The hard sell on succession

Passing a family business from one generation to the next is rarely easy, and it seems many businesses are putting succession in the too-hard basket.

An extensive global report on succession, released this week by business advisory firm Pitcher Partners and the Swinburne University of Technology, has found that selling out of the family business was a key consideration for around 80 per cent of the Australian businesses surveyed that had not commenced a succession process.

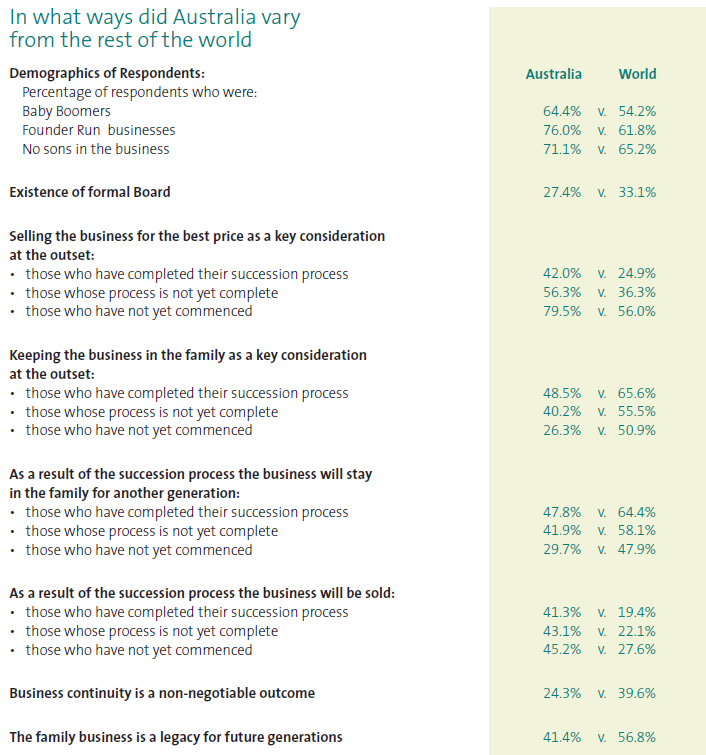

Entitled Succession Reset: Family Business Succession in the 21st Century Report 2014, the study also found that selling out was a key consideration for 42 per cent of Australian businesses that actually had completed their succession process, compared to an average of 24.9 per cent in other countries. In addition, 56.3 per cent of Australian businesses surveyed whose succession process was not yet complete said that selling was a key consideration, compared to 36.3 per cent in other countries.

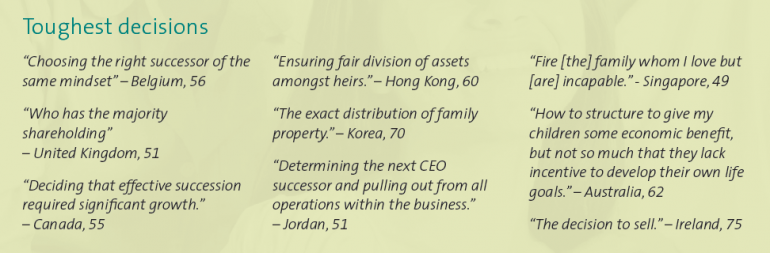

One of the prime reasons often cited by family business owners considering selling out is that the fair distribution of assets to members of the next generation is a major challenge.

The study, which involved more than 2,650 people in 56 countries and was undertaken over four years, also found that children are often being encouraged to follow their own dreams without any overt pressure to join the family business.

What was clearly evident from the survey was that Australia's baby boomers are generally unprepared for succession. In fact, more than 80 per cent of the people surveyed in this age group admitted they do not have a succession plan at this point.

“They need to understand that succession is an ongoing process, not an event,” said Swinburne's Professor Michael Gilding, who led the research efforts for the report. “There is a small window of opportunity to get the message out there for baby boomers.”

The report was launched by the federal Small Business Minister Bruce Billson.

“Families who have moved seamlessly to next generation ownership tell us the process can take a decade,” said Family Business Australia chief executive Robin Buckham. “There are many factors at play: the incumbent generation must have something to retire to, not just from, so that they get out of their children's way, and the next generation need to be ready, willing and able to take over.

“Next genners have to feel entranced by the business opportunity ahead of them, not entrapped by it, and be filled with enthusiasm, not obligation.”

Richard Shrapnel, Pitcher Partners partner and executive director, said the family business sector was experiencing a generational shift and, if this transition was not handled well, the economic impact would be significant.

“In this new era of succession there is significantly more uncertainty and complexity,” Dr Shrapnel said. “The skills required of the incumbent generation to transition their business effectively are far greater than ever before.”

Dr Shrapnel noted that would-be successors were more likely to be university educated with broader career choices or were deterred by the hard work involved in proprietorship. “Or it could be because we are a young nation and we don't have examples of business being transferred across 10 generations.''

Whatever the case, he said, proprietors were leaving the succession “conversation” far too late.

Globally, 69 per cent of respondents concurred that their first-born son was not the natural leader of the business. In Australia, 77 per cent of proprietors said they had no daughters in the business, compared with 80.9 per cent for the rest of the world. But 71 per cent of local businesses did not have a son on the payroll, either.

“Age and gender bias are still evident but much weaker than they have been historically and almost without exception there is an understanding that daughters are potential successors in the business,'' the report says.

Dr Shrapnel said there was also an increased willingness to involve extended family members such as cousins and sons-in-law.

He warned that proprietors without a plan risked eroding the value of their business, because a flood of boomers in their late 60s and early 70s were due to retire from 2020.

"There's a risk there may not be a market for their business or they will not achieve the full capital value," he said.

Also read, Succession is still a taxing issue.