Market Watch

The top-down view of the world remains sound on the data side but volatile on the geopolitical side.

Currently there is a clear mismatching in market pricing as the underlying macro data is pretty good. Global growth is on track to peak in 2018, and all indications are that exports are solid demand remains on a growth trajectory and manufacturing and service indexes are expanding.

If we drill into the Australian data from the week:

- Retail sales: February sales were up 0.6 per cent month-on-month (versus the consensus 0.3 per cent forecast), and were up by 3.0 per cent year-on-year. (Source: Bloomberg).

- Australian manufacturing PMI: Hit a record high of 63.1 points for the month of March. The previous record was 62.1pts in May 2002, all sectors in expansion.

- Trade Balance: Logged a further trade surplus in February at $825 million (consensus was $725 million). The January balance was upgraded to $925 million, which bodes well for net exports.

The slightly weaker data was:

- Building approvals: February saw a 6.2 per cent month-on-month decline and a 3.1 per cent year-on-year decline, much heavier than consensus. But this can be explained by a large fall in the always volatile high-density approvals.

However, markets continue to face pricing pressures from highly fluid geopolitical risk factors. No more so than the press release from the White House on Friday morning AEST stating:

|

‘...the United States Trade Representative (USTR) determined that China has repeatedly engaged in practices to unfairly obtain Americas’ intellectual property… On April 3, 2018, the USTR announced approximately $US50 billion in proposed tariffs on imports from China as an initial means…. …Rather than remedy its misconduct, China has chosen to harm our farmers and manufacturers. In light of China’s unfair retaliation, I [the President] have instructed the USTR to consider whether $US100 billion of additional tariffs would be appropriate under section 301…’ |

How can markets price in risk when the statement is so fluid and uses words such as: ‘consider’, ‘proposed’ ‘initial means’. It has been observed that the President’s language and final actionable policies are considerably different, just look at the resent global tariffs on steel and aluminium. However, there is a baseline scenario in the US-China trade war:

- There will be a tariff(s) enacted under the cause of the section 301.

- The size will be at a minimum $US50 billion.

- China will respond and will likely enact an amount of equal measure.

- Language is likely to increase before any sign of an actual deal arises.

Factor in that baseline scenario and one can understand why market pricing has been so erratic.

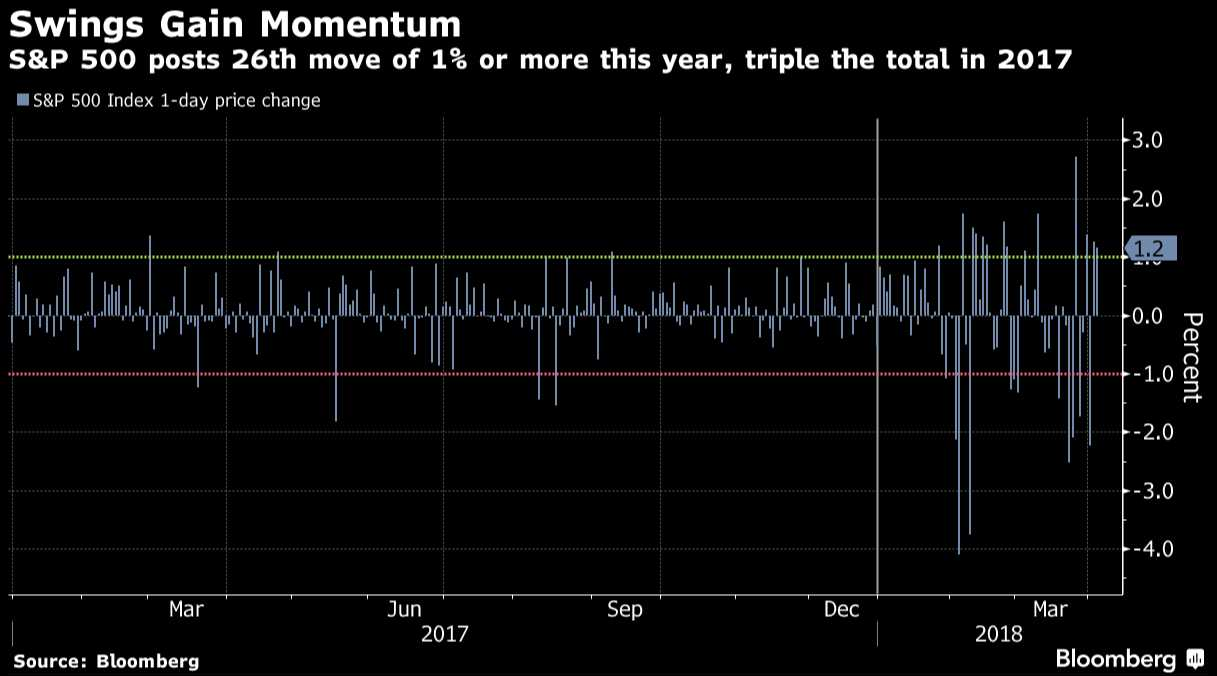

The Dow Jones and S&P indices have experienced their highest levels of 1 per cent or more daily moves in 18 months, and already in the first 70-odd trading days of 2018 the US markets have tripled that total when compared with the whole of 2017.

Macro-economic and geopolitical conditions have structurally changed the short-term outlook, which highlights the importance of asset allocation. The ability to withstand and even expand in the current market will come through diversification and vigilance.