Snakes and ladders in the OECD recovery

Organisation for Economic Co-operation and Development data show that the recovery in developed economies remains slow, with Europe providing a drag on the global economy. But there were a few bright spots.

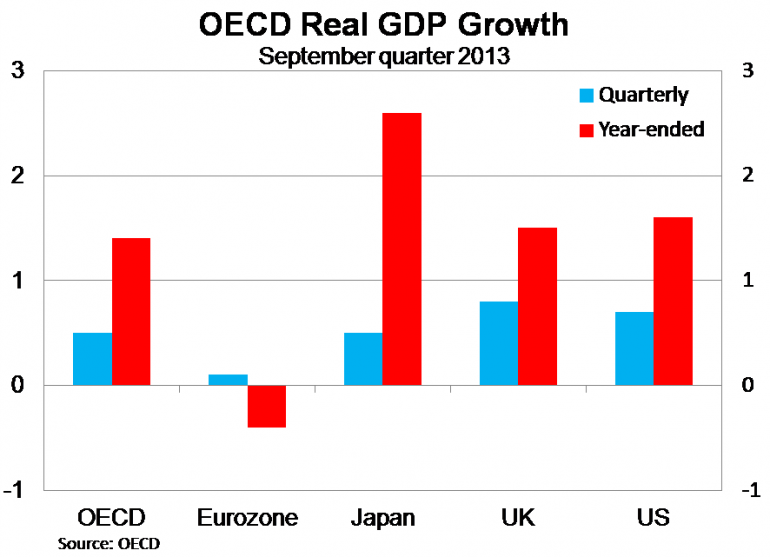

Real GDP in the OECD rose by 0.5 per cent in the September quarter, the same as in the June quarter, to be 1.4 per cent higher over the year. The data is still incomplete, with some countries yet to report on September quarter growth, including Australia, but all of the largest economies in the group have posted results.

In the September quarter, growth has been strongest in the United States and United Kingdom. But growth in the US was partially driven by a stockpiling of inventories, which may be unwound in coming quarters putting some downward pressure on growth. Consumption growth was also relatively weak (Taper waits for the American consumer, November 8). We will get a better feel for the US economy later in the week when the Federal Reserve releases its minutes from its October board meeting.

It is a little easier to be upbeat about prospects for the United Kingdom, and the Bank of England certainly was during its recent Inflation Report (Clearing skies over England’s economy, November 14). It will still be some time before the Bank of England tightens policy, but the September quarter GDP data and other data since then suggest that it may happen in late 2014 or early 2015 – much earlier than previous estimates of 2016.

To the surprise of not a single person, the eurozone continues to drag on both OECD and global growth. The eurozone expanded by 0.1 per cent in the September quarter, to be 0.4 per cent lower over the year (Unpicking Europe’s patchwork recovery, November 15). Of the countries that have reported, Italy contracted the most to be 1.9 per cent lower over the year, while real GDP in Spain is 1.2 per cent lower than last September. Even the German economy is struggling to find any real traction.

The shining light for the OECD remains Japan which grew by 0.5 per cent in the September quarter, to be 2.6 per cent higher over the year. But growth did slow significantly in the September quarter, after expanding by 0.9 per cent in the June quarter.

The Bank of Japan meets on Thursday and is expected to maintain its ultra-loose monetary policy. The pace of growth is expected to pick-up in the December quarter as consumers rush to beat a hike in the national sales tax in April next year. But exports remain a concern for Japan, and given its history analysts should take an ‘I’ll believe it when I see it’ approach to Japanese inflation.

September quarter GDP data for Australia will not be available until December 4. In the Statement on Monetary Policy the Reserve Bank stated that year-ended growth will slow towards 2.25 per cent by the end of the year. Today at 11:30AEDT the Reserve Bank releases the minutes from its board meeting on Melbourne Cup day.

This evening the OECD releases its Global Outlook, but I don’t expect too many surprises. The eurozone will continue to be a drag on the global economy for some time, as austerity measures, deleveraging and internal devaluations weigh on the finances of households, businesses and governments. The US will continue to recover at a slow pace despite the best efforts of their politicians to sabotage that. For Australia, it will be interesting to see how the OECD outlook diverges from that contained in the SMP.