Markets: Cue the iron ore miners

China’s back.

The latest economic data from China says just as much about the global economy as it does about how the country is faring domestically. Adding to a string of positive data, the latest figures suggest China is ready to pull global markets along once again.

Long before the August trade data was announced, the materials index, both here and in the US, had begun to suggest the world’s most influential economy was faring better than market commentators would have us believe.

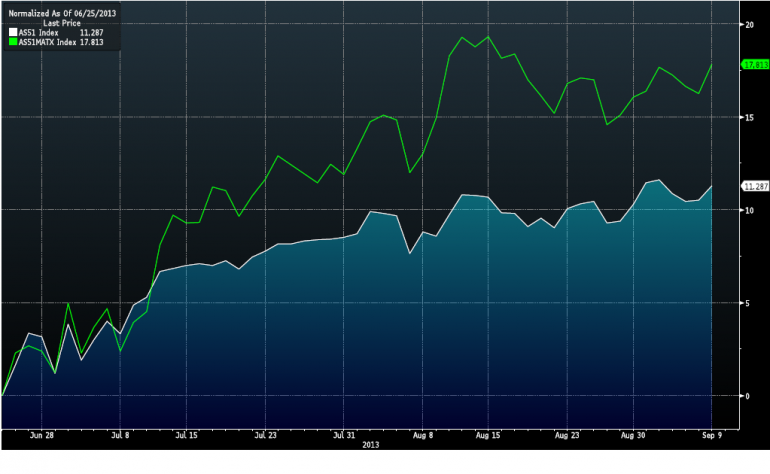

Since June 25 -- the lowest point for both materials indices since November 2009 – the indices have gained 17.8 per cent locally (green line) and 8 per cent in the US (white line). The broader ASX 200 has tacked on 11.3 per cent against 5.3 per cent for the S&P 500.

Source: Bloomberg

Although China’s total imports in August missed expectations, imports of raw materials were up, indicating there is a slight restocking occurring. Cue iron ore miners.

Iron ore imports grew at 10.5 per cent against the same period last year, and were the third strongest month on record even though they were down from July’s record highs. The important takeaway from this is iron ore imports are in fact growing from levels seen over the past 12 months.

A string of improving economic data from the US and Europe to go with China’s latest and an upward revision from the IMF for global growth, mean there are few immediate headwinds for commodity prices. If anything, it appears a resilient Australian dollar could pose the biggest headaches for commodity-focused companies.

Australia’s biggest miners, BHP Billiton, Rio Tinto and Fortescue Metals have enjoyed the resurgence of investor interest as iron ore prices have recovered.

History has shown the materials sector performance is closely linked to demand for commodities. As long as this prevails, the underlying fundamentals suggest the index is set to move back closer to the ASX 200.

On a valuation basis, the price/earnings ratios for BHP and Rio are hovering around 13 and 12 respectively for this financial year.

Fortescue, being more exposed to the iron ore price and with higher leverage, has a much lower ratio of only five times earnings. While this does imply a discount compared with the majors, it reflects the increased risk of Fortescue.

Economic data suggests that current analyst views for our major iron ore miners are in fact realistic possibilities. Each has plenty of upside, however Rio has the most to gain, with a consensus analyst target price of $71.00 against a current share price of $61.95.