Power play

Summary: There's a growing belief that resources are close to the bottom of their price cycle. Investors not normally associated with the sector are starting to enter and investment banks are starting to voice some optimism. Yields for the two biggest miners are approaching the levels of bank stocks. |

Key take-out: One investment bank's coverage of resources stocks has warned investors not to leave it too late. |

Key beneficiaries: General investors. Category: Mining stocks. |

Worms turn! And no sector stays out of favour forever. It's early days but there are early signs of a shift in sentiment away from financial stocks back towards the heavily discounted resources sector.

No-one is suggesting that the turn will lead quickly back to the boom of a few years ago. Commodity prices have a long way to rise before those conditions return, and some commodities have further to fall.

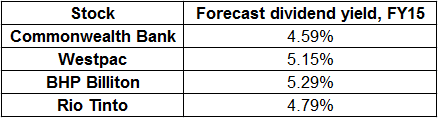

But what is interesting is a comparison between skyrocketing bank shares which are being driven by investors seeking reasonable yields at a time of falling interest rates, and high quality resource stocks, some of which are almost matching banks for yield.

The best example is a comparison of Australia's two biggest banks (by market capitalisation) and two biggest resource companies.

At the close of business Wednesday February 11 Commonwealth Bank at $91.90 was trading on an historic dividend yield of about 4.3% while Westpac at $36.79 was yielding 4.9%.

BHP Billiton at $30.91 was yielding 4.2%, while Rio Tinto at $59.97 was yielding 3.7%.

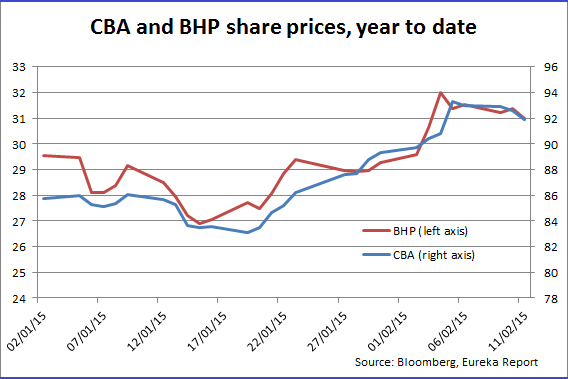

The spectacular rise of bank shares over the past few months is one of the major reasons why the ASX All Ordinaries index is up 10% since mid-December.

Less obvious, but also trending up, have been the resource leaders with some investment banks starting to question whether conditions are right for a change at the top with resource stocks taking the lead.

A clue to an emerging change in the pecking order is a growing belief that resources are close to the bottom of their price cycle, and while iron ore and oil could fall further because of gross over-production, most of the damage has probably been done with supply growth starting to subside as high-cost mines and oilfields are mothballed.

A second clue to the changing mood is the entry into the resources market by investors not normally associated with the sector.

The $175 million punt on Beach Energy by the Kerry Stokes-controlled Seven Group is a bet on a brighter outlook for oil and gas (see Stokes & Co strike oil, February 4), while a $350 million punt on Fortescue Metals Group by the US-based funds manager, Capital Group, is a pure play on an eventual iron ore recovery.

Both Seven and Capital are showing reasonable paper profits with their oil and iron ore investments made over the past two weeks.

Another test of changing conditions can be found in coal, the first sector to crash thanks to a market flooded with excess supply, and now showing signs of being the first sector out of the downturn.

The chief executive of Whitehaven Coal, Paul Flynn, said at the official opening of the Maules Creek mine in NSW last week that conditions for coal were improving.

“2015 looks like the year balance (in the coal market) is achieved with 2016 a year when there could be a slight shortage,” Flynn said.

Easy as it is to dismiss Flynn's comment as the expected optimism of a coal company chief executive there are numbers to back up his opinion, including a 20% rise in Whitehaven's share price over the past two weeks, and positive investment recommendations from a number of investment banks, including Credit Suisse, Deutsche Bank, Citi and Morgan Stanley with a common view being that heavy cost-cutting, together with steady demand for coal, is benefitting the stock.

Political pressure on the coal industry is also delaying the development of some new projects and while the NSW Government has recently approved a number of mine expansions there are doubts about whether two big Indian-backed mines in Queensland will go ahead as that State moves closer to a change of government.

Getting the timing right in a market turn is important and while there are signs of improving investor appetite for resource stocks, such as the successful raising of $US450 million by EMR Capital, a Melbourne-based private equity fund led by long-term resource bull, Owen Hegarty, there is no overall consensus that the turning point has been reached.

J.P. Morgan revealed how close the call is between bank and resource stocks when it told clients on Monday that for the first time in 15 months its “timing model” favoured resources over financials.

But, it was a narrow win for resources with an internal voting system giving resources five votes over four for financials (banks).

What was significant in that one vote win for resources being likely to deliver better future returns over financials was the fact that it was the first time in 15 months that resources were more highly rated.

Citigroup, a few days earlier, had voiced its optimism for a change in conditions, comparing the pattern of previous commodity-price cycles with share price movements.

What Citi found is that in previous periods of commodity-price recovery resource company shares moved ahead of a commodities recovery – a trend which is not currently evident which Citi blames on uncertainty in major markets such as Europe.

Citi did not use its publication titled “Monday Mining Minutes” to recommend specific stocks but it did have as a secondary heading in that document this comment about resources: “Our advice is don't leave it too late”.

Interestingly, given that Rio Tinto is scheduled to release its annual profit report tomorrow (Thursday, February 12), Citi selected it as the stock for a case study in comparing share-price movements with commodity-price movements.

The bank noted what it terms a “pre-emptive pattern” of shares moving ahead of commodity markets, a trend seen in the 1987-to-1998 super-cycle.

Back then, Citi said: “Rio Tinto began performing way ahead of a commodity-price recovery”.

“On this occasion, we think Europe has spooked the mining market and caused it to play down the fact that the US, Japan, Britain and China are actually not doing too badly at all.

“There is a strong likelihood that this residual fear about European contagion may be stopping the miners from acting in a pre-emptive manner like they did in the 1990s.”

Citi added warned that being concerned about the financial (and political) problems of Europe was not irrational, but it did mean that there were opportunities for the brave.

“And by brave we mean investors who are willing to buy when the metal markets and the miners are in the depth of despair and it feels as though the world will never see robust growth again,” Citi said.

“But, of course, it will, at some point”.

As for Rio Tinto's outlook, a clearer picture will become available tomorrow. But the consensus view of analysts is that the miner will report a 13% fall in annual profit offset by a 15% increase in its annual dividend, with the possibility of a capital management program (share buy-back) or a special dividend.

Looking ahead, the investment bank UBS sees this year (calendar 2015) as the bottom of Rio Tinto's profit cycle, but with dividends increasing progressively.

Forecast FY15 dividend yields. Source: Bloomberg.

The key number in a banks v resources analysis is the UBS dividend yield tip for Rio Tinto which is for a rise from 4.5% based on its 2014 assumptions to 5.1% next year, a number which sits comfortably with a “worm turning” investment thesis.