Shareholder value maximisation is a dumb idea

Finance is full of stupid ideas. Have any of you spent any time analysing the CAPM or Efficient Market Hypothesis? Dumb ideas the both of them.

But according to James Montier of GMO, a fund management group, neither of those ideas are the bottom of the barrel. The world's dumbest idea is shareholder value maximisation.

Montier takes aim at shareholder value maximisation in a recent white paper, titled The World's Dumbest Idea. The concept of shareholder value arose in response to the agency problem -- or the agent-principal problem -- that assumed that executives will manage firms for their own benefit, with scant regard to its owners.

Left to their own devices, executives will focus on empire-building and their own personal benefits -- or so the theory goes. The evidence, on the other hand, is far less compelling.

Consider the shift in business sentiment over the past three decades. In 1981, the Business Roundtable (an association of CEOs of leading US companies) stated, “Corporations have a responsibility, first of all, to make available to the public quality goods and services at fair prices, thereby earning a profit that attracts investment … provides jobs, and build the economy.”

Fast forward to 1997 and the role of the corporation had fundamentally changed.

“The principal objective of a business … is to generate economic returns to its owners … if the CEO and the directors are not focused on shareholder value, it may be less likely the corporation will realize that value.”

So what does the evidence say?

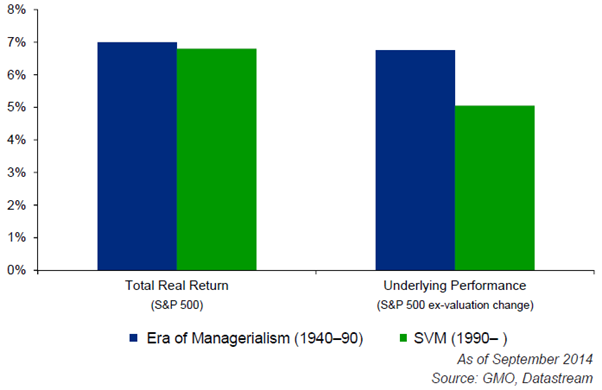

Montier compares the returns achieved by shareholders during the era of managerialism (from 1940 to 1990) against returns during the shareholder value maximisation era (1990 onwards).

The total return between the two periods is virtually identical. By this measure the agent-principal problem appears to have no discernible effect on shareholder returns.

The second measure adjusts the real return to account for shifts in valuation which, according to Montier, “effectively have nothing to do with the underlying return generation of companies, but rather the price that the market is willing to put upon those returns.”

It appears that fixing the agent-principal problem has mostly just increased the willingness of investors to pay for a given profit stream rather than increased the profit stream itself.

Returns by era

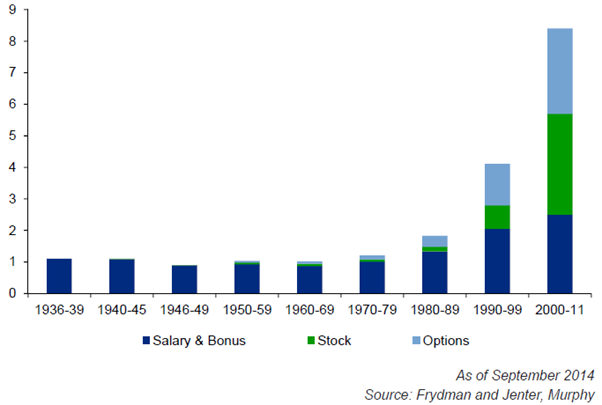

Montier believes that this shift largely concerns the pay of CEOs. The shareholder value era has led to a sharp rise in the amount of stock-related pay. In fact those payment types -- considered unusual as recently as the 1980s -- now dominate total CEO pay.

In the past decade, two-thirds of total CEO compensation has come through stock and options. It's easy to see why CEOs have fully embraced shareholder value -- even if it doesn't improve profits a great deal.

Median CEO Pay ($m; constant 2011 dollars)

Montier notes that aligning managers and shareholders hasn't had the kind of impact that was widely expected. There are at least two reasons.

First, options aren't the same thing as stock; “they give executives all of the upside and none of the downside of equity ownership.” It's a 'heads I win, tails you lose' scenario.

Second, the incentives created by aligning the interests of managers and shareholders can lead to unintended consequences both within the corporation and for the broader economy.

The combination of shareholder value maximisation and decreasing tenures among CEOs (down to 6 years on average between 2005 and 2010; from 12 years during the 1970s), creates the perfect situation for short-term thinking.

Why worry about long-term value when you're only going to be there a few years? It's hardly a surprise that CEOs are more interested in maximising the share price today -- thereby increasing the value of their stock and options -- rather than putting their corporation in a position to expand and meet new challenges.

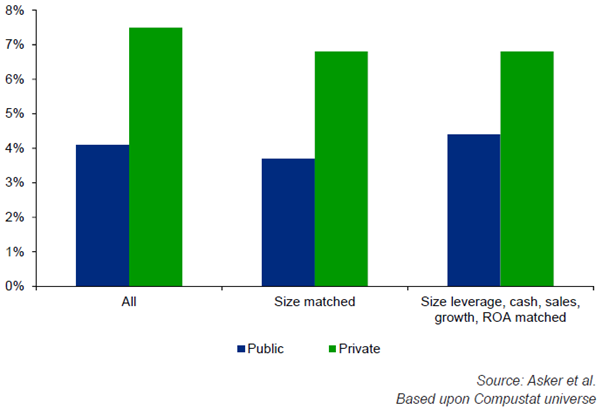

Research indicates that a high share of CFOs are willing to forego profitable projects if taking on the project would result in them missing their quarter earnings-per-share (EPS) forecasts. More recently research indicates that investment rates are nearly twice as high among private firms as they are for public companies.

Private firms vs public firms investment rates (% of total assets)

Tragically, this makes a lot of sense and the past two decades has seen a marked increase in payouts from listed corporations. US corporations have shifted from a ‘retain and reinvest' philosophy during the managerialism era to a ‘downsize and distribute' model during the period of shareholder value maximisation.

Montier believes that the shift towards shareholder value maximisation has increased inequality and softened income growth more generally. Certainly CEO pay is a key part of this debate but it isn't the only one and I suspect that globalisation does a better job explaining why income growth has been softer among lower-education and lower-income Americans.

Rather than maximising shareholder value, the solution to the agent-principal problem has done a good job of maximising CEO value. They are the big winners here, earning rewards and compensation that bears little resemblance to their contribution.

I don't blame them for looking to strike it rich -- that's human nature -- and as long as CEO tenures are short they'll continue to look for short-term value rather than long-term success. But the global financial crisis highlighted the risk associated with that approach.

Montier believes that a broader perspective is called for -- how does stakeholder value maximisation sound? Creating value for not just shareholders but customers, employees, suppliers and taxpayers.