September enviro markets update - VEECs and ESCs

Victorian Energy Efficiency Certificates (VEECs)

With the Victorian election now less than two months away the battlelines for the future of the VEET have been drawn. With hefty creation numbers maintained despite changes to schedule 21C, it appears the only salvation for the VEEC price lies in a Labor victory in late November.

It has proven a big few months for the VEEC market. The Napthine Government succeeded in passing its repeal bill through the state’s Upper House and has it on the agenda to be dealt with in the Lower House on the final three sitting days of the current Parliament which take place next week. Should the bill succeed and the Coalition be re-elected in November, the VEET will draw to a close at the end of 2015 following a final 2m VEEC target for that year.

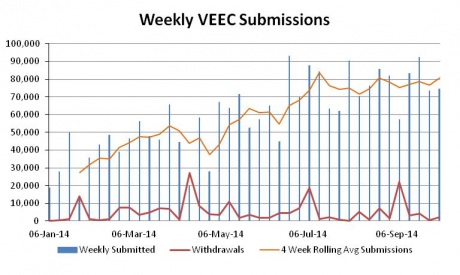

VEEC submissions have remained strong despite the second round of changes to the schedule 21C (down light replacement) creation methodology. As can be seen in the chart above the four-week rolling average has remained quite steady between 70,000-80,000 per week since early July, which has meant that there are now sufficient VEECs either registered or pending registration to meet the 2014 target with close to four months left to create for 2014 eligibility.

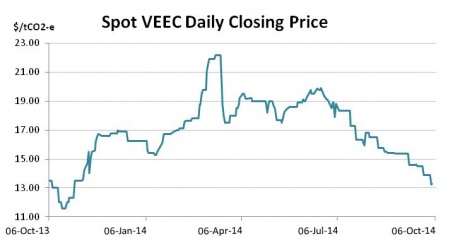

The strong creation numbers combined with the political developments have weighed heavily on the spot price with the market softening steadily across the last three months to reach a low not seen in just under a year.

An unusual state of affairs has prevailed in the forward curve in recent months with backwardation repeatedly seen within a compliance period. In essence, a multitude of forward sellers has put downward pressure of the price. Frequently, for one reason or another, buyers have been present in the spot market. This has resulted in a number of instances where the spot price has been above the forward price within the same compliance year, an outcome which is unusual given buyers would normally prefer to purchase a forward instead of a spot contract so as not to have to have to part with their cash until closer to the compliance date.

With the spot market now sitting close to $13 all eyes are on the Labor Opposition who continues to lead in an albeit tightening series of polls. Labor has publicly thrown its weight behind the VEET scheme, saying it supports it, but as yet has not revealed precisely what target it would set for 2015 or beyond. Creators in the scheme are hoping its target for 2015 will be substantially greater than the 2m that the Coalition proposes which, at the current rate of creation, would be met within six months.

Should the VEET repeal bill not pass the Lower House next week, there will in effect be no target for 2015, though the scheme’s legislation will remain in place with its current end-date of 2020. If the Coalition then goes on to win the election it would have to again pass the repeal bill through both houses. Should Labor win, it would then simply have to outline its target for the next three years of the scheme.

Yet the permutations do not end there. If the Coalition succeeds in repealing the scheme next week and then goes onto to win the election, the 2m target for 2015 will be the scheme’s last. If the repeal succeeds and then Labor are victorious in November, an Andrew’s Government would then have to pass legislation through both Houses to resurrect the scheme.

As is so often the case in the environmental markets, it is politics that will determine the VEEC’s future.

NSW Energy Savings Certificates (ESCs)

On the surface, something deeply unusual has been taking place in recent weeks in the ESC market; supply has spiked sharply in a market which was already well oversupplied, and yet prices have gone up. It appears only time will tell whether this proves a period of irrationality or whether instead there is a sensible explanation.

The trend in the New South Wales ESC market across most of the year has been very much aligned with its southern neighbour. Having begun the year just shy of the $17 mark, the spot ESC market moved progressively lower across most of the year as strong registration numbers first saw the current year’s target met and then comfortably exceeded.

Despite a range of very substantial changes having been made to scheme rules, which were broadly expected to have had a negative impact on registrations (particularly emanating from the commercial lighting methodologies), ESC supply has remained strong. Though there were perhaps few who were expecting just how big the last few weeks would be (more on that shortly).

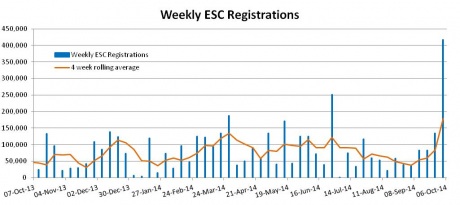

In early August the spot market breached the $10 mark on its way to a mid month (and record) low of $9.55. From that point however, something changed. ESC registrations did admittedly soften, with the four-week rolling average briefly falling below 50,000 per week in early September. Though for a scheme that was already making good headway toward the 2015 target, to some a price recovery seemed a little premature. Sure enough as the weeks past the spot market continued to creep upwards, but what was most intriguing was that the rally coincided with a substantial increase in ESC registrations.

The spike in registrations was dramatic, yet the explanation behind it may go some way to explaining what was taking place. As part of a gradual transition between the old and new rules, the scheme’s administrator set a hard date for creation of ESCs under the old methodologies; September 30. This date was important because it offered the opportunity to put a line under the enormous (though very hard to estimate) pipeline of ESCs which had been constantly speculated on. As it turns out, the pipeline was indeed very large, with over 700,000 being registered over the last four weeks, including a record 415,000 last week.

Creators have been saying for months now that the rule changes have had a catastrophic impact on new sales and installations and that the subsequent drop in registrations that will follow the end of the pipeline will be sharp. There are many who believe the September 30 cut-off date will provide some hard evidence of that drop in sales (although a recent decision by IPART means that there will likely still be some ESCs coming through over the coming weeks from the old rule, but the lion’s share appears to have been accounted for).

And it is here that an explanation for the increase in ESC prices is justified in some people’s minds. Despite the fact that there are currently 4.4m ESCs available to meet the 2014 target of (according to IPART’s forecasts) less than 2.6m, leaving at least 1.8m surplus ESCs already available for the 2015 target, which will again be no more than 2.6m (according to IPART), there are those who believe that registrations under the new rule will be so low as to make it a struggle to achieve that target.

There has, to date, been no further news emanating from the Baird Government on the review of the scheme that has taken place across this year. Under the previous premier, it appeared the review was leaning toward the expansion of the scheme. In recent months, there has been little other than silence on the matter. For a scheme which has enjoyed bipartisan support and is broadly recognised as having provided a clear benefit to the state, there is a hope among creators that an expanded target will, at some stage be announced. And perhaps such an outcome is also playing on the minds of the market’s bulls.

For the record, as it stands, in order to meet the remainder of the 2015 target, roughly 20,000 ESCs must be registered each week between now and April 2016.

Marco Stella is senior broker, Environmental Markets at TFS Green Australia. The TFS Green Australia team provides project and transactional environmental market brokerage and data services, across all domestic and international renewable energy, energy efficiency and carbon markets.