Positioning for China's cash flood

Summary: As Chinese capital markets are liberated, investment in Australia could quite easily double or even triple its current level. |

Key take-out: The most likely scenario as this process develops is that Chinese investors will flood global financial markets purchasing equities and bonds, along with physical assets. |

Key beneficiaries: General investors. Category: Economics. |

Capital market liberalisation in China – which involves reducing the regulation and market controls that reduce the free flow of capital across borders – will be one of the major market drivers over the next five-to-10 years. This process will not only provide greater scope for Chinese investors to buy global assets but also allow foreign investors to invest in China.

A lot, of course, will depend on Chinese Government policy. In the last 24 hours the country has axed its high-profile reformist Minister of Finance, Lou Jiwei, and replaced him with long-time bureaucrat Xiao Jie.

Australians are already wary of Chinese investment inflows. According to the Foreign Investment Review Board (FIRB), Chinese direct foreign investment in Australian assets totalled $46.6 billion in 2014-15, around one-quarter of total foreign investment, with capital flows almost tripling in the past five years.

Around half of that is directed towards Australian property, mainly residential, with Chinese investment a chief driver of the recent residential construction boom.

Even in a highly regulated market for capital, Australia is receiving close to $50bn a year in investment applications. As capital markets are liberated, investment in Australia could quite easily double or even triple its current level.

A research paper by economist Dr Alfred Schipke, from the International Monetary Fund (IMF) and published as part of a recent Reserve Bank of Australia (RBA) conference on structural change in China, explores some of the implications of capital market liberalisation in China.

Recent developments

This issue gained some prominence following the depreciation in the renminbi in August 2015. Capital outflows from China led to an associated decline in foreign currency reserves throughout that period until early 2016. Chinese authorities reacted via greater enforcement of existing capital account controls.

The problem, however, hasn't gone away, with foreign currency reserves falling by a further $US45.7bn in October and now sitting at their lowest level since March 2011. Among Chinese investors there is a strong desire to reduce domestic exposure, in particular to the Chinese property market, and channel funds towards safe-haven assets and countries.

The limited scope to diversify and reduce domestic exposure has created an internal boom-bust financial environment that hit Chinese equities last year and has spread to commodities such as iron ore and coal during 2016. The recent improvement in commodity prices has partly been a product of speculative investment in commodity futures. (Also see A big margins call for iron ore miners and Watch our recent Eureka Moment video, The China syndrome). It isn't expected to last.

Financial integration in China

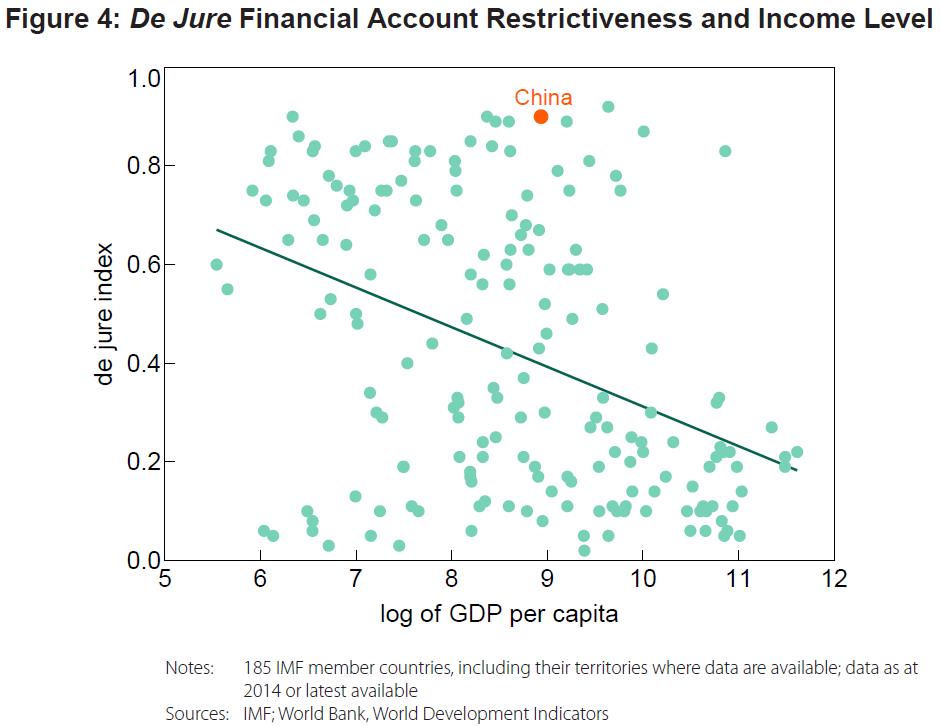

China has gradually opened its capital account, but financial integration is relatively low given the country's level of real GDP per capita. Furthermore, the different types of private capital flows – direct foreign investment, portfolio investment and ‘other' – have been liberalised at a different pace, creating opportunities and frustrations for domestic and foreign investors alike.

The graph below compares financial integration in China against other countries on the basis of real GDP per capita. As we can see China is largely an outlier globally, with relatively closed financial markets. As financial liberalisation continues we expect China to begin to converge with that trend-line.

Inflows and outflows

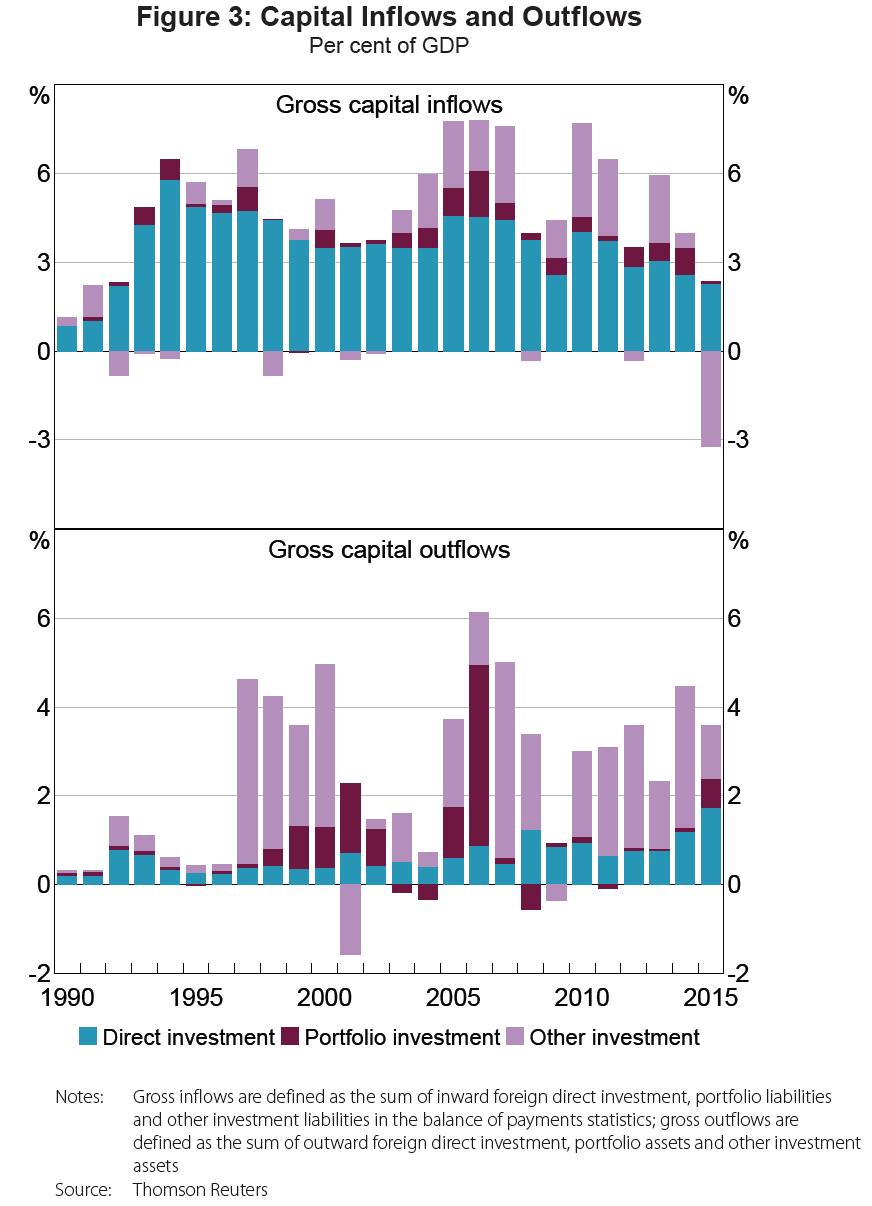

Foreign direct investment (FDI) has dominated capital inflows to China because there are fewer restrictions surrounding these investments. FDI refers to investments made in either establishing business operations or acquiring business assets.

‘Other' flows are mainly banking related and have become increasingly prominent in recent years. Investment via the banking system has been a key pathway through which capital has left China.

The graph below compares capital inflows and outflows. We can see that portfolio investment, which is the category of most relevance to Eureka Report readers, is heavily restricted. Portfolio investment will be one of the major beneficiaries from further capital market liberalisation but we would expect to see an increase in both inflows and outflows (as a share of GDP) as capital markets are opened up.

Implication of full liberalisation

Dr Schipke explores the implications of full financial liberalisation. Such a scenario is unlikely, particularly in one go, but it does provide some insight into how capital flows may adjust to deregulation.

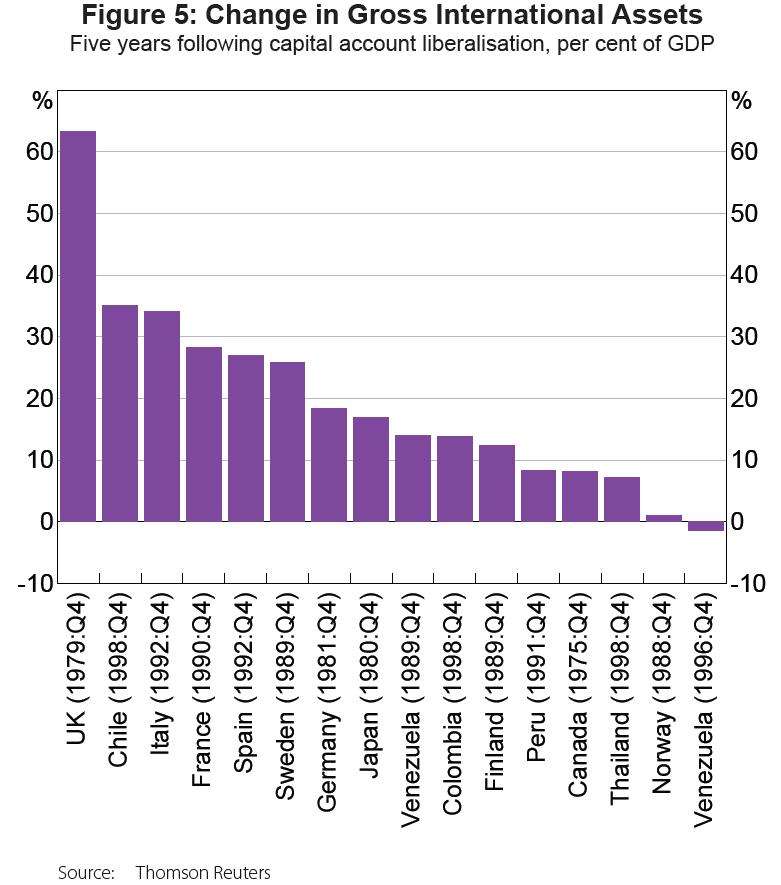

In the past, “countries that liberalised their capital account generally experienced a significant increase in both inward and outward capital flows.” In most cases, “outflows were larger than inflows as domestic investors sought to diversity their savings.” The most likely scenario as this process develops is that Chinese investors will flood global financial markets purchasing equities and bonds, along with physical assets.

The graph below compares the international experience of economies that have gone through a similar process. Whether an economy is large or small, financial liberalisation typically ends up with strong growth in capital outflows as investors take advantage of new investment opportunities.

Nevertheless, there is a great deal of uncertainty surrounding the response of investors to new opportunity; recent history, however, suggests that Chinese investors will embrace financial deregulation enthusiastically.

Research suggests that the net capital outflow from China in the event of full liberalisation could range between 11 and 18 per cent of Chinese nominal GDP. That is around $US1.25 to $US2.1 trillion based on nominal GDP in 2016 dollars.

There are risks associated with opening up markets too quickly. Capital flight is a risk that has proved disastrous for emerging economies in the past, but there are also risks associated with waiting too long. Finding the right balance is difficult and Chinese authorities have so far shown a desire to take a slow and gradual approach.

A closed capital account can distort capital flows leading to an inefficient allocation of capital. A ‘housing bubble' is an example of a distortion caused when capital cannot flow to where it is most useful. The recent speculative booms and busts in equities and commodity futures is another example. One of the reasons that capital is flowing out of China, through legal and not so legal means, is to avoid the risks associated with such distortions.

Liberalisation of Chinese capital markets represents a significant structural change in global financial markets. We have seen the impact that China can have on commodity markets and, more recently, with regards to Australian residential construction. There will be money to be made as Chinese capital floods into Australia and this could prove lucrative for equity and bond owners but also owners of physical capital.

In the near term the most visible sign of Chinese capital outflows will be felt in currency markets. The renminbi continues to fall against other major currencies as capital outflows continue, and this has important implications for Australia.

Domestic investors should closely watch developments in the Chinese currency since a devalued renminbi effectively increases the cost and reduces the demand of iron ore for Chinese steel mills.