The fuel excise is a 'carbon tax on steroids'

Prime Minister Tony Abbott is right to say that the 38 cents per litre fuel excise acts “as a carbon price signal” and is effectively a “carbon tax on steroids”.

But Greens leader Christine Milne is wrong to say, as she did on Insiders on Sunday, that the fuel excise is not a carbon price signal because:

"...it’s attached to putting all of that money into more roads to create more congestion with cars that are some of the most polluting on the planet because we don’t have efficiency standards."

Mr Abbott’s claim is jaw-droppingly hypocritical and politically amateurish given his government is intent on rolling-back Labor’s carbon tax, as well as restoring indexation of the fuel excise.

Not surprisingly, Labor’s transport spokesperson Anthony Albanese was quick to pull him up:

"He’s railed about a price on carbon wrecking the economy, now he’s conceded that his big new petrol tax is just that – it’s a carbon tax on steroids."

But however embarrassing it might be for him, Mr Abbott’s description is right. As I noted back in March 2012 (see What did abolition of petrol excise indexation cost?), the Productivity Commission says the excise on petrol effectively operates like a carbon tax, deterring people from driving.

CSIRO calculated the excise would’ve increased to around 50 cents per litre by that time if indexation by the CPI had not been abolished by the Howard government. It estimated the “missing” 12 cents per litre was equivalent to a carbon tax of $50 per tonne (see Will a carbon tax double the price of petrol?).

The fuel excise is a significant deterrent to driving. At present, it adds about 4 cents per kilometre to the cost of running the average car, or around $600 per year.

The additional cost makes driving less attractive. It encourages motorists to travel fewer kilometres, shift to more fuel-efficient vehicles, or use alternative modes like public transport or walking.

Although its primary purpose is simply to raise revenue, the fuel excise nevertheless also claws back some of the social costs like pollution that motorists impose on others.

While there are better or poorer ways that revenue can be spent, how it’s applied or misapplied does not detract from the efficacy of the fuel excise as a price signal.

The former Labor government understood this. It didn’t spend the revenue from its carbon tax on measures to improve sustainability; it gave it back to the electorate as compensation.

Ms Milne’s claim the government is “putting all that money into more roads” is also wrong, or at best it’s misleading. I think it’s unfortunate the government has resorted to hypothecation to sell indexation, but it’s only proposing to tie the incremental net revenue from indexation to roads, not the much larger $0.38 base tax as Ms Milne seems to imply. Indexation will increase the excise by 1 cent per litre over each of the first four years.

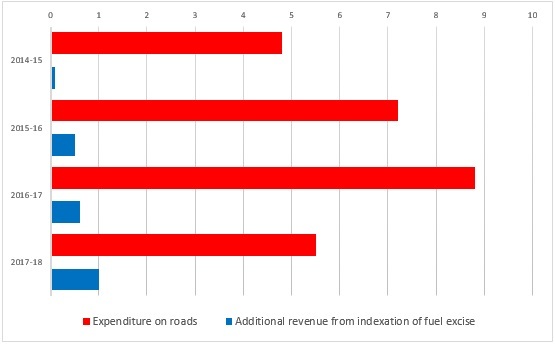

Figure 1: Expected revenue from indexation of fuel excise compared to planned Commonwealth expenditure on roads

Source: Budget 2014-15 Building Australia's Infrastructure

Also, as I noted recently (see Is Labor right to oppose indexation of fuel excise?), the promised hypothecation will make no real material difference. The government proposes to spend much more on roads over the next four years than the extra $2.2 billion it expects to get from indexation over this period (see graph above).

Mr Albanese’s reference to the government’s “big new petrol tax” is also misleading. Restoring indexation is not creating a new tax; it’s purpose is simply to maintain the real value of an existing tax.

I think Ms Milne is right to say the Abbott Government ought to be taking firm action to raise fuel efficiency standards and ought to be spending more on public transport. But she should recognise that indexation is a vital part of the same agenda and shouldn’t be made conditional on how the proceeds are spent.

In fact all sides should get off the hypothecation bandwagon – whether for roads or PT – and continue to treat the fuel excise as a flexible revenue source that’s available for all contingencies.

Originally published by Crikey. Reproduced with permission.