Murray inquiry: What the government's FSI response means for investors

Summary: I think housing rates are headed higher as each of the big four banks opts for less housing growth and an increase in margins. If the RBA lowers official interest rates, the banks will get a double boost – not following the RBA down in housing loans while lowering bank deposit rates. Meanwhile, the next stage in the debate is to what extent superannuation benefits are to be reduced. |

Key take-out: If I am right that housing interest rates will rise and house prices will stabilise, it will be hard to generate higher profits. |

Key beneficiaries: General investors. Category: Bank shares, economy. |

Underneath the government endorsement of the David Murray-chaired Financial System Inquiry and the big banks' broad acceptance of the government's decision is a raft of changes ahead for Australia that we are only just beginning to understand.

Let me give you a preview of some of the changes and then I'll set out how I think a number of the events will play out to justify my conclusions.

- We are headed for higher interest rates in housing – particularly for new loans – which will result in stability of house prices. If that works then there is a good chance negative gearing – a hugely popular strategy with an estimated one million investors – will stay, which is one reason why the government did not block it in superannuation funds

- New rules will come to make it easier to raise capital which will be aimed at the technology sector but should spread through the market including infrastructure

- Credit cards fees will fall but banks will look for other ways to raise money from cards. The nervousness about higher housing interest rates is not good for consumer spending in 2016

- We will see annuity products developed for the big retail and industrial superannuation funds and these will be available for self-managed funds to purchase should they wish to do so, and

- I fear lump sums in superannuation may be restricted.

There are also a whole lot of governance issues involving big superannuation funds and advisors which I suspect will end up being more red tape. There are many other aspects to what the government has agreed to but that's not a bad start.

Let's begin with why I think housing rates are headed higher, particularly on new homes. I also fear that bank deposit rates may head south but I am less confident about the prediction.

Led by CBA and Westpac, the big four Australian banks have made an absolute fortune by capturing around 80 per cent of the home lending market. They aggressively chased home lending because under the old rules less capital was required for loans on dwellings so therefore the returns were much higher than, say, business lending.

Now the rules are being changed and the banks are being forced to raise capital and back those housing loans with more capital. If all other things were equal then the returns the banks will get on housing capital would fall and so would earnings per share and almost certainly dividends. But all other things are most certainly not equal.

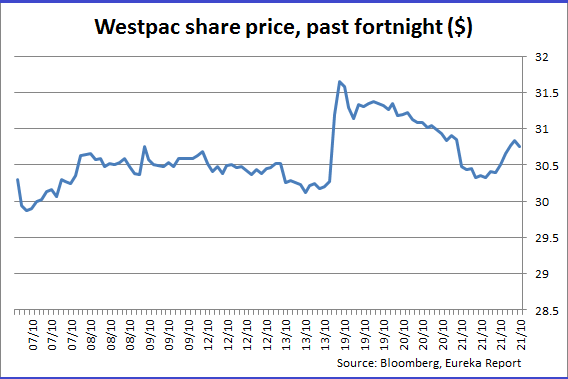

The surface manifestation of change came when Westpac increased its home loan rate by 0.2 per cent and copped a volley of criticism. But given it was across the whole Westpac brand portfolio... it was a move that will be a major boost to profits even though its affiliate banks Bank of Melbourne, Bank SA and St George did not follow.

Almost certainly the Westpac affiliates – St George and Bank of Melbourne – will wait until the other banks move and if Westpac discovers it is losing too much market share in the parent it will get its affiliate banks to boost loans. It's a clever strategy so it's no wonder Westpac shares rose. The other banks were careful not to follow Westpac immediately because it would look like collusion.

But in terms of new loans, that 0.2 per cent increase in interest rates from Westpac was not the main game. At the urging of the regulator all the banks have lifted the interest rates on investor loans and in some cases the increase is almost half a percent.

Again Westpac appears to be leading the pack. When investor loan rates were first increased some months ago the banks were still embracing a growth strategy in housing and wanted to keep expanding. So the banks increased their discounts on owner occupied residential loans and in some cases those discounts reached one per cent below the official rate.

Then suddenly something snapped and one by one the banks have changed their growth strategy with the Westpac 0.2 per cent interest rate hike an accelerant. The discounts are disappearing so in effect when you look at new housing loans rates are actually rising sharply.

It is clear to me that each of the big four banks, in varying ways, has opted for less housing growth and an increase in margins.

This is a very big change in strategy and over time it will transfer money from home owners to the profits of the banks. The whole exercise will not be smooth but watch developments over the next six months to test out my belief.

What the banks would really love is for the Reserve Bank to lower interest rates in the next three or four months. They would not follow the Reserve Bank down in housing loans. As we saw with the flak Westpac received it is much easier to leave rates as they are on existing loans than increase them.

Once the government gets wind of what is happening you can expect a lot of bank criticism but the banks have huge market shares in housing and very thick skins, although the government may try to punish them via credit card margins.

Too much government noise on housing interest rates will frighten the housing market. Even without a government megaphone, once the message gets out among home buyers – residents and investors – that interest rates are going up and the big banks are no longer chasing business then housing prices are likely to stabilise particularly if migration continues to slow. And of course if that happens there isn't any need to change the negative gearing rules – a move which would be very unpopular electorally. Separately, the smaller banks have not had the same capital restraints imposed on them and they will be much more active in growing their housing business.

Indeed on the day the government endorsed Murray's FSI Report, Macquarie Bank, via its affiliate Mark Bouris's Yellow Brick Road, lowered its interest rates on blue chip housing loans to 3.92 per cent.

If the small banks are too aggressive and get too much business then the big banks' strategy of higher margins and low or no growth might unravel.

Back to the issue of deposits. If the Reserve Bank lowers official interest rates, the banks will get a double boost: first by not following them down in housing loans but at the same time lowering bank deposit rates.

These new developments come as we continue to have an income recession outside the public service. So it is not a recipe for strong profit growth in companies that are serving consumers like retailers. The increase in Westpac's interest rates lowered the ANZ-Roy Morgan measure of consumer confidence and if house prices stabilise under the weight of higher mortgage rates that will also dampen demand.

Right now the Australian stock market is being helped by a series of global events caused by the delay of the Federal Reserve in increasing interest rates. I and many others have been saying for a long time that there would not be big US interest rate rises.

One of the reasons the US is frightened to lift interest rates is that it will suck money out of the less developed countries. These delays in increasing US interest rates are helping less developed countries which need help in the wake of the slowdown in China. Australia is not a 'less developed country' but we are classified in that bracket and that combined with the fact the US equity market has been heavily shorted means any delays in US interest rate rises will help Australian shares in the next few months, although our dollar tends to rise as well when all this occurs.

But if I am right in what is going to happen to local housing interest rates and in house prices then it will be hard to generate the higher profits necessary to justify rises in share prices.

As events develop we will be talking about the new annuities that are going to be developed and the easier rules on capital raisings.

Meanwhile the next stage in the debate is to what extent superannuation benefits are to be reduced and how any reduction fits into adjusting the total tax and social services situation. On this front no one knows what will happen but there is at least a chance existing benefits may be grandfathered.

If the private superannuation sector is to be curbed then some of the public sector superannuation rorts need to be chopped off. Hopefully that will make some of the government public service advisors who are big beneficiaries of the rorts think about what they are doing.

Footnote: How do my remarks on interest rates fit into predictions of a collapse in house prices? The banks do not want that and their interest rate measures will not cause a collapse. A big fall will require some other event like a recession or a reduction in Asian buying.