September enviro markets update - STCs and LGCs

Small-scale Technology Certificates (STCs)

STCs (MWhs) | Bid | Offer | Last/Curve |

Spot t 3 | 38.95 | 39.05 | 39.00 |

Q313 15 Oct 2013 | 39.00 | 39.10 | 39.05 |

Q413 15 Jan 2014 | 38.75 | 38.95 | 38.85 |

Q114 15 Apr 2014 | 38.40 | 38.60 | 38.50 |

Q214 15 Jul 2014 | 38.40 | 38.60 | 38.50 |

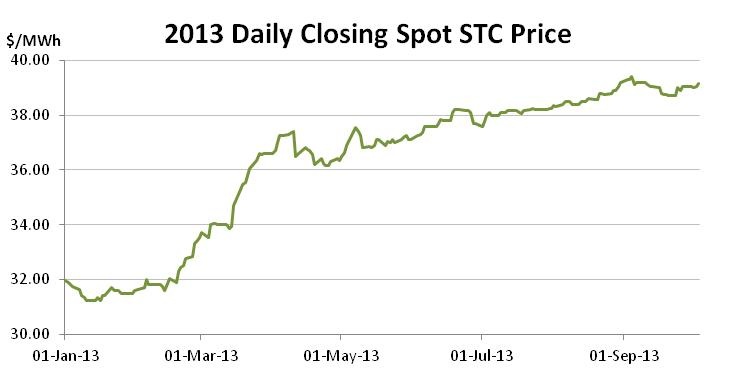

As the countdown to the end of Q3 compliance continues the spot STC price first peaked (briefly at $39.40) before then stabilising just above the $39 level. The question that each side of the market is presently weighing up is has the market gone as high as it will for the quarter or is there still some life left?

A quick glimpse at the 2013 spot STC price reveals a pricing trend that most share market investors would love to experience; an almost constantly increasing spot price which currently sits more than 22 per cent above the level at which it opened the year.

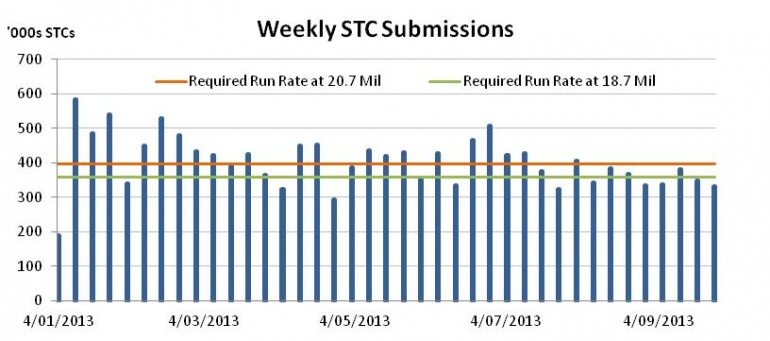

STC submissions have fallen in the second half of the year reflecting the fact that subsidies have been further wound back at both a federal and state levels, to the point that the Clean Energy Regulator’s estimate of the number of STCs to be created in 2013 will prove by far its most accurate to date.

Yet for a market that has come to imbue an overwhelming sense of predictability across the year, the coming three weeks present an interesting dilemma for both buyers and sellers.

At the heart of the quandry for sellers is whether or not more can be extracted from the STC price in the coming three weeks as the end of Q3 compliance approaches. In less than three weeks we will know whether buyers will be forced to pay higher to secure whatever remaining STCs they require for Q3 or whether those left holding unsold STCs will instead need to carry their stock into Q4 in the hope that a considerably higher price will be achievable.

In order to carry STCs a business must either finance that carriage via debt or instead use operating capital (or reinvested profits) to fund the carry; either way an interest cost (or opportunity cost) applies. For the sake of simplicity and conservatism, if we take a modest (opportunity cost) approach, then no risk savings accounts are currently available at rates in excess of 4 per cent.

What this means is that the opportunity cost of carrying STCs (using only the risk free rate) is more than 12 cents per month. This is significant because should a seller decide to hold their STCs beyond Q3 compliance to instead sell them, say in January, they would need to achieve a price 36 cents above that which they could have sold in Q3 just to balance to ledger. If the business were to consider alternative investment options with greater returns as a comparison, the carriage of STCs becomes even more costly.

In short this means that there is very little incentive to hold large volumes of STCs beyond Q3 and therefore that the coming weeks will likely prove decisive for many sellers.

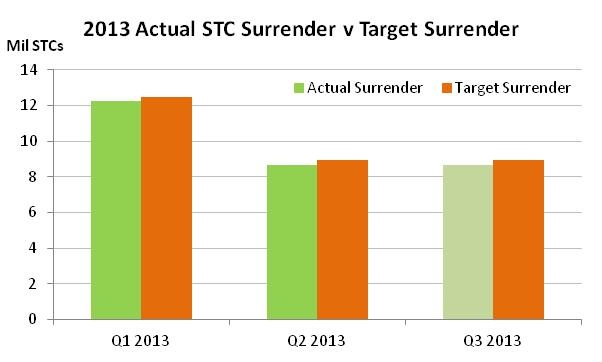

On the buy side, conditions also point to an interesting few weeks ahead, for opposing reasons. A substantial number of STCs will be surrendered between now and the Q3 compliance date of October 28. If we take the expected proportion of the 2013 target, then Q3 surrender would amount to 8.93m. In practice, the Q3 surrender will likely amount to something similar to the Q2 surrender of roughly 8.67m. This number will considerably reduce the working surplus of STCs.

However, for buyers, the market’s cap of $40 means the potential upside is limited and therefore a failure to purchase STCs in the market at lower prices will fail to result in huge losses. This therefore creates a greater incentive for buyers to take a chance on a spot price drop. The big question that remains is have buyers become complacent in their acquisition of STCs which will leave them needing to purchase considerable numbers in the coming weeks? Or have they instead, through a combination of spot and forward purchases got ahead of the curve?

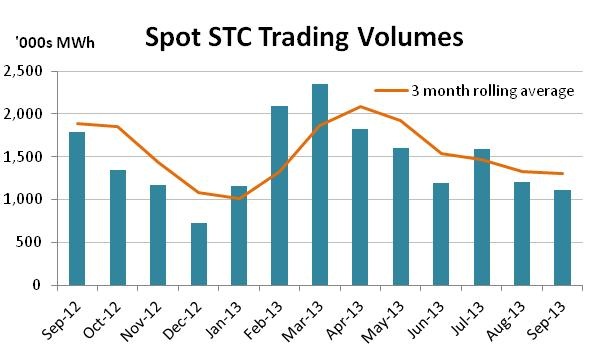

In terms of spot market trade volumes, activity over recent months has been fairly stable at about 50 per cent of the highs seen in the first quarter of this year when the spot price began to soar and 2-times multiplier systems were still abundant. Activity in the forward market however has remained fairly stable indicating an increase in the number of proponents undertaking hedging practices.

The vicinity of the current spot price to the market’s cap is also having an interesting impact on the forward market. Because of the limited upside, buyers have been relatively disinterested in locking in deals beyond the current quarter at prices above or even in line with the current spot price. Instead the forward market beyond Q3 has been trading at a discount to the spot price with Q4 in the $38.75-$38.85 range and deals for 2014 compliance around the $38.50 mark.

Large-scale Generation Certificate (LGCs)

LGCs (MWhs) | Bid | Offer | Last/Curve |

Spot t 3 | 34.40 | 34.60 | 34.50 |

Cal 13 15 Jan 2014 | 34.70 | 35.00 | 34.85 |

Cal 14 15 Jan 2015 | 35.95 | 36.25 | 36.10 |

Cal 15 15 Jan 2 | 37.10 | 37.70 | 37.40 |

Cal 16 16 Jan 2017 | 38.00 | 39.00 | 38.50 |

In the nation’s large-scale renewable market – contrary to what the prevailing logic would have suggested – the rise of the Coalition has coincided with a considerable recovery price. Yet the dual regulatory concerns of the carbon price repeal and the Renewable Energy Target Review still linger.

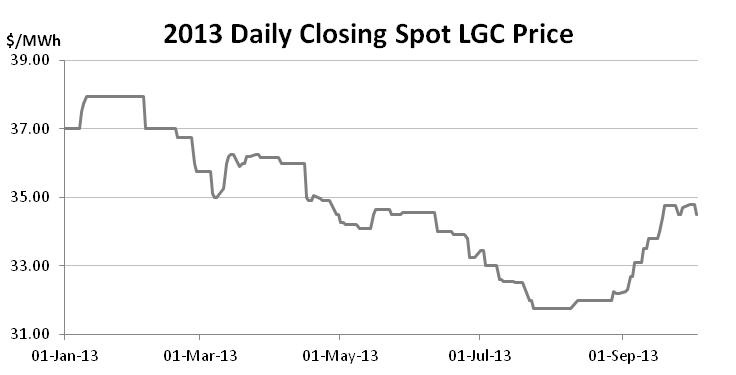

Until recently, by most measures 2013 had been a gloomy year in the LGCs. Having commenced the year in January at $37.00, the spot market reached just shy of $38.00 before a steady downward run saw the market bottom at $31.75 in late July; a low not seen since early 2011. Across much of the year political uncertainty surrounding the Coalition’s plans for the Renewable Energy Target and the repeal of the carbon price were suggested as the underlying of source of the softening.

Yet right at the point when it appeared most certain that the Coalition would return to power, the sentiment in the market changed. In the latter part of August, with the federal election only weeks away and the Coalition a shoe-in, support returned to the market. By month’s end the spot had reached $32.25. The week following Abbott’s election saw the spot reach $34 on its way to a high of $34.80 in late September.

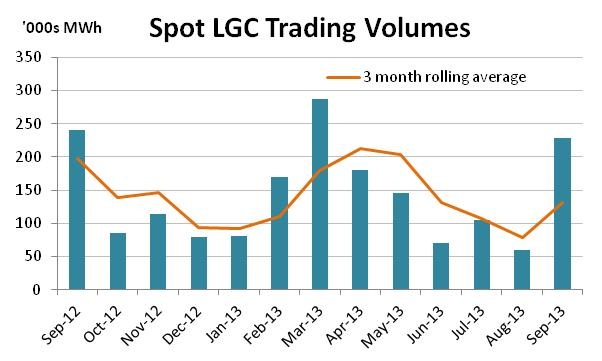

While the recent positivity has, in part, ameliorated an otherwise fairly dismal year, the price gains have coincided with another outcome which strikes a positive cord; the most active market conditions in more than a year.

While spot trade activities were solid across the last month, the forward market has also experienced a renaissance with a multitude of transactions across Cal 13, 14 and 15. The increase in activity, while having brought a smile to the faces of brokers and traders alike, also indicates that, after a long break, participants are re-engaging with the market.

While the increased level of trade activity is welcomed by all, it does little to change the fact that the large-scale renewable market faces a bumpy road ahead, with a slew of potential regulatory changes looming. Included among these are the repeal of the carbon price, the abolition of the CEFC, as well as the potential for changes to arise from the 2014 RET Review.

While the repeal of the carbon price and the abolition of the CEFC will make it harder for renewable projects to get off the ground and hence could result in an increase in LGC prices, the suspicion that the Coalition is intent on altering the target from the current fixed arrangement to a lower, floating price has the potential to have the opposite effect (a reduction in the target which would result from such a change would, by definition, reduce demand across the remainder of the decade).

The uncertainty surrounding the future of the scheme continues to spur interest in the options market with participants looking to acquire some insurance against potential adverse price movements. Activity has been principally focused in the Cal 14 and Cal 15 markets, though occasional forays into Cal 16 have been made.

An indication of the uncertainty of the market beyond 2014 is manifest in the implied volatilities of options traded for the 2015 vintage and beyond which, unlike those in the 2014 which have generally seen volatility around the 15 per cent mark, have tended to be in the 16-18 per cent range.

Marco Stella is senior broker, environmental markets at TFS Green Australia. TFS Green Australia provides project and transactional environmental market brokerage and data services across all domestic and international renewable energy, energy efficiency and carbon markets.