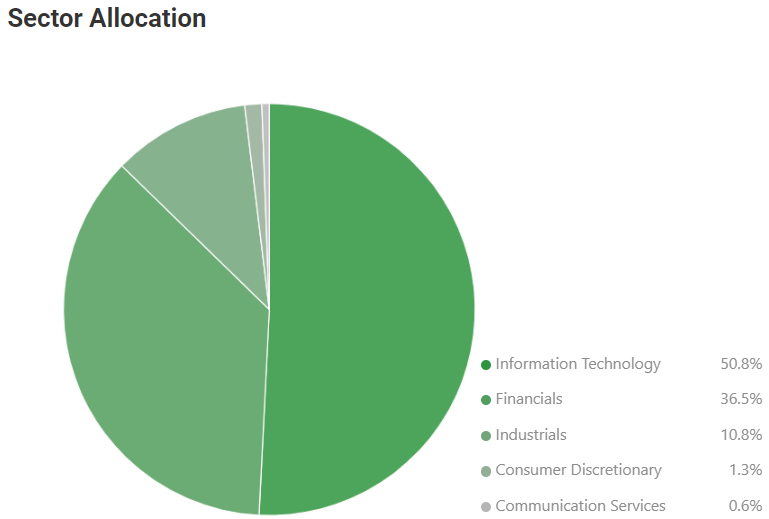

As of writing, 62 per cent of the fund constituents are US companies, with the remainder spread across European and Asian markets (plus Brazil). Half of the fund constituents are information technology companies and over a third are classified as financial services.

The fund is broadly diversified, with businesses as varied as Visa, Xero and Gartner all classified as Information Technology companies. The idea is that this variety will reduce volatility while optimising returns from its large cap, higher-growth constituents. Chugh said this was one of the factors that led ETFS to offer FTEC rather than a pure play ETF focused on blockchain and crypto more specifically.

FTEC provides investors with a cost-effective (0.69 per cent pa), diversified exposure to nine sub-themes whose constituents will benefit from or are directly the cause of disruption.

Long-established behemoths like Visa and MasterCard will continue to benefit from the ongoing digitalisation of payments while simultaneously fending off newer payments disrupters like Square and Adyen.

DeFI and blockchain are well represented by the likes of Coinbase, Marathon Digital, Galaxy Digital and Riot Blockchain who will all benefit as trade volumes and market cap of digital assets and crypto continue to explode.

Meantime, the forthcoming BetaShares Crypto Innovators ETF (ASX: CRYP) aims to "provide investors with exposure to a portfolio of global companies at the forefront of the rapidly emerging crypto economy".

CRYP will be issued on the ASX and track the Bitwise Crypto Industry Innovators Index developed by Bitwise, one of the largest global crypto-asset managers. We’ll look at this in more depth in the near future.

ETF Securities chose the Chi-x exchange to list FTEC for a host of reasons, including the fact it was quicker to market and cost efficient. Chi-x is well served by brokers and a complete list of trading participants can be found here.

In the US, ProShares Bitcoin Strategy ETF recently debuted on Intercontinental Exchange Inc's (ICE.N) NYSE Arca exchange under the ticker BITO. This is the first Bitcoin-related ETF approved by the SEC in the US, althought it is a Bitcoin futures ETF and not a "spot" Bitcoin ETF.

Other Bitcoin-related ETFs are expected to obtain approval in the near term on US exchanges. These managed products have been widely anticipated by the crypto community and hopes are high that they will see significant inflows which could drive Bitcoin's price substantially higher.

Fintech, blockchain and DeFI are all significant market trends with a strong tailwind and propulsive network effects. Products like FTEC provide a way for local investors to get on the train and, hopefully, to enjoy the ride.

Frequently Asked Questions about this Article…

The ETFS Fintech & Blockchain ETF (ASX:FTEC) is an exchange-traded fund that provides investors with exposure to a diversified portfolio of companies involved in fintech, blockchain, and decentralized finance (DeFI). It mirrors the indXX Developed Markets Fintech & DeFi Index, which includes 75 companies across nine sub-themes, such as digital payments and decentralized finance. This ETF allows investors to gain exposure to these high-growth sectors without directly managing crypto assets.

The BetaShares Crypto Innovators ETF (ASX:CRYP) focuses specifically on companies at the forefront of the crypto economy, tracking the Bitwise Crypto Industry Innovators Index. In contrast, FTEC offers broader exposure to fintech and blockchain sectors, including digital payments and DeFI, not just crypto innovators. CRYP is more targeted towards the crypto industry, while FTEC provides a diversified approach across multiple financial technology themes.

Investors might consider ETFs like FTEC for exposure to fintech and blockchain because they offer a cost-effective and diversified way to invest in these rapidly growing sectors. FTEC includes a range of companies across various sub-themes, reducing volatility and optimizing returns. It allows investors to benefit from the digitalization of payments and the growth of DeFI without the complexities of directly managing crypto assets.

The FTEC ETF includes nine main sub-themes: Digital Payments, Trading and Capital Markets, Financial Data Provider and Analyzer, Point-of-Sale (POS), Personal Finance Software, Tax Compliance Software and Backend Payment Processing, Decentralized Finance (DeFI), Financial Enterprise Solutions, and Peer-to-Peer Lending and Crowdfunding. These sub-themes encompass a wide range of companies benefiting from or driving disruption in the fintech and blockchain sectors.

The performance of FTEC is influenced by the indXX Developed Markets Fintech & DeFi Index, which it mirrors. This index is known for its broad diversification and rigorous selection methodology, focusing on companies with primary revenue from fintech and DeFI sub-themes. The index has achieved an annualized return of over 21% since 2016, reflecting the high growth potential of the sectors it covers. FTEC's performance is directly tied to the success of the companies within this index.