Tallying the Cost of a Comfortable or Modest Retirement

In the world of personal finance there is no more significant question than how much one needs need to retire. The question that closely accompanies that one is: how much income will one have in retirement?

The questions have a surprising amount of complexity behind them, needing an understanding of superannuation rules, taxation rules, age pension rules and an estimation of future investment returns.

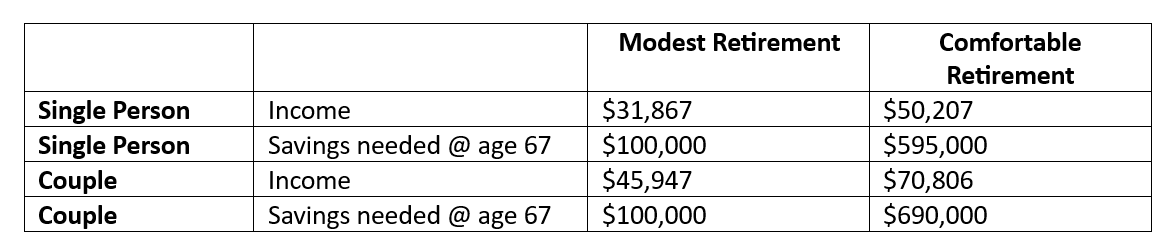

One of the innovations that help us understand what might be a reasonable expectation for retirement is the AFSA Retirement Standards, which set out to identify what a ‘modest’ and ‘comfortable’ retirement might look like and how much is needed to fund these models.

They start with the important assumption that these figures are for people who own their own home. The figures were updated for the June 2023 quarter, important because they will reflect much of the recent inflation over the past 18 months or so. The AFSA retirement standards are set out in the following table:

(Source: AFSA retirement standards Retirement Standard - ASFA (superannuation.asn.au))

Another Benchmark

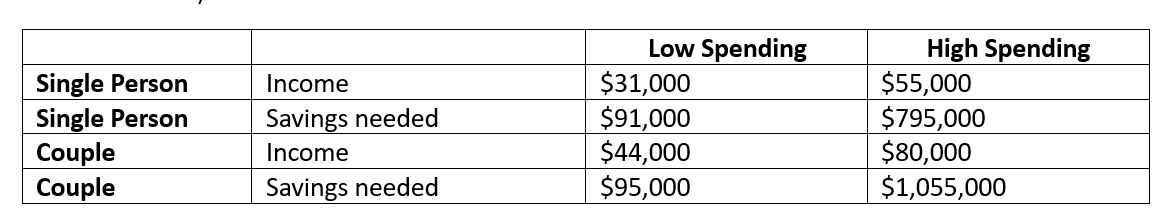

It is interesting to compare the AFSA Retirement Standards with another benchmark of retirement needs/income, the Super Consumers Australia saving targets for current retirees (age 65 to 69) (in the table below):

(Source: Choice.com.au How much do you need to retire? Our updated numbers are here | CHOICE)

The Super Consumers Australian targets suggest that a couple who own their own home and want to live on $44,000 will need to have $95,000. This is a similar level of assets and income to the AFSA standard which suggest a $45,950 standard can be funded with $100,000 of assets. Indeed, this is probably the theme of the comparison – figures are not dissimilar, supporting the idea that the estimates in both cases are reasonable.

Both calculations acknowledge that there will be a combination of income and drawings from assets, and age pension, to fund retirement.

The Importance of Home Ownership

A crucial element to this discussion is that both sets of standards assume that the retiree owns and has paid off their home.

This is an important financial consideration of retirement – if you are going to retire with a mortgage, or if you are planning on renting, it will be very important to budget for those extra housing costs.

The 2020 Retirement Income Review (RIR) found that retirees who rented were at greater risk of financial stress and poverty – it is important to acknowledge that the retirement calculations referred to in this article rely on the person owning their own home as part of the financial supports for their retirement.

A Nice Starting Point

I find the most positive element of these figures at the ‘modest retirement’ end of the spectrum, where owning your own home and having $100,000 in superannuation provides for a modest retirement. This is a clear guide as to where the foundation for retirement might start – own your own property with a modest amount of superannuation/investments left over and you can have the building blocks of a modest retirement.

Most people are going to aspire to more than ‘modest’. Every dollar in investments or superannuation about the $100,000 level will build on that ‘modest lifestyle’.

Beyond Comfortable

The AFSA Retirement Standards suggest that a single person needs to accumulate around $600,000 in assets and a couple around $700,000, to provide about $50,000 of income (single person) and $71,000 (couple).

In both these cases, income will be made up of both drawings from superannuation/assets, and from some part age pension.

If we were starting to look at the next lifestyle beyond ‘comfortable’, perhaps an ‘expansive’ lifestyle with income of $75,000 for a single person and $95,000 for a couple – allowing for more travel, a nicer car, more expensive hobbies – the level of assets required to generate this level of income is likely to be beyond the asset test limit of the age pension, which is $656,500 for a single homeowner, and $986,500 for the combined assets of a homeowning couple.

If we use a drawdown rate from retirement assets of 5 per cent, it implies assets of $1.5 million for the homeowning single and $1.9 million for the homeowning couple are needed – well beyond the asset test limit. It is an important reminder that people looking for a more expansive lifestyle are unlikely to be able to rely on any age pension and will probably have to accumulate a significant pool of assets.

It is interesting to look at the figures. For the single homeowner, a 50 per cent increase in income (going from the comfortable $50,000 to the expansive $75,000) required an increase in assets from $600,000 to $1.5 million, or a 150 per cent increase. For the homeowning couple, their 34 per cent increase in income from $71,000 to $95,000 required a 170 per cent increase in assets from $700,000 to $1.9 million.

You can see this similar phenomenon as you move between the ASFA figures and Super Consumers Australia figures for a comfortable/high spending retirement. The increase in income is $9,000 (from $71,000 to $80,000) and requires an increase in assets from $700,000 to $1,055,000. A 13 per cent increase in income has required an extra 50 per cent in assets.

Of course, you might argue that the 5 per cent withdrawal rate is conservative, and retirees might be able to get away with fewer assets if they adopt a 6 per cent withdrawal rate. The intuition, however, remains the same and is that the move from a comfortable lifestyle to an expansive one will require a significant commitment to accumulating assets.

Conclusion

We get back to one of these big questions around personal finance – how much do I need and how much will I be able to spend?

Both the AFSA Retirement Standards and the Super Consumers Australian calculations set out roughly similar benchmarks for retirees at the start of their retirement – own your own house, have a little in superannuation and you have the foundation of a modest/low spending retirement.

The positive news is that as you accumulate more, the combination of being able to draw more and receive the age pension means that you can quickly build on that lifestyle.

However, once you get beyond the point of receiving some part age pension, it takes a significant level of assets to make the next jump to a more ‘expansive’ lifestyle. As well as this piece of reality, it is also worth keeping in mind that both these calculations rely on the retiree owning their home outright. If you don’t, then carefully adding accommodation costs to your budget, and thinking about how they will be funded, is crucial.

Frequently Asked Questions about this Article…

The AFSA Retirement Standard provides benchmarks for what a 'modest' and 'comfortable' retirement might look like, helping individuals understand how much they need to save. It considers factors like superannuation, taxation, and age pension rules to estimate future retirement income needs.

Home ownership is crucial in retirement planning as both the AFSA Retirement Standards and Super Consumers Australia assume retirees own their homes. This assumption significantly affects financial calculations, as owning a home reduces housing costs, which can otherwise lead to financial stress.

For a 'comfortable' retirement, AFSA suggests a single person needs around $600,000 in assets, while a couple needs about $700,000. This level of assets is expected to provide an income of approximately $50,000 for singles and $71,000 for couples.

The Super Consumers Australia targets are similar to the AFSA standards, suggesting that a couple who owns their home and wants to live on $44,000 annually needs $95,000 in assets. This aligns closely with AFSA's suggestion of $100,000 in assets for a $45,950 income.

The 5% withdrawal rate is used to estimate how much income can be drawn from retirement assets. It suggests that for an 'expansive' lifestyle, a single homeowner would need $1.5 million in assets, and a couple would need $1.9 million, which is beyond the age pension asset test limits.

Considering housing costs is crucial because the retirement calculations assume home ownership. If retirees have a mortgage or rent, they need to budget for these additional costs, as renting can increase the risk of financial stress and poverty.

Transitioning from a 'comfortable' to an 'expansive' lifestyle requires a significant increase in assets. For example, a single homeowner would need to increase their assets from $600,000 to $1.5 million to boost income from $50,000 to $75,000, highlighting the need for substantial savings.

The article notes that the AFSA Retirement Standards were updated for the June 2023 quarter to reflect recent inflation. This update is crucial as inflation affects the cost of living and, consequently, the amount needed for a 'modest' or 'comfortable' retirement.