Spain still struggling to find its feet

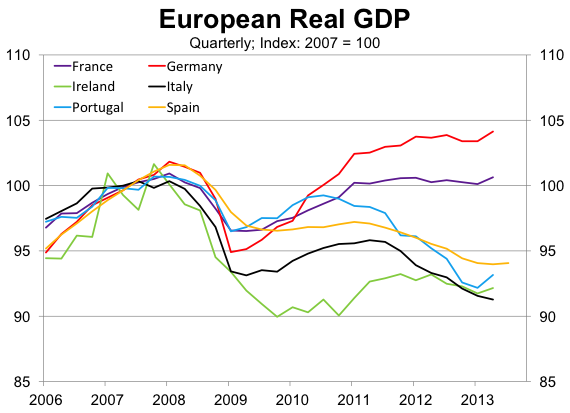

Spain’s ‘recession’ may technically be over but the economic performance of the country remains depressing, and with more austerity to come the recovery will be a drawn out affair. According to IMF estimates, Spain and other European countries face the ominous prospect of more than a lost decade of economic growth.

Spain’s real gross domestic product (GDP) rose by 0.1 per cent in the September quarter 2013, according to the Bank of Spain, prompting calls that their two-year recession is over. Technically I suppose it is but sustainable growth for Spain will remain elusive for some time.

The classical definition of a recession – two consecutive quarters of economic contraction – is convenient for classifying economic performance. But when it comes to the European sovereign debt crisis and the global financial crisis it is a hopelessly inadequate description.

Spain, for example, has suffered nine consecutive quarters of economic decline but has also contracted in 16 of the last 22 quarters. Forget about the recession ending, for Spain the global financial crisis has yet to end, effectively merging with the sovereign debt crisis.

The same could be said of a range of European economies. How can Greek policy makers distinguish between the two? When did one begin and the other end? For countries in the eurozone this has been a six-year recession, with plenty of pain to come.

Spain’s GDP remains 7½ per cent below its peak in early 2008, with the unemployment rate at 26 per cent. Many of those out of work are the long-term unemployed, who are likely to suffer from eroded skills and productivity when they eventually find a job. There is also evidence that those who graduate or enter the workforce during a recession face lower earnings which persists over for the following decade. The future is not bright for Spain’s teens; it can only be worse for Greece’s teens.

Without a flexible exchange rate, Spain has struggled to boost export growth and international competitiveness, which is necessary to offset the massive shortfall in domestic demand. This has proved problematic for a number of countries in the eurozone who would all benefit from a lower currency. Right now, the Euro is driven by the much stronger German economy.

The Euro leaves countries within Europe with a limited range of policy options. Monetary policy? Nope. Currency depreciation? Nope. Fiscal policy? Only of the austerity variety.

Spain recorded a government deficit of 11 per cent in 2012. It will be lower in 2013 but sharp reductions in government expenditure will be necessary to bring the deficit down to the 3 per cent Euro limit. The tentative recovery – and I use that phrase lightly – will struggle when faced with increasingly contractionary fiscal policy. Why would businesses in Spain take risks in this environment? Why would they take on more staff?

At least the European Central Bank has come around to what should have been self-evident: contractionary fiscal policy is contractionary. Fiscal consolidation might be handled with a little more subtlety in the future.

Regardless of how fiscal consolidation is handled the recovery will be a drawn out affair. The IMF World Economic Outlook estimates that in 2018 Spain’s real GDP will still be well below its 2008 level. Much like Japan in the 1990s and 2000s, Spain faces more than a lost decade of economic growth. The same can be said for other European economies such as Italy, Portugal and Ireland. The Greek recovery will take even longer.

Although Spain’s recession is technically over, the remaining challenges facing policy makers are vast. Austerity remains the most serious impediment to growth, effectively removing the one-policy response available to support growth. Spain’s recession will remain an ongoing issue regardless of definitions and we should not let one period of modest GDP growth change that.