Paul Clitheroe's Making Money: Are you overexposed to cash?

Household deposits grew by $50 billion in the September quarter 2023. It means Aussies now have close to $1.7 trillion sitting in savings accounts.

Don’t get me wrong, in the short term holding cash is absolutely terrific. So, I know it sounds a bit weird, but in the long term it is an absolutely terrible investment. The worst.

Cash plays a different role for all of us. For you it may be saving for a home deposit, a car or a holiday. That is a great reason to hold and build cash.

For me, at age 68, we like to hold a couple of years’ worth of basic living expenses in cash. If markets fall, which they can and will, we don’t want to be selling property and shares at low values to be able to eat. We use our cash, plus rent and dividends until, as they always do, markets recover.

As we head into 2024, there are three good reasons to consider whether too much of your portfolio is invested in cash:

1. Are you really earning the advertised rate?

Our banks and other institutions offering us interest on our money are in the business of buying and selling money. They pay savers one rate, lenders a higher rate, and keep the difference. Nothing wrong with that, but we savers need to make sure we are getting the best rate we can.

Late last year, consumer watchdog – the ACCC, handed down its report on retail deposits. It found savers need to jump through a variety of hoops to continually earn bonus interest. Most failed to keep up with the conditions of their savings account, to the point where, on average, over 70% of bonus interest accounts didn’t actually earn bonus interest each month in the first half of 2023.

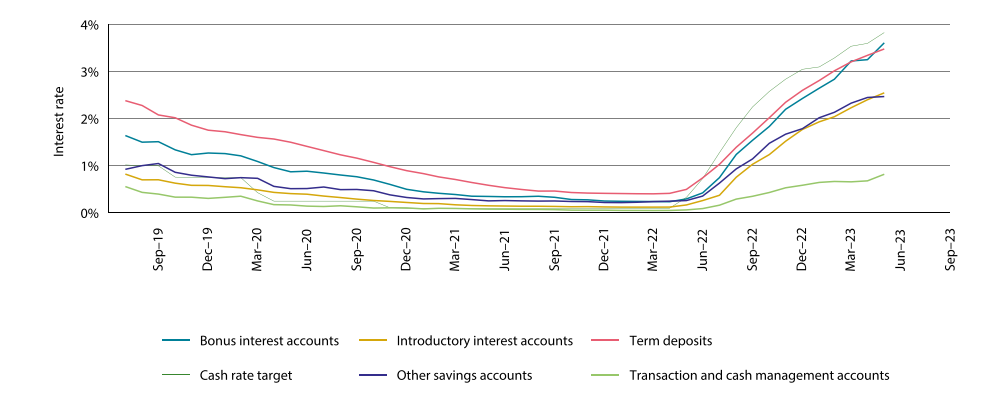

The result is that average effective rates, in other words, what our money really earned, was continually below the RBA’s cash rate – as shown in the graph below.

|

Estimated average effective interest rates of select banks’ retail deposit products, July 2019 – May 2023 |

|

|

|

Source: ACCC Retail deposits inquiry |

It’s an extraordinary finding, one that confirms how earning a high rate on cash calls for ongoing effort to be sure you are earning a solid return.

2. Have you considered the opportunity cost of cash?

I think we’re all in agreement that cash is great in the short term and you can earn over 5% with very high security from banks and other authorised deposit takers.

Anyone offering you higher returns than this on your cash means higher risk of losing some or all of your money. So, we need to look at opportunity cost. This is simply what other investment opportunities are available to you.

In the long term, shares and property have historically returned well above cash. This is why major super funds “balanced” accounts have averaged around 9% a year over many decades.

Sure, cash rates are far more attractive these days, you may well have earned nearly 5% on your cash last year.

By comparison, Aussie shares have recorded price gains of 4.73% over the past 12 months. But that’s just capital growth. If we add in dividends, the total return for the year is 9.18%. That’s almost double the return on cash, but growth investments like shares and property are hopeless as short term investments. In the short term, a year or two, they may rise strongly or fall dramatically!

Where I argue that cash is a terrible asset, is in a longer time frame, say 5 to 7 years. Historically, growth type investments outperform cash by a big margin, and are a lot more tax effective than the fully taxable returns from cash.

3. Are you concentrating risk?

One word here: diversification. It’s all about investing in a variety of asset classes to spread risk and smooth out returns.

Cash can seem like a risk-free asset class especially as bank balances are government guaranteed up to $250,000 per account holder per bank.

But the main risk of cash is not losing your money.

It’s the possibility that the value of your capital – the purchasing power of your money – won’t keep up with inflation.

Let me put it this way. The latest ABS data shows inflation has dropped to 4.3%. Great news.

For cash investors, it means every dollar held in a cash account needs to have increased by at least 4.3% (meaning you’ve earned a minimum return of 4.3%) over the past year just to maintain your wealth let alone forge ahead financially.

The catch is that as inflation falls, we are likely to see interest rates drop also. Economists at CommBank, Westpac and AMP (to name a few) are expecting interest rates to fall in 2024. And you don’t need to be an economist to see that this could see investors switch from cash to shares, pushing up share values, or to understand that lower rates will likely benefit companies, potentially helping to drive dividends higher.

Ordinary investors are often among the last to react to these sorts of events, often waiting until rates have fallen, or stock values have climbed, to shift money out of cash and into equities. By that stage, the lion’s share of stock market gains may have gone to investors who acted early.

My tips for cash

Yes, cash is a very safe asset class, though it’s not entirely without risks. Holding too much in cash can mean you’re not getting the benefit of diversification, and it can come at the cost of weaker returns over time.

I’ve been around for a long time and as I said in the start of this article, I love holding cash for the right purposes and you should too. But if I had held cash throughout my adult life, I would be very poor indeed. It is a dud long term investment after tax and inflation tear into it.

The reason my wife and I can contemplate retirement with financial independence has zero to do with cash, and everything to do with buying a home, growing investments such as shares, and building our super over many decades. These “growth” type assets have averaged returns close to 10% annually, and are treated in a very favourable way by our tax system.

The rule? This is simple, hold cash for specific short term purposes. Otherwise, please take a look at history, do your research and invest in much better long term assets like shares and property.

Frequently Asked Questions about this Article…

Holding too much cash is considered a bad long-term investment because it typically offers lower returns compared to growth assets like shares and property. Over time, inflation and taxes can erode the purchasing power of cash, making it less effective at building wealth.

The main risk of keeping a large portion of your portfolio in cash is the potential loss of purchasing power due to inflation. While cash is safe in terms of capital preservation, it may not keep up with inflation, leading to weaker returns over time.

To ensure you're earning the best interest rate on your cash savings, regularly review the terms of your savings account and compare rates offered by different banks. Be aware of any conditions required to earn bonus interest, as many savers fail to meet these and miss out on higher returns.

The opportunity cost of holding cash instead of investing in other assets is the potential higher returns you could earn from growth investments like shares and property. Historically, these assets have outperformed cash over the long term, offering better returns and tax advantages.

Diversification helps reduce investment risk by spreading your investments across different asset classes. This approach can smooth out returns and protect your portfolio from the volatility of any single investment, such as cash, which may not keep up with inflation.

Interest rates might fall in 2024 due to declining inflation. Lower rates could lead investors to shift from cash to shares, potentially increasing share values and dividends. This shift may result in cash investments offering lower returns compared to other asset classes.

Cash should play a role in your investment portfolio for short-term needs, such as saving for a home deposit or emergency fund. For long-term growth, consider diversifying into assets like shares and property, which historically offer higher returns.

To balance safety and growth in your investment strategy, hold cash for short-term needs and emergencies, while investing in growth assets like shares and property for long-term wealth building. This approach leverages the safety of cash and the higher returns of growth investments.