Term deposits going short

Summary: Cashed-up investors are gravitating towards shorter duration term deposits.

Key take-out: Three and six-month term deposits are proving popular.

A growing band of investors are shifting their cash into bank term deposits to shelter from the heightened stock market volatility and to hedge their bets on interest rates.

But, instead of locking their funds into multi-year fixed rate products, many are choosing short-maturity accounts ranging from just 90 days to six months. This provides an early exit point to divert funds back into the stock market, and provides an added option of investing in longer-term products if financial institutions finally start lifting their term deposit rates.

That's despite the Reserve Bank board last week choosing to keep the official cash rate on hold at 1.5 per cent for a record 22nd straight month.

Yet, it seems many investors are punting on higher returns in the medium term by steering away from two, three and five-year term deposit accounts, and instead locking in for three and six-month periods at rates ranging from 2.75 per cent to 2.82 per cent (market average 2.19 per cent).

A key attraction of term deposits, like other savings accounts, is that there is a Federal Government guarantee on deposits, up to a maximum of $250,000, should a financial institution fail.

According to data from the Australian Prudential Regulation Authority (APRA), around $20 billion flowed into term deposit accounts over the second half of 2017.

This took the total amount held in term deposits across Australian and foreign banks and other financial institutions to approximately $973.7 billion, with 80 per cent of that held in the major banks ($782.1 billion to be exact) as of the end of last year.

NAB General Manager of Transactional Products and Pricing, Shane Conway, says shorter maturity term deposits are gaining in popularity.

"We do see customers often feel more comfortable choosing a shorter term to match their individual needs – that's often because they want to be able to access their savings sooner. That's the benefit of term deposits – customers can choose how long they want to put their savings away for," Conway says.

Peter Gianniotis, Director of Business Development of Adelaide fintech company, the Term Deposit Shop isn't surprised by the large amount being held in term deposits, describing the current term deposit space as an easy-to-understand, vanilla product, and a “haven for volatility”.

“When markets are skittish, people dash and generally they will lock that cash away for a period of time depending on their perception on how long the volatility will last”, Gianniotis says. “Likewise, as a general comment, for portfolios that have asset allocations, normally a term deposit or cash weighting has a place in that, regardless of volatility.”

This type of investing is popular for SMSFs. According to data from Investment Trends, SMSFs are holding $170 billion in cash, including term deposits, representing 23 per cent of their total assets. A further 36 per cent is held in direct shares. Also read, Buffett's message to SMSF trustees.

So where are the best rates?

According to Gianniotis, three and six-month products are currently the most popular deposit time frames.

“That tells us that people may see longer terms increasing and they aren't prepared to lock away. And it also tells us that they perceive volatility in the next 3-6 months and want to see how the markets go,” Gianniotis says.

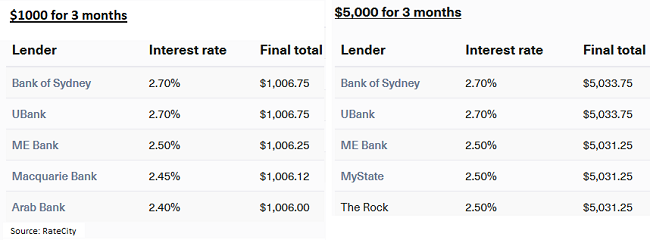

Meanwhile, according to rates comparison site RateCity, Bank of Sydney and UBank currently have the highest interest rates for three month term deposits, with interest rates of 2.7 per cent.

The table below shows the highest rates currently on offer for six and 12-month term deposits.

RateCity money editor, Sally Tindall, term deposit rates are now very similar to those on high-interest online savings accounts.

“The big question you have to ask yourself is whether it's worth locking up your money,” Tindall says. “If you're someone who finds it hard to resist spending, term deposits offer the ultimate security. Not only is there limited access to your investment, you have a guaranteed return.”

But investors also need to factor in the effects of inflation, with the current rate at 1.9 per cent.

Future of term deposits

While short lock-in periods are popular at the moment, down the track this sentiment may change. Despite this, “term deposits are here to stay, regardless of the market landscape,” Gianniotis says.

“There will always be a need for the product, there's no question about that. One of the biggest plusses of the product is that it's vanilla. It's easy to understand from a ‘mum and dad' investor perspective, in comparison to bonds and hybrid cash products.”.

Equally low in risk and reward, term deposits are ideal for those in or saving for retirement, general investors and those keen to lock away their cash so they're not tempted to spend it.